What is Interest Rate Parity?

Interest Rate Parity is a financial concept that relates to the relationship between interest rates and exchange rates in international markets. It is based on the idea that the difference in interest rates between two countries should be equal to the difference in their exchange rates.

Definition and Formula

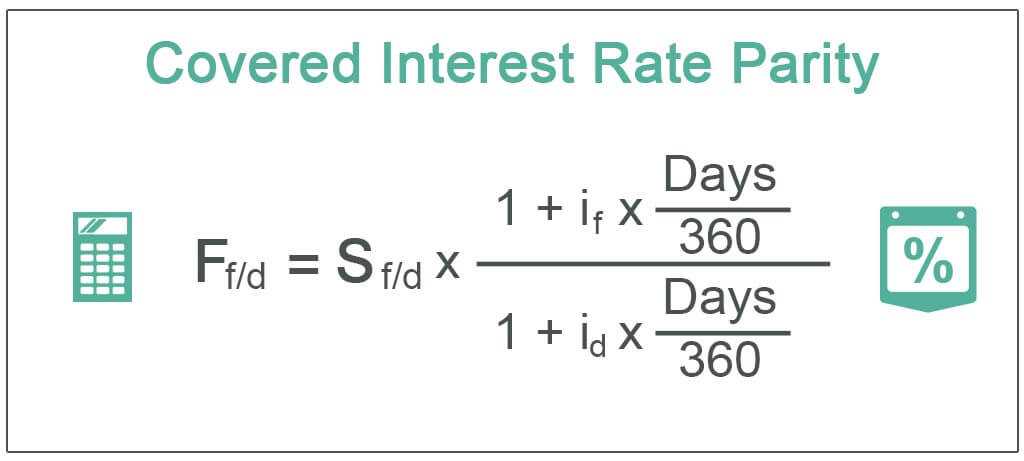

The formula for Interest Rate Parity is as follows:

| Forward Exchange Rate | = | Spot Exchange Rate | * | (1 + Foreign Interest Rate) | / | (1 + Domestic Interest Rate) |

|---|

Interest Rate Parity Example

Let’s say the spot exchange rate between the US dollar and the British pound is 1.30. The interest rate in the US is 2%, and the interest rate in the UK is 1.5%. According to Interest Rate Parity, the forward exchange rate should be:

| Forward Exchange Rate | = | 1.30 | * | (1 + 0.015) | / | (1 + 0.02) | = | 1.2928 |

|---|

Therefore, based on Interest Rate Parity, the expected future exchange rate between the US dollar and the British pound is 1.2928.

How it Works in Practice

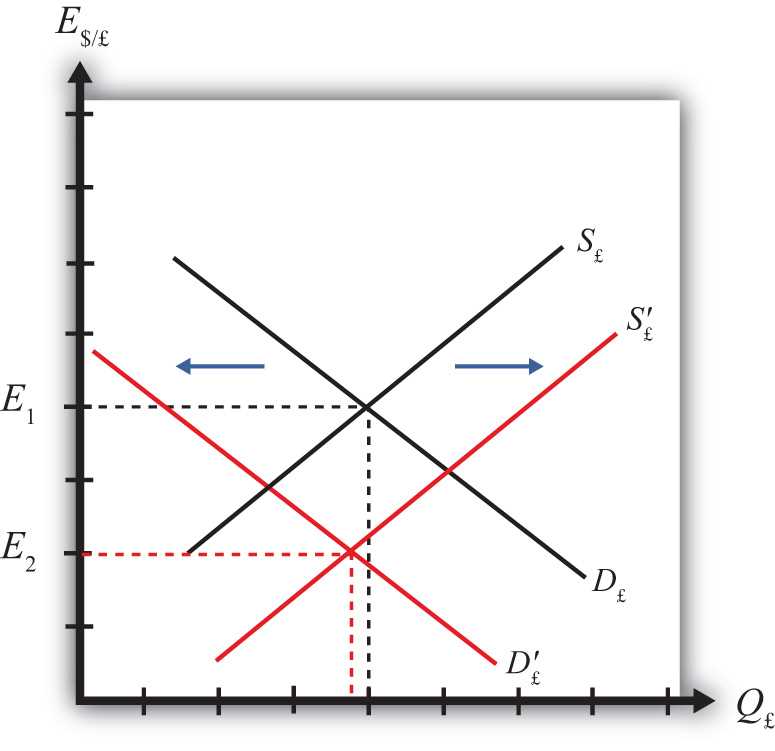

In practice, Interest Rate Parity is used by investors and traders to determine whether a currency is overvalued or undervalued. If the forward exchange rate calculated using Interest Rate Parity is higher than the current spot exchange rate, it suggests that the currency is expected to appreciate in the future. Conversely, if the forward exchange rate is lower than the spot exchange rate, it suggests that the currency is expected to depreciate.

