What is the Home Buyers Plan (HBP)?

The Home Buyers Plan (HBP) is a program offered by the Canadian government that allows individuals to withdraw funds from their registered retirement savings plans (RRSPs) to purchase or build a qualifying home. This program is specifically designed to assist first-time homebuyers in saving for a down payment.

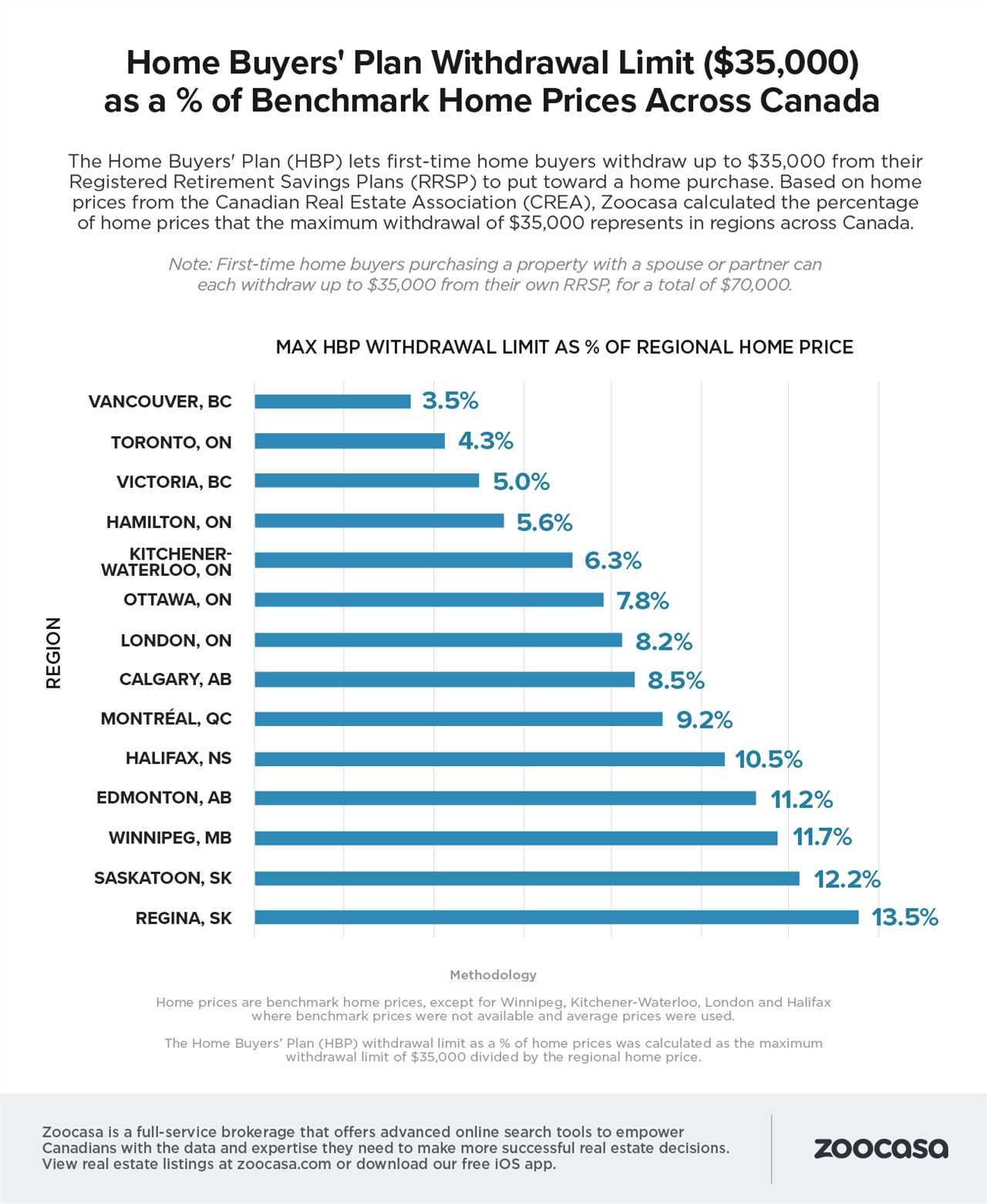

Under the HBP, eligible individuals can withdraw up to $35,000 from their RRSPs, tax-free, to put towards the purchase or construction of a home. This withdrawal does not count as income and therefore does not incur any tax liabilities. However, the withdrawn amount must be repaid to the RRSP within a specified timeframe to maintain its tax-free status.

