International Fisher Effect (IFE): Definition, Example, Formula

The International Fisher Effect (IFE) is a financial theory that suggests that the difference in interest rates between two countries will determine the future exchange rate between their currencies. According to the IFE, if the interest rate in one country is higher than in another, the currency of the country with the higher interest rate will depreciate relative to the currency of the country with the lower interest rate.

The IFE is based on the concept of interest rate parity, which states that the difference in interest rates between two countries should be equal to the difference in their expected inflation rates. This means that if the interest rate in one country is higher than in another, it is because the market expects higher inflation in that country.

For example, let’s say the interest rate in the United States is 5% and the interest rate in Japan is 2%. According to the IFE, this would imply that the market expects the inflation rate in the United States to be 3% higher than in Japan. Therefore, the IFE predicts that the value of the Japanese yen will appreciate by 3% relative to the US dollar.

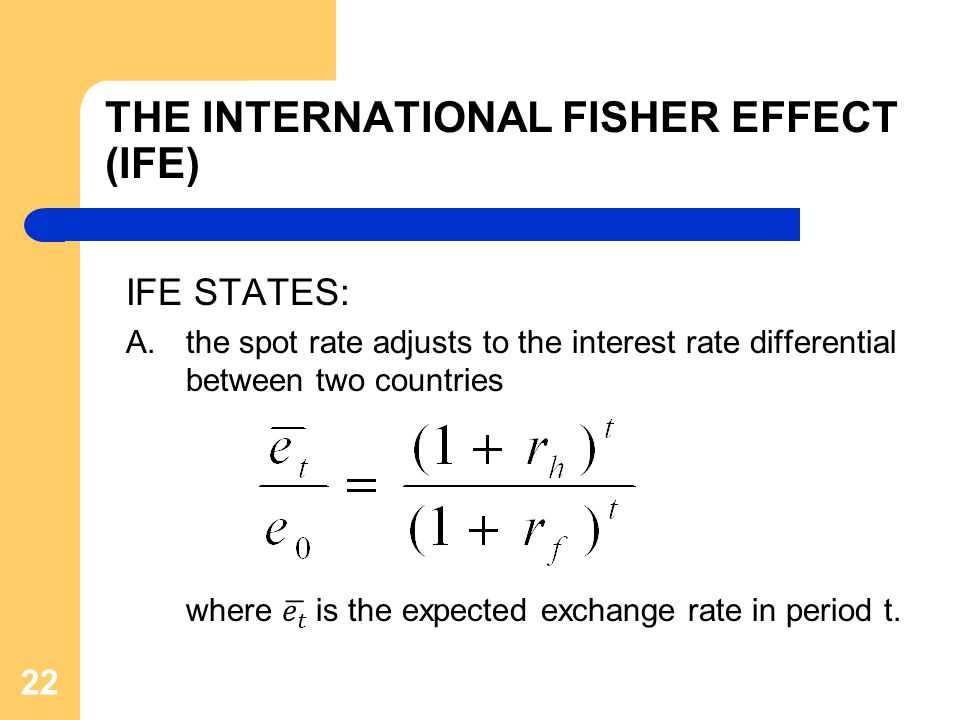

The formula for calculating the expected exchange rate based on the IFE is as follows:

- Expected exchange rate = Spot exchange rate * (1 + Interest rate in the foreign country) / (1 + Interest rate in the domestic country)

Using the example above, if the spot exchange rate is 100 yen per dollar, the expected exchange rate would be:

- Expected exchange rate = 100 * (1 + 0.02) / (1 + 0.05) = 100 * 1.02 / 1.05 = 98.10 yen per dollar

Therefore, according to the IFE, the expected exchange rate between the US dollar and the Japanese yen would be 98.10 yen per dollar.

What is the International Fisher Effect?

The International Fisher Effect (IFE) is an economic theory that suggests a relationship between interest rates, inflation rates, and exchange rates in different countries. It is based on the concept of purchasing power parity (PPP), which states that the exchange rate between two currencies should adjust to reflect changes in their relative purchasing power.

