In Specie Definition and Meaning in Asset Distributions

In specie distributions can occur in various situations, such as when a company distributes its assets to shareholders or when a trust distributes assets to beneficiaries. Instead of liquidating the assets and distributing cash, the assets themselves are transferred to the recipients.

This method of distribution can be beneficial in certain circumstances. For example, if a company wants to distribute a non-cash asset to its shareholders, such as shares in another company or real estate, it can do so through an in specie distribution. This allows the shareholders to directly receive ownership of the asset without the need to sell it.

Benefits of In Specie Distributions

There are several benefits associated with in specie distributions. Firstly, it allows for the direct transfer of assets, which can be advantageous when the assets have a specific value or are unique in nature. It also eliminates the need to sell the assets, which can incur transaction costs and potentially impact the market.

In specie distributions can also provide tax advantages. Depending on the jurisdiction and the specific circumstances, distributing assets in specie may have tax implications that differ from distributing cash. It is important to consult with tax professionals or advisors to understand the tax implications of in specie distributions in a particular situation.

Considerations for In Specie Distributions

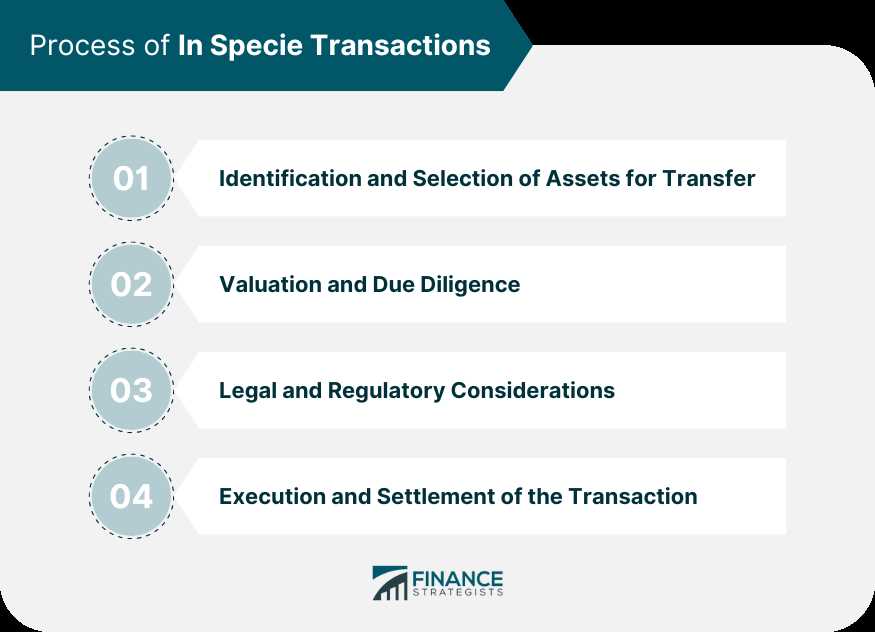

While in specie distributions can offer various benefits, there are also considerations to keep in mind. One important factor is the valuation of the assets being distributed. It is crucial to accurately determine the value of the assets to ensure a fair distribution among the recipients.

Additionally, in specie distributions may require legal and regulatory compliance. Depending on the jurisdiction and the type of assets being distributed, there may be specific rules and regulations that need to be followed. It is essential to consult legal professionals to ensure compliance with all applicable laws and regulations.

Examples of In Specie Distributions

Examples of in specie distributions include a company distributing its subsidiary shares to its shareholders, a trust distributing real estate properties to its beneficiaries, or a partnership distributing its investment portfolio to its partners. In each case, the assets are transferred directly to the recipients without the need for conversion into cash.

Overall, in specie distributions provide an alternative method of distributing assets that can be advantageous in certain situations. By directly transferring assets to recipients, it allows for the preservation of the assets’ value and potential tax advantages. However, it is important to carefully consider the valuation and legal considerations associated with in specie distributions to ensure a fair and compliant distribution process.

When an in specie distribution occurs, the ownership of the assets is transferred from one entity to another. This can happen in various situations, such as when a company distributes its shares to its shareholders, or when a trust distributes its assets to its beneficiaries.

One of the main reasons for choosing an in specie distribution is to avoid the costs and tax implications associated with selling the assets. By distributing the assets in their current form, the recipients can potentially avoid capital gains tax or other taxes that would be triggered by a sale.

In specie distributions can also be used to facilitate the transfer of assets between related entities, such as in a corporate restructuring or a family estate planning scenario. By transferring the assets directly, the entities involved can maintain control and ownership over the assets while achieving their desired objectives.