Definition and Formula

Interest Rate Parity (IRP) is a financial concept that relates to the equilibrium between the interest rates of two different currencies. It states that the difference in interest rates between two countries should be equal to the percentage difference between the forward exchange rate and the spot exchange rate. In other words, it suggests that the interest rate differential between two countries should be offset by the expected change in the exchange rate over a given period.

The formula for interest rate parity is as follows:

Forward Exchange Rate = Spot Exchange Rate * (1 + Interest Rate of Foreign Currency) / (1 + Interest Rate of Domestic Currency)

This formula allows investors and traders to calculate the expected future exchange rate between two currencies based on the current spot exchange rate and the interest rates of the respective countries. By comparing the calculated forward exchange rate with the actual forward exchange rate, investors can identify potential arbitrage opportunities.

Interest Rate Parity is based on the principle of no-arbitrage, which assumes that investors will take advantage of any discrepancies in interest rates and exchange rates to make risk-free profits. If interest rate parity does not hold, it would create an opportunity for investors to borrow in a low-interest-rate currency, convert it to a high-interest-rate currency, invest in the higher-yielding assets, and then convert the proceeds back to the original currency, making a profit in the process.

However, in reality, interest rate parity is not always perfectly maintained due to various factors such as transaction costs, capital controls, and market inefficiencies. These deviations from interest rate parity can create opportunities for investors to engage in carry trades, where they borrow in a low-interest-rate currency and invest in a high-interest-rate currency, profiting from the interest rate differential.

Interest rate parity is an essential concept in international finance and plays a crucial role in determining exchange rates and interest rate differentials between countries. It helps investors and traders assess the fair value of currencies and make informed decisions regarding currency investments and hedging strategies.

Interest Rate Parity Example

Let’s consider an example to understand how interest rate parity works in practice.

Suppose there are two countries, Country A and Country B, with different interest rates. The interest rate in Country A is 5%, while the interest rate in Country B is 3%. The current exchange rate between the two countries is 1 Country A currency unit equals 2 Country B currency units.

Next, the investor would invest the borrowed money in Country A, where they can earn a higher interest rate of 5%. After a year, the investor would have earned interest on their investment in Country A.

Now, let’s calculate the returns for the investor:

Initial investment in Country B: $1000

Interest rate in Country B: 3%

Exchange rate: 1 Country A currency unit equals 2 Country B currency units

After one year, the investor would have earned an interest of $30 in Country B. The investor would then convert the money back to Country B currency at the new exchange rate of 1 Country A currency unit equals 1.8 Country B currency units.

So, the investor would receive $30 * 1.8 = $54 in Country B currency. However, the investor would still need to repay the borrowed amount of $1000 at an interest rate of 3%, which amounts to $1030.

This example demonstrates how interest rate parity ensures that there are no risk-free arbitrage opportunities in the foreign exchange market. If there were such opportunities, investors would quickly exploit them, leading to an equalization of interest rates and exchange rates between countries.

Overall, interest rate parity is an important concept in international finance that helps maintain equilibrium in interest rates and exchange rates between countries.

How it Works in Practice

Interest rate parity is a concept that is widely used in international finance to explain the relationship between interest rates and exchange rates. It is based on the idea that the difference in interest rates between two countries should be equal to the difference in their exchange rates.

When interest rate parity holds, it means that investors are not able to make risk-free profits by borrowing in one currency and investing in another. If there is a discrepancy between the interest rates and exchange rates, it creates an opportunity for arbitrage, where investors can take advantage of the difference to make profits.

For example, let’s say the interest rate in Country A is 5% and the interest rate in Country B is 3%. According to interest rate parity, the exchange rate between the two countries should adjust so that investors are indifferent between investing in either country. If the exchange rate does not adjust accordingly, investors can borrow in the country with the lower interest rate, convert the funds into the currency of the country with the higher interest rate, and invest at the higher rate. This would create a demand for the currency with the higher interest rate, causing its value to increase and the exchange rate to adjust.

In practice, however, interest rate parity may not always hold due to various factors such as transaction costs, capital controls, and market imperfections. These factors can create deviations from interest rate parity and provide opportunities for investors to exploit the differences in interest rates and exchange rates.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.