INVESTING BASICS

Are you interested in the world of finance and investment? Do you want to learn more about the role of investment bankers? Look no further! Our comprehensive Investment Banking Guide is here to help you understand the ins and outs of this exciting field.

What is Investment Banking?

Investment banking is a crucial part of the financial industry. It involves providing financial advice, raising capital, and facilitating mergers and acquisitions for corporations, governments, and other entities. Investment bankers play a vital role in connecting businesses with investors and helping them achieve their financial goals.

Why Should You Learn About Investment Banking?

What Will You Learn in Our Investment Banking Guide?

Our Investment Banking Guide covers a wide range of topics, including:

- The history and evolution of investment banking

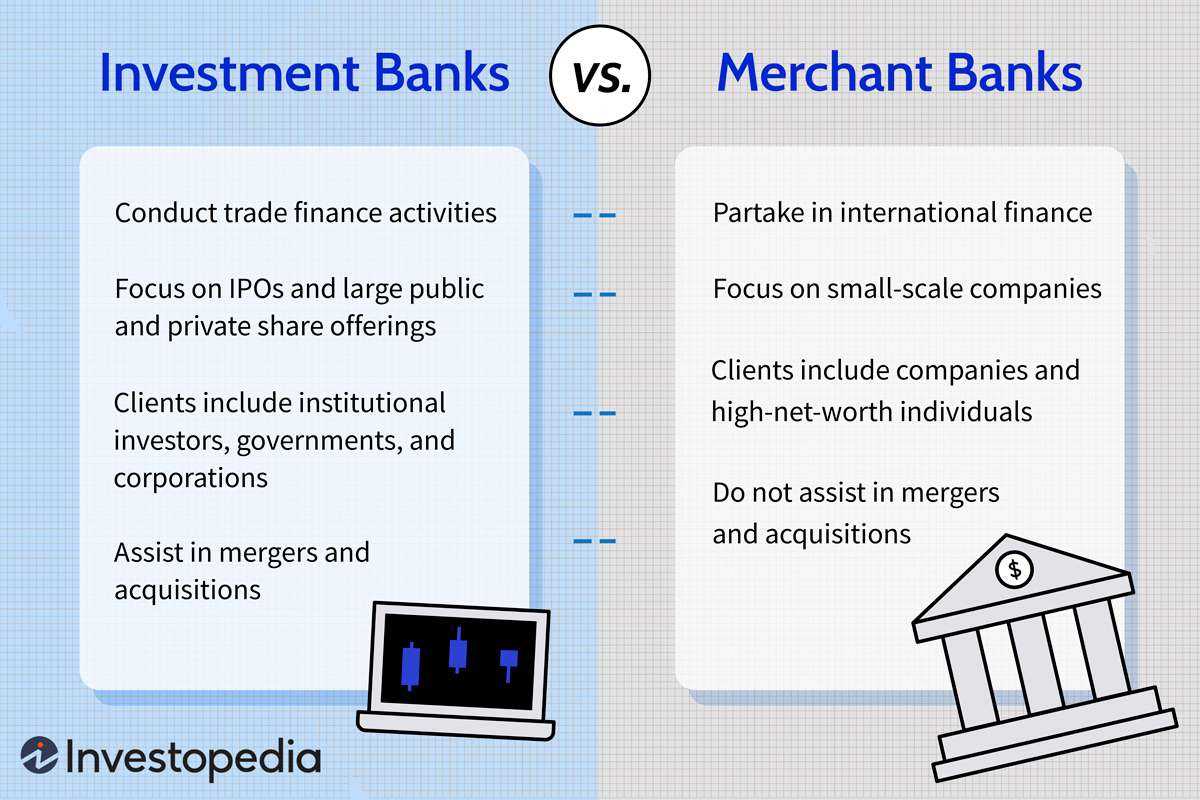

- The different types of investment banks

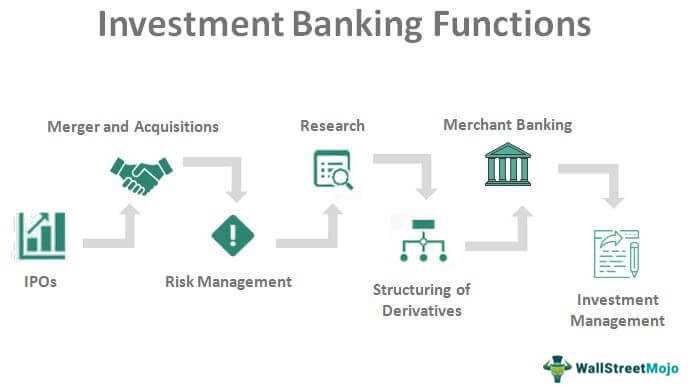

- The role of investment bankers in mergers and acquisitions

- The process of raising capital through initial public offerings (IPOs)

- The skills and qualifications required to become an investment banker

Don’t miss out on this opportunity to expand your knowledge and take your investment game to the next level!