Benefits of In Specie Distributions

An in specie distribution refers to the distribution of assets in their existing form, rather than converting them to cash. This type of distribution can offer several benefits to both the distributing entity and the recipient.

- Preservation of Ownership: One of the key advantages of in specie distributions is that they allow the recipient to maintain ownership of the assets being distributed. Instead of selling the assets and receiving cash, the recipient receives the assets directly, which can be particularly beneficial if the assets have sentimental or strategic value.

- Tax Efficiency: In specie distributions can also provide tax advantages. By distributing assets instead of cash, the distributing entity may be able to avoid triggering capital gains taxes that would have been incurred if the assets were sold. Additionally, the recipient may benefit from a stepped-up cost basis for the assets, potentially reducing future tax liabilities.

- Diversification: In specie distributions can be an effective way to diversify an investment portfolio. By receiving assets in different asset classes or sectors, the recipient can enhance their portfolio’s diversification without having to make additional purchases.

- Cost Savings: In some cases, in specie distributions can be more cost-effective than selling assets and distributing cash. Selling assets can incur transaction costs, such as brokerage fees, that can be avoided with in specie distributions. This can be particularly advantageous for distributing entities that want to minimize expenses.

- Flexibility: In specie distributions offer flexibility in terms of how the recipient can utilize the distributed assets. They can choose to hold onto the assets, sell them at a later date, or use them for other purposes, depending on their financial goals and market conditions.

Overall, in specie distributions can provide a range of benefits, including preservation of ownership, tax efficiency, diversification, cost savings, and flexibility. However, it is important to consider the specific circumstances and objectives of both the distributing entity and the recipient before opting for an in specie distribution.

Considerations for In Specie Distributions

1. Valuation

One of the key considerations is the valuation of the assets being distributed. It is crucial to accurately determine the value of the assets to ensure a fair and equitable distribution. This may require the involvement of professionals such as appraisers or independent valuers.

2. Tax Implications

Another important consideration is the tax implications of in specie distributions. Depending on the jurisdiction and the nature of the assets, there may be tax consequences for both the distributing entity and the recipient. It is essential to consult with tax advisors or professionals to understand the potential tax liabilities and plan accordingly.

3. Legal and Regulatory Compliance

In specie distributions may be subject to legal and regulatory requirements. It is crucial to ensure that the distribution complies with all applicable laws and regulations. This may involve obtaining necessary approvals or permissions from regulatory authorities or complying with specific rules related to the distribution of certain types of assets.

4. Liquidity and Portfolio Diversification

Before opting for an in specie distribution, it is important to consider the liquidity and diversification of the recipient’s portfolio. In specie distributions involve transferring specific assets, which may affect the overall liquidity and diversification of the recipient’s investment portfolio. It is essential to assess the impact on the portfolio’s risk profile and ensure that the distribution aligns with the recipient’s investment objectives.

5. Transaction Costs

There may be transaction costs associated with in specie distributions. These costs can include fees for asset transfers, legal fees, or any other expenses related to the distribution process. It is important to consider these costs and evaluate whether the benefits of the in specie distribution outweigh the associated expenses.

By carefully considering these factors, individuals and entities can make informed decisions regarding in specie distributions and ensure that the distribution process is executed smoothly and in compliance with all relevant requirements.

Examples of In Specie Distributions

In specie distributions are a common practice in the financial industry, and they can take various forms depending on the specific circumstances of the distribution. Here are a few examples of in specie distributions:

| Example | Description |

|---|---|

| 1 | A real estate investment trust (REIT) decides to distribute a portion of its property holdings to its shareholders in the form of in specie distributions. The shareholders receive ownership of specific properties, which they can choose to keep or sell. |

| 2 | A mutual fund company decides to distribute a portion of its portfolio holdings to its investors in the form of in specie distributions. The investors receive shares of specific stocks or bonds, which they can choose to hold or sell. |

| 3 | A company undergoing a spin-off decides to distribute a subsidiary or division to its shareholders in the form of in specie distributions. The shareholders receive ownership of the subsidiary or division, which may then become a separate publicly traded company. |

| 4 | An individual decides to distribute their investment portfolio to their heirs in the form of in specie distributions. The heirs receive ownership of specific assets, such as stocks, bonds, or real estate properties, as part of their inheritance. |

These examples illustrate the flexibility and applicability of in specie distributions in various contexts. They allow for the direct transfer of ownership of assets, providing shareholders or investors with more control and flexibility in managing their investments.

It is important to note that in specie distributions may have tax implications, and individuals or entities involved should consult with tax professionals or financial advisors to understand the potential tax consequences.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.