ISIN: Definition, Usage, and Importance

An International Securities Identification Number (ISIN) is a unique code that is used to identify securities such as stocks, bonds, and other financial instruments. It consists of a 12-character alphanumeric code that is assigned to each security.

The ISIN is widely used in the financial industry for various purposes. One of its main uses is to facilitate the trading and settlement of securities. By using the ISIN, investors and traders can easily identify and track specific securities, which helps to ensure efficient and accurate transactions.

In addition to facilitating trading, the ISIN is also used for regulatory and reporting purposes. Many regulatory bodies require companies to use ISINs when filing financial reports or disclosing information about their securities. This helps to ensure transparency and accountability in the financial markets.

The ISIN is also important for investors and financial institutions when conducting research and analysis. By using the ISIN, they can quickly access information about a specific security, such as its issuer, country of origin, and other relevant details. This information is crucial for making informed investment decisions and managing risk.

Overall, the ISIN plays a vital role in the functioning of international markets. It provides a standardized and efficient way to identify and track securities, which helps to facilitate trading, ensure regulatory compliance, and support informed decision-making. Without the ISIN, the global financial system would be much more complex and less transparent.

What is an ISIN?

An International Securities Identification Number (ISIN) is a unique code that is used to identify securities such as stocks, bonds, and other financial instruments. It is a globally recognized standard for identifying securities and is used by investors, traders, and regulators around the world.

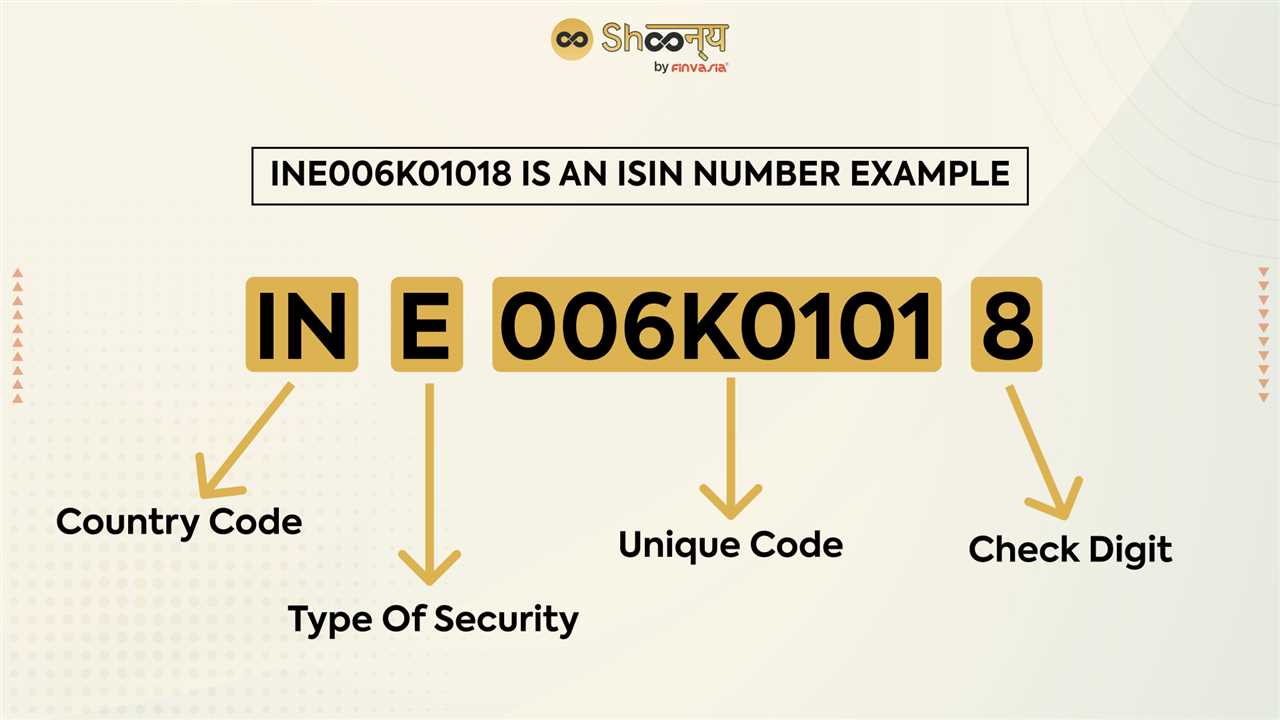

The ISIN is a 12-character alphanumeric code that provides detailed information about the security, including the country of issuance, the type of security, and the issuer. It is assigned by a national numbering agency in each country and is used to ensure the accuracy and efficiency of securities trading and settlement.