The IFE states that the difference in interest rates between two countries is equal to the difference in their expected inflation rates. In other words, if the interest rate in one country is higher than in another country, it is because the market expects the inflation rate in the first country to be higher as well.

How does the International Fisher Effect work?

The International Fisher Effect is based on the idea that investors are rational and seek to maximize their returns. If the interest rate in one country is higher than in another country, investors will be attracted to the higher interest rate and will invest their money in that country. This increased demand for the currency of the country with the higher interest rate will cause its exchange rate to appreciate, making its goods and services more expensive for foreign buyers.

On the other hand, if the interest rate in one country is lower than in another country, investors will be less inclined to invest their money in that country. This decreased demand for the currency of the country with the lower interest rate will cause its exchange rate to depreciate, making its goods and services cheaper for foreign buyers.

Example of the International Fisher Effect

If the market expects the inflation rate in the United States to be higher than in Japan, investors will demand a higher interest rate to compensate for the expected loss in purchasing power. As a result, the exchange rate between the US dollar and the Japanese yen will adjust to reflect this difference, with the US dollar appreciating relative to the Japanese yen.

Formula for the International Fisher Effect

The formula for the International Fisher Effect is as follows:

Interest rate differential = Expected inflation rate differential

or

Where:

- i1 is the interest rate in country 1

- i2 is the interest rate in country 2

- π1 is the expected inflation rate in country 1

- π2 is the expected inflation rate in country 2

This formula shows that the difference in interest rates between two countries is equal to the difference in their expected inflation rates. It is used to predict and explain changes in exchange rates based on differences in interest rates and inflation rates.

Example of the International Fisher Effect

The International Fisher Effect (IFE) is a theory that suggests that the difference in interest rates between two countries is equal to the expected change in exchange rates between their currencies. This theory is based on the idea that investors will seek higher returns in countries with higher interest rates, which will lead to an increase in demand for that country’s currency and a subsequent appreciation of its value.

To better understand the concept of the IFE, let’s consider an example. Suppose there are two countries, Country A and Country B. Country A has an interest rate of 5%, while Country B has an interest rate of 3%. According to the IFE, the difference in interest rates between the two countries should lead to an expected change in exchange rates.

Let’s assume that the current exchange rate between the currencies of Country A and Country B is 1:1. Based on the interest rate differential, the IFE suggests that the currency of Country A should appreciate against the currency of Country B. In other words, the exchange rate should change to, for example, 1.05:1.

However, it is important to note that the IFE is a theory and may not always hold true in practice. There are various factors that can influence exchange rates, such as economic conditions, political stability, and market sentiment. Therefore, it is essential to consider other factors when making investment decisions or predicting currency movements.

| Country | Interest Rate |

|---|---|

| Country A | 5% |

| Country B | 3% |

Formula for the International Fisher Effect

The International Fisher Effect (IFE) is a theory that suggests that the difference in interest rates between two countries will determine the future exchange rate between their currencies. The IFE formula is used to calculate this expected exchange rate:

Expected Exchange Rate = Spot Exchange Rate x (1 + Interest Rate of Foreign Country) / (1 + Interest Rate of Domestic Country)

The IFE formula assumes that investors are rational and seek to maximize their returns. It suggests that if the interest rate in the foreign country is higher than the domestic country, investors will be attracted to invest in the foreign country, leading to an increase in demand for the foreign currency. This increased demand will cause the foreign currency to appreciate in value, resulting in a higher expected exchange rate.

Conversely, if the interest rate in the domestic country is higher, investors will prefer to invest in the domestic country, leading to a decrease in demand for the foreign currency. This decreased demand will cause the foreign currency to depreciate in value, resulting in a lower expected exchange rate.

The IFE formula provides a way to estimate the future exchange rate based on interest rate differentials. However, it is important to note that it is a theoretical model and may not always accurately predict actual exchange rate movements. Various other factors, such as economic conditions, inflation rates, and political events, can also influence exchange rates.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.