Here are some key points to know about investment bankers:

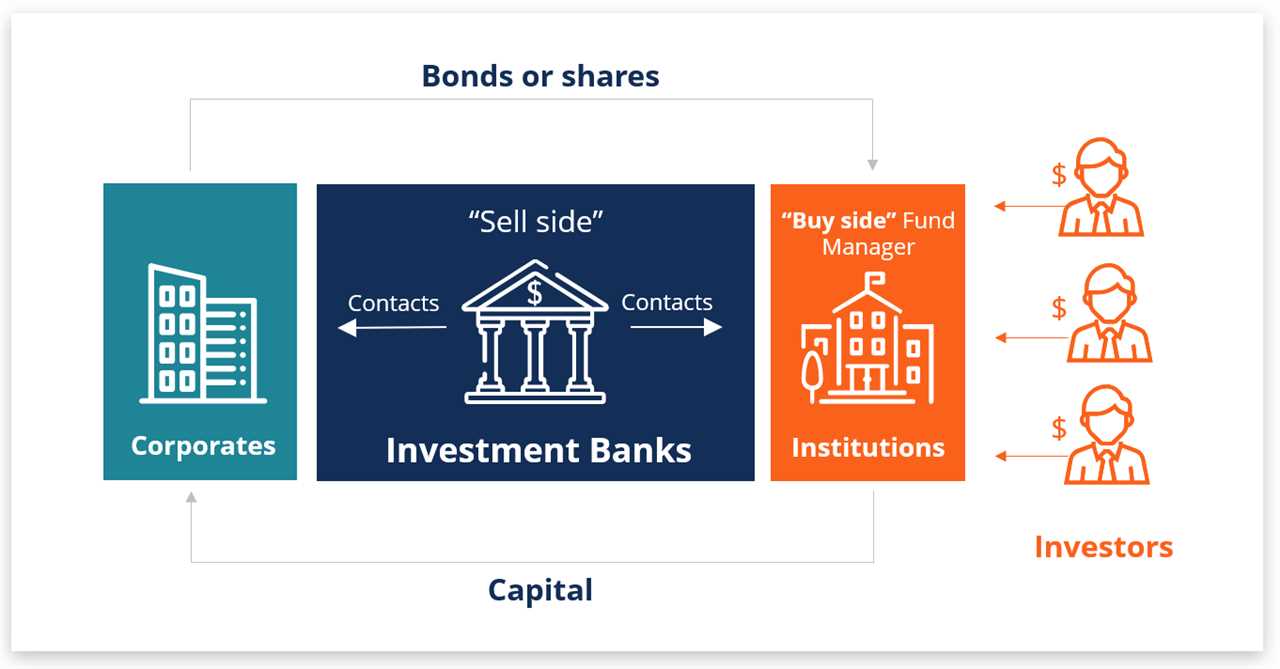

- Raising Capital: One of the primary roles of investment bankers is to help companies raise capital. They do this by underwriting securities, such as stocks and bonds, and selling them to investors. Investment bankers have extensive knowledge of the financial markets and can advise companies on the best strategies for raising funds.

- Mergers and Acquisitions: Investment bankers also play a crucial role in mergers and acquisitions (M&A) transactions. They help companies evaluate potential targets, negotiate deals, and secure financing for the transactions. Investment bankers use their expertise to ensure that the M&A deals are structured in a way that maximizes value for their clients.

- Financial Advisory: Investment bankers provide financial advisory services to their clients. They offer strategic advice on various financial matters, such as capital structure, corporate finance, and risk management. Investment bankers analyze market trends, conduct financial modeling, and provide recommendations to help their clients make informed decisions.

- Market Research: Investment bankers conduct extensive market research to identify potential investment opportunities and evaluate market conditions. They analyze industry trends, economic data, and company financials to provide insights to their clients. Investment bankers use this research to develop investment strategies and make recommendations to their clients.

- Relationship Management: Investment bankers build and maintain relationships with clients, investors, and other stakeholders in the financial industry. They act as trusted advisors to their clients and work closely with them to understand their financial goals and objectives. Investment bankers also network with potential investors to facilitate capital raising activities.

Overall, investment bankers play a critical role in the financial industry by helping companies raise capital, facilitating mergers and acquisitions, providing financial advisory services, conducting market research, and building relationships. Their expertise and knowledge are essential for businesses looking to navigate the complex world of finance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.