The ISIN is similar to a social security number or a passport number for a security. It is used to track and identify the security throughout its lifecycle, from issuance to trading and settlement. This helps to prevent confusion and ensure that the correct security is being traded or settled.

In addition to the ISIN, securities may also have other identification codes, such as ticker symbols or CUSIP numbers. However, the ISIN is the most widely used and recognized code for identifying securities on a global scale.

Overall, the ISIN plays a crucial role in the functioning of international financial markets. It provides a standardized and efficient way to identify securities, which is essential for accurate and transparent trading and settlement processes.

How is ISIN Used?

The International Securities Identification Number (ISIN) is a unique identifier used in the financial industry to identify securities such as stocks, bonds, and other financial instruments. It is a 12-character alphanumeric code that provides a standardized way to identify and track securities globally.

ISIN codes are used by investors, traders, and regulators to facilitate the trading and settlement of securities. They are used in various financial transactions, including buying and selling securities, transferring ownership, and reporting to regulatory authorities.

One of the primary uses of ISIN is in the trading and clearing process. When a security is listed on an exchange, it is assigned an ISIN code, which is then used to identify the security in trading systems. This allows investors and traders to easily search for and trade specific securities.

ISIN codes also play a crucial role in the settlement process. When a trade is executed, the ISIN code is used to identify the securities being traded, ensuring that the correct securities are delivered to the buyer and the appropriate funds are transferred to the seller.

In addition to trading and settlement, ISIN codes are used for regulatory purposes. Regulators require companies to report their securities transactions using ISIN codes, which helps ensure transparency and accountability in the financial markets.

Furthermore, ISIN codes are used for market data and reference purposes. Financial data providers use ISIN codes to organize and categorize securities, allowing investors and analysts to easily access information about specific securities.

In summary, ISIN codes are widely used in the financial industry for trading, settlement, regulatory reporting, and market data purposes. They provide a standardized way to identify and track securities, facilitating efficient and transparent financial markets.

The Importance of ISIN

The International Securities Identification Number (ISIN) plays a crucial role in the global financial markets. It is a unique identifier assigned to each security, such as stocks, bonds, and derivatives, traded on international exchanges. The importance of ISIN lies in its ability to provide standardized and reliable information about securities, facilitating efficient trading, risk management, and regulatory compliance.

1. Standardization and Identification

ISIN serves as a standardized code that uniquely identifies each security, eliminating confusion and ensuring accurate identification. With ISIN, market participants can easily differentiate between securities issued by different companies or countries. This standardization simplifies the process of trading and settlement, as well as enhances transparency in the market.

2. Efficient Trading and Risk Management

By having access to reliable and standardized information through ISIN, investors can make informed investment decisions and better assess the risks associated with specific securities. This helps to mitigate potential losses and ensure the stability and integrity of the financial markets.

3. Regulatory Compliance

Furthermore, ISIN facilitates cross-border trading and regulatory harmonization by providing a common language for market participants and regulators across different jurisdictions. It promotes transparency, fairness, and efficiency in the global financial markets.

The Importance of ISIN in International Markets

The International Securities Identification Number (ISIN) plays a crucial role in international markets. It is a unique identifier assigned to financial securities, such as stocks, bonds, and derivatives, traded on global exchanges. The ISIN provides a standardized and internationally recognized code that helps facilitate efficient trading and investment processes.

One of the key reasons why ISIN is important in international markets is its role in ensuring transparency and accountability. By assigning a unique code to each security, the ISIN allows market participants to easily identify and track individual securities across different markets and jurisdictions. This helps prevent confusion and reduces the risk of errors in trading and settlement processes.

Furthermore, the ISIN is essential for regulatory compliance. Many countries require securities to have an ISIN in order to be listed and traded on their exchanges. This helps ensure that securities meet certain standards and regulations, promoting investor protection and market integrity.

The use of ISIN also enhances market efficiency. By providing a standardized code, the ISIN simplifies the process of trading and settlement, making it easier for investors to buy and sell securities across different markets. This promotes liquidity and improves market access for both domestic and international investors.

Additionally, the ISIN is crucial for risk management and portfolio analysis. By using ISINs, investors and financial institutions can accurately track and analyze the performance of individual securities and portfolios. This enables them to make informed investment decisions and manage their risk exposure effectively.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.