What is the Harvard MBA Indicator?

The Harvard MBA Indicator is a powerful tool used for economic forecasting. It is a metric that measures the percentage of Harvard Business School graduates who accept job offers by a certain date. This indicator is considered a key metric because it provides valuable insights into the state of the economy and can help predict future economic trends.

When the job market is strong and the economy is doing well, a higher percentage of Harvard MBA graduates tend to accept job offers early in the recruiting season. On the other hand, when the job market is weak and the economy is struggling, fewer graduates accept job offers early.

How does the Harvard MBA Indicator work?

The Harvard MBA Indicator works by tracking the percentage of graduates who accept job offers within a specific timeframe. This data is collected and analyzed to determine the overall strength or weakness of the job market and the economy as a whole.

The indicator is based on the assumption that Harvard Business School graduates are highly sought after by employers and are often seen as a leading indicator of economic trends. When a higher percentage of graduates accept job offers, it suggests that companies are hiring and the economy is performing well. Conversely, when a lower percentage of graduates accept job offers, it indicates a weaker job market and a potential economic slowdown.

Why is the Harvard MBA Indicator a key metric for economic forecasting?

The Harvard MBA Indicator is considered a key metric for economic forecasting because it provides a timely and reliable measure of the job market and the overall state of the economy. By tracking the percentage of graduates who accept job offers, economists and analysts can make predictions about future economic trends and adjust their strategies accordingly.

This indicator is particularly valuable because it is based on real-time data from a prestigious business school and reflects the behavior of highly educated and skilled individuals. It offers insights into the hiring practices of top companies and provides a glimpse into the overall health of the job market.

Overall, the Harvard MBA Indicator is a valuable tool for economic forecasting and can help businesses, investors, and policymakers make informed decisions based on the current state of the job market and the economy.

Why is it a Key Metric for Economic Forecasting?

The Harvard MBA Indicator is considered a key metric for economic forecasting due to its strong correlation with economic trends. This indicator is based on the percentage of Harvard Business School graduates who accept job offers by a certain date each year.

When the economy is strong and job prospects are favorable, a higher percentage of MBA graduates tend to accept job offers early in the recruiting season. This indicates confidence in the job market and suggests that businesses are actively hiring and expanding. On the other hand, when the economy is weak and job prospects are uncertain, a lower percentage of MBA graduates accept job offers early, indicating a lack of confidence in the job market and potential economic downturn.

Accurate Economic Predictions

By analyzing the data from the Harvard MBA Indicator, economists and financial analysts can make accurate predictions about the state of the economy. This indicator serves as an early warning system, providing insights into the overall health of the job market and the broader economy.

Historically, the Harvard MBA Indicator has been a reliable predictor of economic downturns and recoveries. It has shown a strong correlation with key economic indicators such as GDP growth, unemployment rates, and stock market performance. Therefore, monitoring the Harvard MBA Indicator can help businesses, investors, and policymakers make informed decisions and prepare for potential economic changes.

Insight into Market Trends

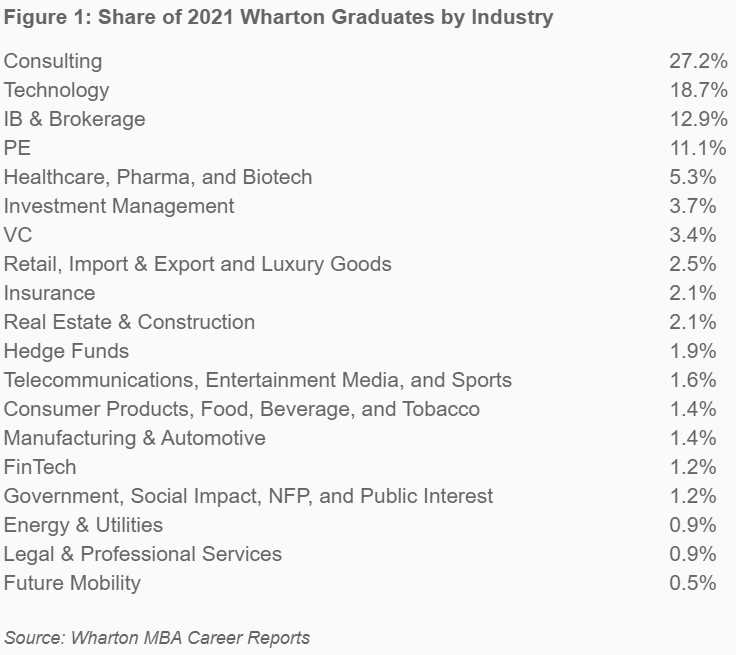

In addition to its predictive power, the Harvard MBA Indicator also provides valuable insights into market trends. By analyzing the industries and sectors that attract a higher percentage of MBA graduates, analysts can identify emerging trends and areas of growth.

