What is a Guaranteed Loan?

A guaranteed loan is a type of loan that is backed by a third-party guarantee. This means that if the borrower defaults on the loan, the guarantor will step in and cover the outstanding balance. The guarantee provides additional security for the lender, making it easier for borrowers to qualify for the loan.

How Does a Guaranteed Loan Work?

When a borrower applies for a guaranteed loan, they must meet certain eligibility criteria set by the lender and the guarantor. This may include providing proof of income, demonstrating the ability to repay the loan, and meeting any other requirements specified by the lender.

If the borrower is approved for the loan, the lender will disburse the funds, and the borrower will be responsible for repaying the loan according to the agreed-upon terms. If the borrower defaults on the loan, the guarantor will step in and repay the outstanding balance.

Exploring the Process

The process for obtaining a guaranteed loan may vary depending on the type of loan and the guarantor involved. In some cases, the borrower may need to apply directly with the guarantor, while in other cases, they may apply through a lender who works with the guarantor.

During the application process, the borrower will need to provide the necessary documentation and information to demonstrate their eligibility for the loan. This may include proof of income, identification documents, and any other required paperwork.

Once the loan is approved, the borrower will receive the funds and can use them for the intended purpose. They will then need to make regular payments to repay the loan, including any interest and fees that may apply.

Examples of Guaranteed Loans

There are several types of guaranteed loans available, each with its own specific requirements and purposes. Some common examples include:

- Small Business Administration (SBA) loans

- USDA Rural Development loans

- VA loans for veterans

- FHA loans for homebuyers

These loans are guaranteed by the respective government agencies, making it easier for borrowers to qualify and obtain financing for their specific needs.

Showcasing Real-Life Scenarios

Guaranteed loans have helped numerous individuals and businesses achieve their goals by providing access to financing that may not have been available otherwise. Whether it’s starting a new business, purchasing a home, or funding an education, guaranteed loans offer a valuable opportunity for borrowers to secure the funding they need.

A guaranteed loan is a type of loan that is backed by a third-party guarantor. This guarantor, often a government agency or a financial institution, provides a guarantee to the lender that the loan will be repaid in full if the borrower defaults. This guarantee reduces the risk for the lender and allows borrowers who may not meet traditional lending criteria to access financing.

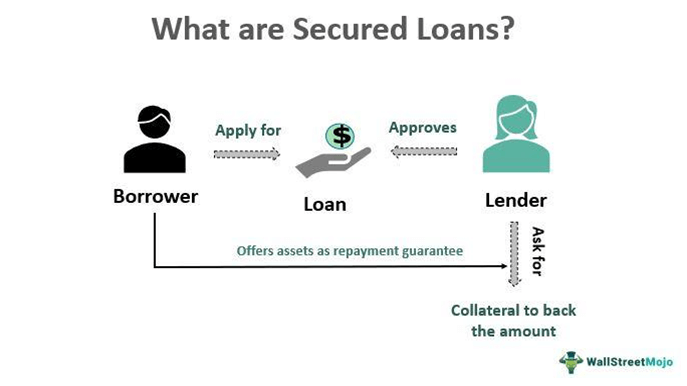

Guaranteed loans are commonly used in situations where the borrower does not have sufficient collateral or a strong credit history to secure a loan on their own. The guarantor’s guarantee serves as a form of collateral, providing assurance to the lender that they will be repaid.

Benefits of Guaranteed Loans

There are several benefits to obtaining a guaranteed loan:

- Increased Access to Financing: Guaranteed loans provide individuals and businesses with access to financing that they may not otherwise qualify for. This can help stimulate economic growth and provide opportunities for individuals to improve their financial situation.

- Lower Interest Rates: Since the lender’s risk is reduced with a guaranteed loan, borrowers may be able to secure lower interest rates compared to other types of loans.

- Flexible Repayment Terms: Guaranteed loans often come with flexible repayment terms, allowing borrowers to tailor the loan to their specific financial situation.

- Building Credit: Successfully repaying a guaranteed loan can help borrowers build or improve their credit history, making it easier to qualify for future loans.

Types of Guaranteed Loans

There are various types of guaranteed loans available, each with its own specific requirements and purposes. Some common types of guaranteed loans include:

| Loan Type | Description |

|---|---|

| Federal Housing Administration (FHA) Loans | Guaranteed loans for homebuyers with low credit scores or limited down payment funds. |

| Small Business Administration (SBA) Loans | Guaranteed loans for small businesses that may not qualify for traditional bank loans. |

| USDA Rural Development Loans | Guaranteed loans for individuals and businesses in rural areas to promote economic development. |

| Department of Veterans Affairs (VA) Loans | Guaranteed loans for eligible veterans and their families to purchase or refinance a home. |

How Does a Guaranteed Loan Work?

A guaranteed loan is a type of loan that is backed by a third party, such as a government agency or a financial institution. This third party guarantees to repay the loan if the borrower defaults on their payments. This guarantee reduces the risk for the lender, making it easier for borrowers to obtain financing.

