Definition and Role

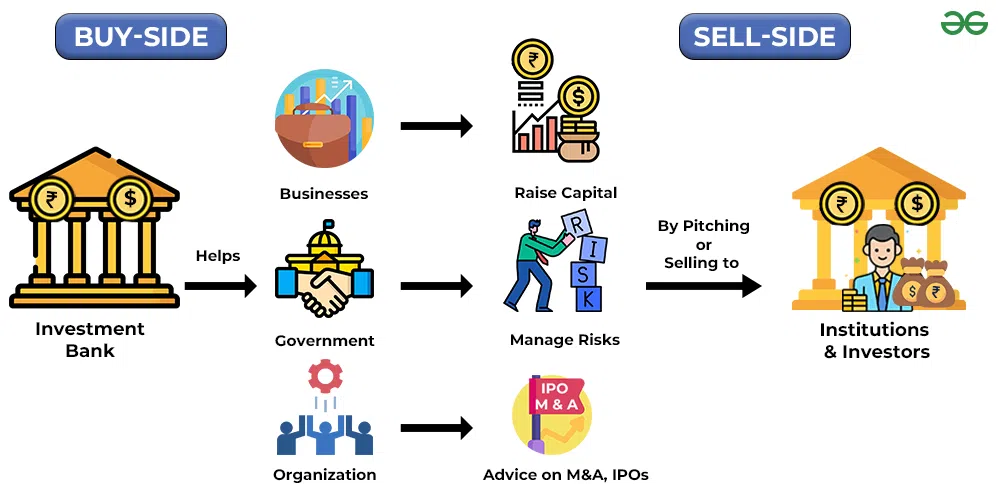

Investment banks provide a range of services, including mergers and acquisitions advisory, underwriting of initial public offerings (IPOs), debt and equity financing, asset management, and trading of securities. They act as intermediaries between investors and issuers, helping companies raise funds through various financial instruments such as stocks, bonds, and derivatives.

Role in the Financial Market

Investment banks play a significant role in the functioning of the financial market. They help companies access capital markets and raise funds for expansion, research and development, acquisitions, and other business activities. By underwriting securities, investment banks assume the risk of selling the securities to investors at a predetermined price, ensuring that the issuing company receives the necessary funds.

Furthermore, investment banks provide valuable advisory services to companies looking to merge with or acquire other businesses. They conduct due diligence, analyze financial data, and negotiate on behalf of their clients to ensure the best possible outcome for all parties involved.

Investment banks also play a crucial role in the trading of securities. They facilitate the buying and selling of stocks, bonds, and other financial instruments on behalf of their clients, providing liquidity to the market and ensuring efficient price discovery.

Regulatory Environment

Investment banks are required to adhere to various regulations regarding capital adequacy, risk management, client protection, and transparency. These regulations aim to prevent market manipulation, insider trading, and other illegal activities that could undermine the stability and fairness of the financial system.

Services and Offerings

An investment bank offers a wide range of services and offerings to its clients. These services can be categorized into several key areas:

1. Capital Raising: Investment banks help companies raise capital by issuing stocks or bonds. They assist in the process of underwriting, pricing, and distributing these securities to investors.

2. Mergers and Acquisitions: Investment banks play a crucial role in facilitating mergers and acquisitions. They provide advisory services to companies looking to buy or sell businesses, helping them with valuation, negotiations, and deal structuring.

3. Corporate Finance: Investment banks offer corporate finance services, which include financial planning, budgeting, and strategic advice. They help companies optimize their capital structure, manage cash flow, and make informed financial decisions.

4. Trading and Sales: Investment banks have trading desks that execute trades on behalf of clients. They provide access to various financial markets, including stocks, bonds, commodities, and derivatives. They also offer sales services, where they pitch investment opportunities to institutional investors.

5. Research: Investment banks employ research analysts who provide insights and analysis on various industries, companies, and investment opportunities. They publish research reports that help clients make informed investment decisions.

6. Risk Management: Investment banks assist clients in managing financial risks. They offer hedging strategies, derivatives products, and risk assessment services to help clients mitigate market risks and protect their investments.

7. Wealth Management: Some investment banks have wealth management divisions that cater to high-net-worth individuals. They offer personalized investment advice, portfolio management, and financial planning services.

8. Asset Management: Investment banks may also have asset management divisions that manage investment portfolios on behalf of clients. They offer various investment products, such as mutual funds, hedge funds, and private equity funds.

Overall, investment banks provide comprehensive financial services to corporations, governments, and individuals. They play a crucial role in the global economy by facilitating capital flows, supporting corporate growth, and driving financial innovation.

Notable Examples of Investment Banks

There are several investment banks that have made a significant impact in the financial industry. These banks have a long history of providing top-notch services and have played a crucial role in shaping the global economy. Here are some notable examples:

1. Goldman Sachs: Founded in 1869, Goldman Sachs is one of the most prestigious investment banks in the world. It offers a wide range of services, including investment banking, asset management, and securities trading. Goldman Sachs has a strong reputation for its expertise in mergers and acquisitions and has been involved in many high-profile deals.

2. JPMorgan Chase: JPMorgan Chase is one of the largest investment banks in the United States. It provides a comprehensive range of financial services, including investment banking, asset management, and private banking. JPMorgan Chase has a global presence and is known for its strong relationships with corporate clients.

3. Morgan Stanley: Morgan Stanley is another prominent investment bank that offers a wide range of financial services. It has a strong presence in investment banking, wealth management, and sales and trading. Morgan Stanley has a reputation for its strong research capabilities and has been involved in many successful IPOs.

4. Deutsche Bank: Deutsche Bank is a German investment bank that operates globally. It offers a wide range of services, including corporate banking, asset management, and securities trading. Deutsche Bank has a strong presence in Europe and has been involved in many significant financial transactions.

5. Citigroup: Citigroup is a multinational investment bank that provides various financial services. It has a strong presence in investment banking, wealth management, and consumer banking. Citigroup has a global network and is known for its innovative solutions and strong risk management practices.

These investment banks have played a crucial role in the financial industry and have helped shape the global economy. Their expertise and services have been instrumental in facilitating mergers and acquisitions, raising capital for businesses, and providing financial solutions to clients around the world.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.