Gearing Ratios: Definition, Types, and Calculation Guide

What are Gearing Ratios?

Types of Gearing Ratios

There are several types of gearing ratios that provide different perspectives on a company’s financial leverage:

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its total equity. It indicates the proportion of a company’s financing that comes from debt.

- Debt Ratio: The debt ratio measures the proportion of a company’s assets that are financed by debt. It is calculated by dividing total debt by total assets.

- Equity Ratio: The equity ratio measures the proportion of a company’s assets that are financed by equity. It is calculated by dividing total equity by total assets.

- Interest Coverage Ratio: This ratio assesses a company’s ability to cover its interest expenses with its operating income. It is calculated by dividing operating income by interest expenses.

How to Calculate Gearing Ratios

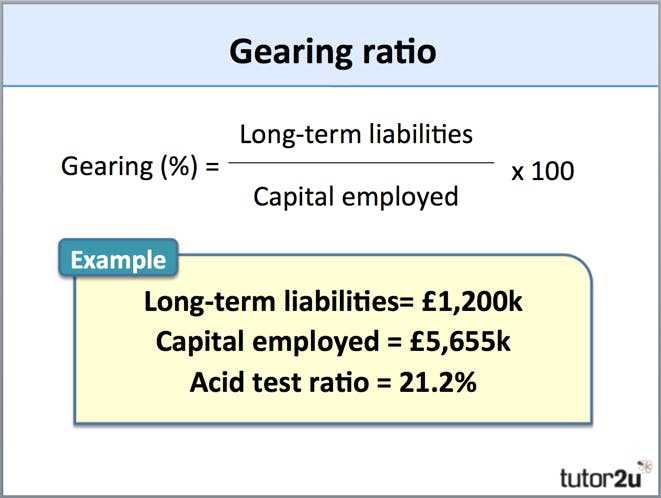

Calculating gearing ratios involves simple mathematical formulas using financial data from a company’s balance sheet and income statement. Here are the formulas for some common gearing ratios:

- Debt-to-Equity Ratio = Total Debt / Total Equity

- Debt Ratio = Total Debt / Total Assets

- Equity Ratio = Total Equity / Total Assets

- Interest Coverage Ratio = Operating Income / Interest Expenses

By calculating these ratios, investors and analysts can gain insights into a company’s financial leverage, risk profile, and ability to meet its financial obligations. It is important to compare these ratios with industry benchmarks and historical data to assess a company’s performance and financial health accurately.

What are Gearing Ratios?

Gearing ratios are financial ratios that measure the proportion of a company’s debt to its equity or capital. They provide insights into a company’s financial health and its ability to meet its financial obligations. Gearing ratios are commonly used by investors, creditors, and analysts to assess the risk and stability of a company.

Importance of Gearing Ratios

Gearing ratios help stakeholders understand the financial structure of a company and its level of leverage. They indicate the extent to which a company relies on debt financing compared to equity financing. A high gearing ratio suggests that a company has a significant amount of debt, which can increase financial risk. On the other hand, a low gearing ratio indicates a more conservative financial structure with a higher proportion of equity.

Gearing ratios are particularly important for investors and creditors. Investors use gearing ratios to evaluate the risk-return tradeoff of investing in a company. A higher gearing ratio may indicate higher potential returns but also higher risk. Creditors, such as banks and bondholders, use gearing ratios to assess a company’s ability to repay its debt obligations. A company with a high gearing ratio may have difficulty meeting its debt payments, increasing the credit risk for lenders.

Types of Gearing Ratios

There are several types of gearing ratios commonly used in financial analysis:

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its total equity. It indicates the proportion of a company’s financing that comes from debt versus equity.

- Debt Ratio: This ratio measures the percentage of a company’s assets that are financed by debt. It shows the extent to which a company relies on debt to finance its operations.

- Equity Ratio: This ratio measures the percentage of a company’s assets that are financed by equity. It represents the proportion of a company’s financing that comes from shareholders’ equity.

- Interest Coverage Ratio: This ratio assesses a company’s ability to cover its interest expenses with its operating income. It indicates the company’s ability to meet its interest payment obligations.