The HBP provides a valuable opportunity for individuals to access their retirement savings to achieve their goal of homeownership. By allowing tax-free withdrawals from RRSPs, the program helps to alleviate the financial burden of saving for a down payment, making homeownership more attainable for many Canadians.

The Home Buyers Plan (HBP) is a program offered by the Canadian government that allows individuals to withdraw funds from their Registered Retirement Savings Plan (RRSP) to purchase or build a qualifying home. This program aims to assist first-time homebuyers in accumulating a down payment by utilizing their retirement savings.

Here are some key points to understand about the Home Buyers Plan:

| Eligibility | Only individuals who are considered first-time homebuyers are eligible to participate in the Home Buyers Plan. This means that you cannot have owned a home within the past four years. Additionally, you must have a written agreement to buy or build a qualifying home. |

| Withdrawal Limit | The maximum amount that can be withdrawn from an RRSP under the Home Buyers Plan is $35,000. This limit applies to each individual, so if you are purchasing a home with a partner, you can both withdraw up to $35,000. |

| Repayment | Once you withdraw funds from your RRSP under the Home Buyers Plan, you have up to 15 years to repay the amount. The repayment schedule begins in the second year after the withdrawal, and you must repay at least 1/15th of the amount each year. If you fail to make the required repayments, the amount will be included in your taxable income for that year. |

| Qualifying Home | The home you intend to purchase or build must be considered a qualifying home under the Home Buyers Plan. This includes a wide range of properties, such as single-family homes, semi-detached homes, townhouses, condominiums, and mobile homes. |

| Application Process | To participate in the Home Buyers Plan, you must complete and submit Form T1036 to the Canada Revenue Agency (CRA). This form outlines the details of your RRSP withdrawal and the intended use of the funds. The CRA will then determine your eligibility and provide further instructions. |

It is important to note that while the Home Buyers Plan provides a means for first-time homebuyers to access their retirement savings, it is crucial to carefully consider the long-term implications of withdrawing funds from your RRSP. Consult with a financial advisor to understand the potential impact on your retirement savings and overall financial plan.

How Does the Home Buyers Plan Work?

The Home Buyers Plan (HBP) is a program introduced by the Canadian government to help first-time homebuyers access their Registered Retirement Savings Plan (RRSP) funds for the purchase or construction of a home. Here is a step-by-step guide on how the Home Buyers Plan works:

- Eligibility: To be eligible for the Home Buyers Plan, you must be a first-time homebuyer or have not owned a home in the past four years. You must also have a written agreement to buy or build a qualifying home.

- Withdrawal: You can withdraw up to $35,000 from your RRSP under the Home Buyers Plan. If you are buying a home with your spouse or common-law partner, both of you can withdraw up to $35,000, resulting in a total withdrawal of $70,000.

- Repayment: After withdrawing funds from your RRSP, you have up to 15 years to repay the amount back into your RRSP. The repayment period starts in the second year following the withdrawal. Each year, you must repay at least 1/15th of the total amount withdrawn. If you do not repay the required amount, it will be added to your taxable income for that year.

- Home Purchase: Once you have withdrawn the funds from your RRSP, you can use them towards the down payment or other expenses related to the purchase or construction of a qualifying home. The funds can be used for a new or resale home, as well as for building a home on land you already own.

- Documentation: When filing your income tax return, you must complete and submit Form T1036 to the Canada Revenue Agency (CRA) to report your Home Buyers Plan withdrawal.

Step-by-Step Guide to Utilizing the Home Buyers Plan

Utilizing the Home Buyers Plan (HBP) can be a great way for first-time homebuyers to access their retirement savings to purchase a home. Here is a step-by-step guide on how to use the HBP:

- Determine your eligibility: Before you can utilize the HBP, you need to make sure you meet the eligibility criteria. This includes being a first-time homebuyer, having a written agreement to buy or build a qualifying home, and being a resident of Canada.

- Contribute to your RRSP: If you haven’t already, start contributing to your RRSP to take advantage of the HBP. The funds you contribute can be used towards the down payment on your home.