For example, if there is a significant increase in MBA graduates accepting job offers in the technology sector, it may indicate a growing demand for tech talent and potential investment opportunities in related industries. Similarly, a decline in MBA graduates accepting job offers in traditional sectors like finance or consulting may suggest a shift in market dynamics and the need for businesses to adapt their strategies accordingly.

Overall, the Harvard MBA Indicator offers a unique perspective on the job market and the broader economy. Its ability to accurately predict economic trends and provide insights into market dynamics makes it a key metric for economic forecasting.

Benefits of Using the Harvard MBA Indicator

1. Timely and Reliable Data

The Harvard MBA Indicator is updated regularly and provides real-time data on the state of the economy. This means that businesses and investors can access the most up-to-date information to make informed decisions.

2. Comprehensive Analysis

The Harvard MBA Indicator takes into account a wide range of economic factors, including employment rates, consumer spending, and business sentiment. This comprehensive analysis provides a holistic view of the economy and allows for more accurate predictions.

3. Predictive Power

By analyzing historical data and trends, the Harvard MBA Indicator has proven to be a reliable predictor of economic performance. Businesses and investors can use this predictive power to anticipate market trends and adjust their strategies accordingly.

4. Competitive Advantage

Using the Harvard MBA Indicator gives businesses and investors a competitive advantage by providing them with valuable insights that others may not have. This advantage can help businesses stay ahead of the curve and make strategic decisions that drive growth and profitability.

Accurate Economic Predictions

The Harvard MBA Indicator is a powerful tool that provides accurate economic predictions. By analyzing the enrollment trends of Harvard Business School, this indicator can forecast future economic conditions with a high level of accuracy.

When the indicator shows an increase in MBA applications, it suggests that individuals are seeking to further their education during an economic downturn. This indicates a potential recovery in the near future. On the other hand, a decrease in applications indicates a lack of confidence in the economy and may signal an upcoming recession.

By using the Harvard MBA Indicator, businesses and investors can make informed decisions about their strategies and investments. They can anticipate economic trends and adjust their plans accordingly, minimizing risks and maximizing opportunities.

Benefits of the Harvard MBA Indicator

There are several benefits to using the Harvard MBA Indicator for economic forecasting:

- Reliability: The indicator has a proven track record of accurately predicting economic conditions.

- Timeliness: The indicator provides real-time data, allowing businesses to stay ahead of economic trends.

- Accessibility: The indicator is readily available and can be accessed by anyone interested in economic forecasting.

- Cost-effectiveness: The indicator is a cost-effective tool compared to other complex economic models.

Overall, the Harvard MBA Indicator is a valuable resource for businesses, investors, and economists alike. Its accurate predictions and insights into market trends can help guide decision-making and lead to successful outcomes in an ever-changing economic landscape.

Insight into Market Trends

The Harvard MBA Indicator takes into account various factors such as business confidence, hiring plans, and investment intentions of Harvard Business School graduates. These factors are highly indicative of the overall sentiment and direction of the market.

On the other hand, if the indicator shows a decline in business confidence and investment intentions, it may suggest that the market is entering a period of uncertainty or downturn. In such cases, businesses and investors can take proactive measures to mitigate risks and protect their assets.

Overall, the Harvard MBA Indicator provides valuable insights into market trends that can help businesses and investors stay ahead of the curve and make more informed decisions. By leveraging this information, they can adapt their strategies, allocate resources effectively, and maximize their chances of success in the ever-changing market.

| Benefits of Using the Harvard MBA Indicator |

|---|

| Accurate Economic Predictions |

| Insight into Market Trends |

How to Access the Harvard MBA Indicator

If you’re interested in accessing the Harvard MBA Indicator for economic forecasting, you’ll be pleased to know that it’s readily available to the public. Here are the steps to access this key metric:

- Visit the official Harvard MBA Indicator website.

- On the homepage, you’ll find a section dedicated to accessing the indicator. Click on the “Access Now” button.

- You’ll be redirected to a registration page where you’ll need to create an account. Fill in your personal details, including your name, email address, and password.

- Once you’ve created your account, you’ll receive a confirmation email. Click on the link provided in the email to verify your account.

- After verifying your account, you’ll be able to log in to the Harvard MBA Indicator platform.

- On the platform, you’ll have access to a range of features and tools related to economic forecasting. Explore the different sections to gain insights into market trends and make accurate predictions.

- Make sure to regularly check the Harvard MBA Indicator platform for updates and new data. The indicator is updated frequently to provide the most up-to-date information for economic forecasting.

By following these simple steps, you’ll be able to access the Harvard MBA Indicator and utilize its powerful tools for economic forecasting. Start leveraging this key metric today and stay ahead of market trends.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.