Calculating Gearing Ratios

Types of Gearing Ratios

Gearing ratios are financial ratios that measure the proportion of a company’s debt to its equity or assets. These ratios provide valuable insights into a company’s financial structure and its ability to meet its financial obligations. There are several types of gearing ratios that are commonly used by analysts and investors to assess a company’s financial health and risk profile.

1. Debt-to-Equity Ratio

The debt-to-equity ratio is one of the most commonly used gearing ratios. It measures the proportion of a company’s total debt to its total equity. This ratio indicates the extent to which a company is financed by debt compared to equity. A high debt-to-equity ratio suggests that a company has a higher level of financial risk, as it relies more on borrowed funds to finance its operations.

2. Debt Ratio

3. Equity Ratio

4. Interest Coverage Ratio

The interest coverage ratio measures a company’s ability to meet its interest payments on its debt. It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expense. A higher interest coverage ratio indicates a company’s ability to easily meet its interest obligations, while a lower ratio suggests a higher level of financial risk.

5. Fixed Charge Coverage Ratio

The fixed charge coverage ratio is similar to the interest coverage ratio, but it takes into account all fixed charges, including interest, lease payments, and other fixed obligations. It is calculated by dividing a company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) by its fixed charges. A higher fixed charge coverage ratio indicates a company’s ability to meet all of its fixed obligations, while a lower ratio suggests a higher level of financial risk.

| Gearing Ratio | Formula | Interpretation |

|---|---|---|

| Debt-to-Equity Ratio | Total Debt / Total Equity | Higher ratio indicates higher financial risk |

| Debt Ratio | Total Debt / Total Assets | Higher ratio indicates higher financial risk |

| Equity Ratio | Total Equity / Total Assets | Higher ratio indicates lower financial risk |

| Interest Coverage Ratio | EBIT / Interest Expense | Higher ratio indicates better ability to meet interest obligations |

| Fixed Charge Coverage Ratio | EBITDA / Fixed Charges | Higher ratio indicates better ability to meet fixed obligations |

How to Calculate Gearing Ratios

Gearing ratios are important financial ratios that measure a company’s level of debt relative to its equity or assets. These ratios provide insights into a company’s financial leverage and its ability to meet its financial obligations. There are different types of gearing ratios, including the debt ratio, equity ratio, and debt-to-equity ratio. Calculating these ratios involves simple mathematical formulas.

Debt Ratio

The debt ratio is a gearing ratio that measures the proportion of a company’s assets that are financed by debt. It is calculated by dividing the company’s total debt by its total assets and multiplying the result by 100 to express it as a percentage. The formula for the debt ratio is as follows:

Debt Ratio = (Total Debt / Total Assets) x 100

For example, if a company has total debt of $500,000 and total assets of $1,000,000, the debt ratio would be:

(500,000 / 1,000,000) x 100 = 50%

This means that 50% of the company’s assets are financed by debt.

Equity Ratio

The equity ratio is a gearing ratio that measures the proportion of a company’s assets that are financed by equity. It is calculated by dividing the company’s total equity by its total assets and multiplying the result by 100. The formula for the equity ratio is as follows:

Equity Ratio = (Total Equity / Total Assets) x 100

For example, if a company has total equity of $600,000 and total assets of $1,000,000, the equity ratio would be:

(600,000 / 1,000,000) x 100 = 60%

This means that 60% of the company’s assets are financed by equity.

Debt-to-Equity Ratio

The debt-to-equity ratio is a gearing ratio that measures the proportion of a company’s financing that comes from debt compared to equity. It is calculated by dividing the company’s total debt by its total equity. The formula for the debt-to-equity ratio is as follows:

Debt-to-Equity Ratio = Total Debt / Total Equity

For example, if a company has total debt of $500,000 and total equity of $600,000, the debt-to-equity ratio would be:

500,000 / 600,000 = 0.83

This means that the company has $0.83 of debt for every $1 of equity.

Calculating gearing ratios is a straightforward process that involves basic arithmetic. These ratios provide valuable information about a company’s financial structure and can help investors and analysts assess its financial health and risk profile.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.