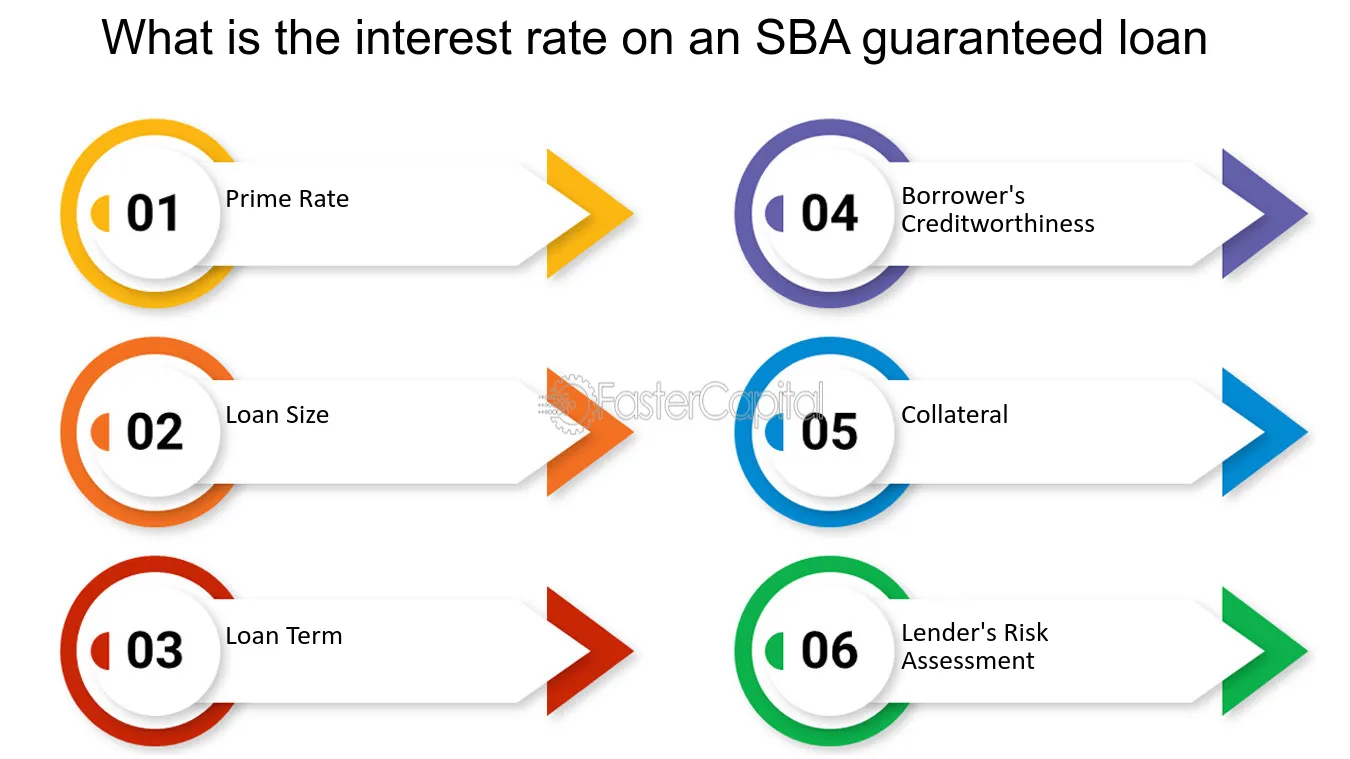

When a borrower applies for a guaranteed loan, they must meet certain eligibility criteria set by the lender and the third-party guarantor. These criteria may include a minimum credit score, a stable income, and a specific loan purpose, among other factors.

If the borrower meets the eligibility criteria, the lender will review their application and assess their creditworthiness. The lender will also evaluate the collateral, if any, that the borrower is offering to secure the loan. Collateral can be in the form of real estate, vehicles, or other valuable assets.

Once the lender approves the loan, the borrower will receive the funds and begin making regular payments according to the agreed-upon terms. If the borrower fails to make their payments, the third-party guarantor will step in and repay the loan on their behalf.

Guaranteed loans can be used for various purposes, such as purchasing a home, starting a business, or financing education. The specific terms and conditions of the loan, including the interest rate and repayment period, will vary depending on the lender and the guarantor.

Exploring the Process

When applying for a guaranteed loan, there is a specific process that borrowers must follow. This process typically involves several steps:

1. Research and Preparation

2. Application

Once you have gathered all the necessary information, you can proceed with the loan application. This typically involves filling out an application form provided by the lender or financial institution offering the guaranteed loan. The application form will require you to provide personal and financial information, such as your income, employment history, and credit score.

3. Documentation

After submitting the loan application, you will need to provide supporting documentation to verify the information provided. This may include documents such as pay stubs, bank statements, tax returns, and identification documents.

4. Loan Approval

Once the lender has reviewed your application and supporting documentation, they will assess your eligibility for the guaranteed loan. This evaluation process may involve checking your credit history, income stability, and debt-to-income ratio. If you meet the requirements, the lender will approve your loan application.

