What is a Government-Sponsored Enterprise (GSE)?

A Government-Sponsored Enterprise (GSE) is a financial institution that is created by the government to provide support to specific sectors of the economy. These entities are typically established with a public purpose in mind, such as promoting homeownership or facilitating access to credit for certain industries.

GSEs are unique in that they operate with a hybrid structure, combining elements of both private and public entities. While they are privately owned, they have a close relationship with the government and receive certain benefits and privileges as a result.

The primary role of GSEs is to provide liquidity and stability to the markets they serve. They do this by purchasing loans from lenders, such as banks or mortgage companies, and either holding them in their portfolio or securitizing them into mortgage-backed securities (MBS) that can be sold to investors.

One of the most well-known examples of a GSE is the Federal National Mortgage Association (Fannie Mae). Fannie Mae was created in 1938 during the Great Depression to provide stability to the housing market by purchasing mortgages from lenders and providing them with funds to originate new loans.

Another example is the Federal Home Loan Mortgage Corporation (Freddie Mac), which was established in 1970 to expand the secondary mortgage market and increase homeownership opportunities.

Overall, GSEs play a crucial role in supporting the economy by providing stability and liquidity to specific sectors. They help promote homeownership, facilitate access to credit, and ensure the availability of affordable housing options.

Definition and Overview

A Government-Sponsored Enterprise (GSE) is a financial institution that is created and supported by the government, but operates independently of direct government control. GSEs are typically established to provide a specific public service or promote a particular sector of the economy.

GSEs can take various forms, including corporations, agencies, or associations. They are often involved in sectors such as housing, agriculture, education, and infrastructure. The primary objective of a GSE is to enhance the availability and affordability of credit in their respective sectors.

One key characteristic of GSEs is their ability to access funding at lower interest rates compared to private entities. This is because GSEs are often seen as having an implicit government guarantee, which reduces the perceived risk for investors. As a result, GSEs can provide loans or other financial products at more favorable terms to borrowers.

Another important aspect of GSEs is their role in promoting stability and liquidity in the financial markets. They often act as intermediaries between lenders and borrowers, facilitating the flow of funds and reducing the impact of market fluctuations. GSEs can also provide a secondary market for mortgages and other loans, which helps to increase the availability of credit.

However, the independence of GSEs from direct government control can sometimes lead to challenges. There have been instances where GSEs have faced financial difficulties, which have required government intervention to prevent systemic risks. The financial crisis of 2008, for example, highlighted the risks associated with GSEs and led to significant reforms in their regulation and oversight.

Examples of Government-Sponsored Enterprises

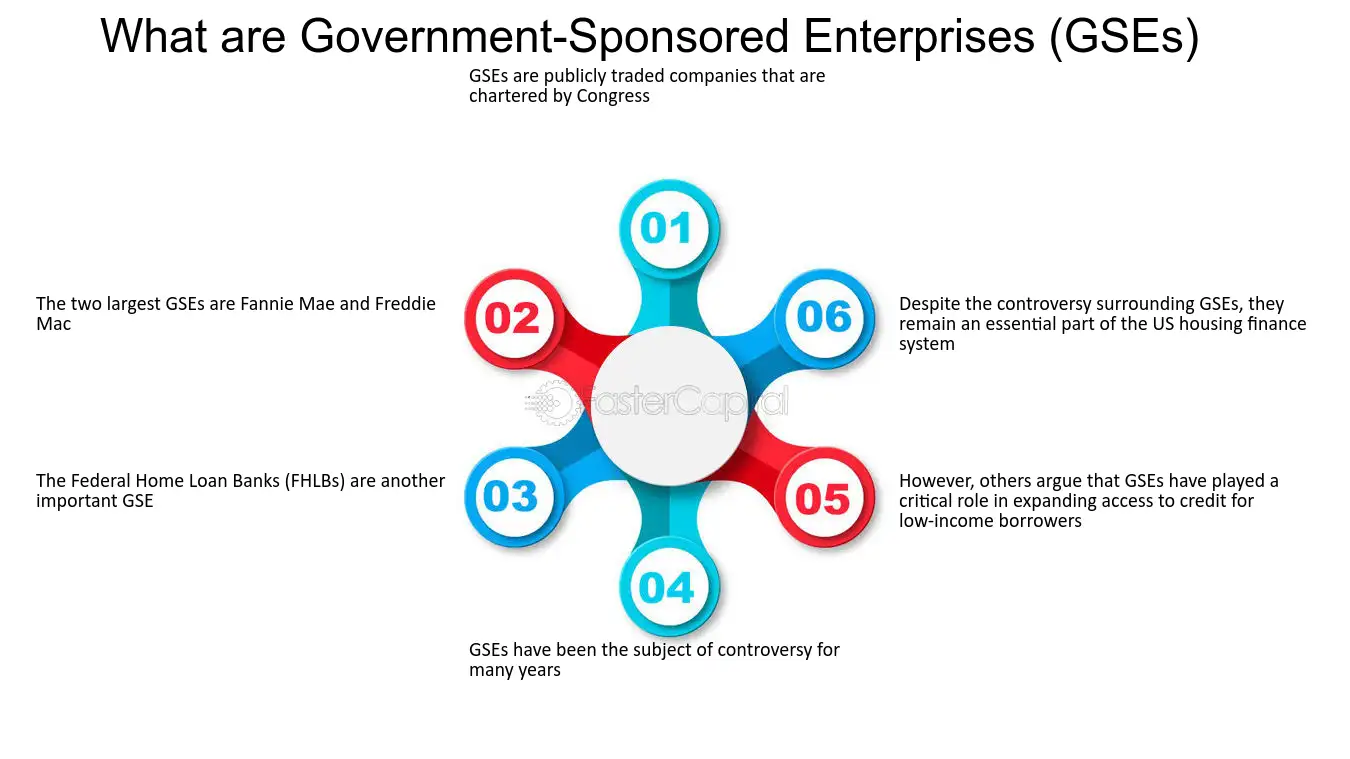

Government-sponsored enterprises (GSEs) are a unique type of financial institution that operate under the guidance and support of the government. They play a crucial role in the economy by providing funding and stability to various sectors, such as housing and agriculture. Here are some examples of well-known GSEs:

1. Federal National Mortgage Association (Fannie Mae)

Fannie Mae is one of the most prominent GSEs in the United States. Established in 1938, it was created to expand the secondary mortgage market and provide stability to the housing market. Fannie Mae purchases mortgage loans from lenders, thereby freeing up capital for banks to issue more loans. This helps to increase homeownership rates and promote affordable housing.

2. Federal Home Loan Mortgage Corporation (Freddie Mac)

Freddie Mac, similar to Fannie Mae, was established to support the housing market. It was created in 1970 to provide liquidity to the mortgage market by purchasing mortgage loans from lenders. By doing so, Freddie Mac helps to ensure that banks have enough funds to continue lending to homebuyers. This promotes stability in the housing market and encourages homeownership.

3. Federal Agricultural Mortgage Corporation (Farmer Mac)

Farmer Mac is a GSE that focuses on the agricultural sector. It was established in 1988 to provide a secondary market for agricultural real estate and rural housing mortgage loans. Farmer Mac purchases these loans from lenders, which allows them to provide more financing to farmers and rural communities. This helps to support the agriculture industry and promote rural development.

4. Student Loan Marketing Association (Sallie Mae)

These examples highlight the diverse range of sectors that GSEs support. By providing stability and liquidity to these sectors, GSEs play a crucial role in promoting economic growth and ensuring access to essential services.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.