- Complete the HBP application: Fill out the necessary forms to apply for the HBP. This includes Form T1036, which is the Home Buyers’ Plan (HBP) Request to Withdraw Funds from an RRSP.

- Withdraw funds from your RRSP: Once your application is approved, you can withdraw the funds from your RRSP. You can withdraw the full amount or a portion of it, depending on your needs.

- Use the funds for your down payment: The funds you withdraw from your RRSP can be used towards your down payment. Make sure to keep track of these funds and use them solely for the purpose of purchasing your home.

- Repay the withdrawn amount: After withdrawing the funds, you have up to 15 years to repay the amount back into your RRSP. This repayment is important to ensure that you don’t incur any penalties or taxes.

Benefits of the Home Buyers Plan

The Home Buyers Plan (HBP) offers several benefits for individuals who are looking to purchase their first home. This program allows individuals to withdraw funds from their Registered Retirement Savings Plan (RRSP) to use towards the purchase of a qualifying home. Here are some of the key benefits of utilizing the Home Buyers Plan:

1. Tax-Free Withdrawals

2. Higher Down Payment

By utilizing the Home Buyers Plan, individuals can increase their down payment amount, which can have several benefits. A higher down payment can help reduce the overall mortgage amount, resulting in lower monthly mortgage payments. It can also potentially help individuals qualify for a lower interest rate, saving them money over the life of the mortgage.

3. Flexibility

The Home Buyers Plan provides flexibility in terms of repayment. Individuals have up to 15 years to repay the withdrawn amount back into their RRSP. This flexibility allows individuals to manage their finances and repay the amount at a pace that suits their financial situation.

4. Joint Participation

If both individuals in a couple are first-time homebuyers, they can each withdraw up to the maximum allowed amount from their respective RRSPs. This joint participation can significantly increase the funds available for the down payment, making it easier to purchase a home.

5. No Penalties for Early Withdrawal

6. Opportunity for Homeownership

The Home Buyers Plan provides an opportunity for individuals who may not have enough savings for a down payment to become homeowners. By accessing their RRSP funds through this program, individuals can fulfill their dream of owning a home and build equity for their future.

| Benefits | Summary |

|---|---|

| Tax-Free Withdrawals | Withdrawals from RRSP are tax-free |

| Higher Down Payment | Increased down payment amount for lower mortgage payments |

| Flexibility | Up to 15 years to repay the withdrawn amount |

| Joint Participation | Both individuals in a couple can participate |

| No Penalties for Early Withdrawal | No penalties or taxes if repaid within the specified timeframe |

| Opportunity for Homeownership | Allows individuals to become homeowners with limited savings |

Advantages of Using the Home Buyers Plan for First-Time Homebuyers

Buying a home for the first time can be an exciting but daunting process. One of the challenges that many first-time homebuyers face is saving enough money for a down payment. Fortunately, the Home Buyers Plan (HBP) offers several advantages that can make the home buying process more accessible and affordable.

1. Access to Your Retirement Savings

One of the main advantages of the Home Buyers Plan is that it allows you to access your retirement savings to use towards the purchase of your first home. Under the HBP, you can withdraw up to $35,000 from your Registered Retirement Savings Plan (RRSP) without incurring any tax penalties. This means that you can tap into your savings without having to pay taxes on the amount withdrawn.

2. Tax Benefits

Another advantage of using the Home Buyers Plan is the tax benefits it offers. When you withdraw money from your RRSP under the HBP, the amount is considered a loan from your RRSP and not a taxable income. This means that you won’t have to pay taxes on the withdrawn amount, which can save you a significant amount of money.

3. Repayment Flexibility

The Home Buyers Plan also offers repayment flexibility, which is beneficial for first-time homebuyers. After withdrawing money from your RRSP, you have up to 15 years to repay the amount back into your RRSP. This gives you ample time to repay the loan without putting undue financial strain on yourself.

4. Joint Participation

If you’re purchasing a home with your spouse or common-law partner, both of you can participate in the Home Buyers Plan. This means that you can each withdraw up to $35,000 from your respective RRSPs, allowing you to access a larger amount of money for your down payment.

5. No Prepayment Penalties

Unlike traditional mortgages, the Home Buyers Plan does not come with prepayment penalties. This means that if you have extra funds available, you can make additional payments towards your RRSP loan without incurring any penalties. This can help you pay off the loan faster and save on interest charges.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.