5. Loan Disbursement

After loan approval, the lender will disburse the funds to you. The disbursement method may vary depending on the type of guaranteed loan. For example, if it is a mortgage loan, the funds may be directly transferred to the seller or the escrow account. If it is a small business loan, the funds may be deposited into your business bank account.

6. Repayment

Once you have received the loan funds, you will need to start repaying the loan according to the agreed-upon terms. This typically involves making regular monthly payments, which may include both principal and interest. Failure to repay the loan as agreed may result in penalties, fees, and damage to your credit score.

It is important to note that the specific process may vary depending on the lender and the type of guaranteed loan. It is always recommended to carefully review the loan terms and conditions and seek professional advice if needed.

Examples of Guaranteed Loans

Guaranteed loans are available in various forms and for different purposes. Here are some examples of guaranteed loans:

1. Small Business Administration (SBA) Loans: The SBA offers guaranteed loans to small businesses that may not qualify for traditional bank loans. These loans provide financial assistance for starting or expanding a business, purchasing equipment, or refinancing existing debt. The SBA guarantees a portion of the loan, reducing the risk for lenders and making it easier for small businesses to access funding.

2. Federal Housing Administration (FHA) Loans: FHA loans are guaranteed by the Federal Housing Administration and are designed to help individuals and families with low to moderate incomes become homeowners. These loans have more flexible qualification requirements and lower down payment options compared to conventional mortgages. The FHA guarantees a portion of the loan, making it less risky for lenders.

3. Farm Service Agency (FSA) Loans: The FSA provides guaranteed loans to farmers and ranchers who are unable to obtain financing from traditional lenders. These loans can be used for various purposes, such as purchasing land, livestock, equipment, or operating expenses. The FSA guarantees a portion of the loan, making it more attractive to lenders and increasing access to credit for farmers and ranchers.

4. Student Loans: Some student loans are guaranteed by the government, such as Federal Direct Stafford Loans. These loans are available to undergraduate and graduate students to help cover the cost of tuition, fees, and other educational expenses. The government guarantees these loans, making them more accessible and affordable for students who may not have a credit history or meet the income requirements of private lenders.

5. Veterans Affairs (VA) Loans: VA loans are guaranteed by the Department of Veterans Affairs and are available to eligible veterans, active-duty military personnel, and surviving spouses. These loans offer favorable terms and lower interest rates compared to conventional mortgages. The VA guarantees a portion of the loan, making it easier for veterans and military personnel to obtain financing for purchasing a home.

6. Export-Import Bank (Ex-Im Bank) Loans: The Ex-Im Bank provides guaranteed loans to support U.S. exports and promote international trade. These loans help exporters finance their export transactions and mitigate the risk of non-payment by foreign buyers. The Ex-Im Bank guarantees a portion of the loan, making it more attractive to lenders and facilitating international trade.

These are just a few examples of guaranteed loans, and there are many other programs and organizations that offer similar financing options. The guarantee provided by the government or a designated agency reduces the risk for lenders, making it easier for individuals, businesses, and farmers to access the funds they need.

Showcasing Real-Life Scenarios

Guaranteed loans have been instrumental in helping individuals and businesses achieve their financial goals. Let’s take a look at some real-life scenarios where guaranteed loans have made a significant impact:

- Small Business Expansion: Sarah owns a small bakery and wants to expand her business by opening a second location. However, she lacks the necessary funds to make this expansion a reality. Sarah applies for a guaranteed loan through a government program specifically designed to support small businesses. With the guaranteed loan, Sarah is able to secure the funds she needs to open the second bakery, hire additional staff, and purchase the necessary equipment.

- Homeownership: John and Lisa have been renting an apartment for years and dream of owning their own home. However, they struggle to save enough money for a down payment. They decide to apply for a guaranteed loan through a mortgage lender. The guaranteed loan program allows them to qualify for a mortgage with a lower down payment requirement. John and Lisa are thrilled to finally become homeowners and start building equity in their own property.

- Higher Education: Emily is a high school student with dreams of attending college. However, the cost of tuition and other expenses is a major barrier for her. Emily applies for a guaranteed student loan through a federal program. The guaranteed loan enables her to cover the costs of tuition, books, and living expenses while she pursues her degree. Thanks to the guaranteed loan, Emily can focus on her studies without worrying about the financial burden.

- Debt Consolidation: Mark is struggling with multiple high-interest debts, including credit card balances and personal loans. He finds it challenging to keep up with the monthly payments and the accumulating interest. Mark decides to apply for a guaranteed debt consolidation loan through a reputable financial institution. The guaranteed loan allows him to combine all his debts into a single loan with a lower interest rate. This simplifies his monthly payments and helps him save money in the long run.

These real-life scenarios demonstrate the versatility and benefits of guaranteed loans. Whether it’s starting a business, buying a home, pursuing higher education, or managing debt, guaranteed loans provide individuals and businesses with the financial support they need to achieve their goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.