Forward Price Calculation: Definition

In finance, the concept of forward price calculation refers to the process of determining the price at which a financial instrument, such as a commodity, currency, or security, can be bought or sold for delivery at a future date. The forward price is based on the current spot price of the instrument, as well as other factors such as interest rates and time to maturity.

Forward price calculation is an important tool used by investors, traders, and businesses to manage their future financial commitments and hedge against price fluctuations. It allows them to lock in a price for a future transaction, reducing uncertainty and minimizing potential losses.

The concept of forward price calculation is based on the principle of arbitrage, which assumes that there should be no opportunity for risk-free profits in a well-functioning market. In other words, the forward price of an instrument should be such that it eliminates any potential arbitrage opportunities.

Forward Price Calculation: Formulas

There are several formulas used for calculating forward prices, depending on the type of instrument and the assumptions made. Some common formulas include:

| Instrument | Formula |

|---|---|

| Commodity | Forward price = Spot price + Cost of carry |

| Currency | |

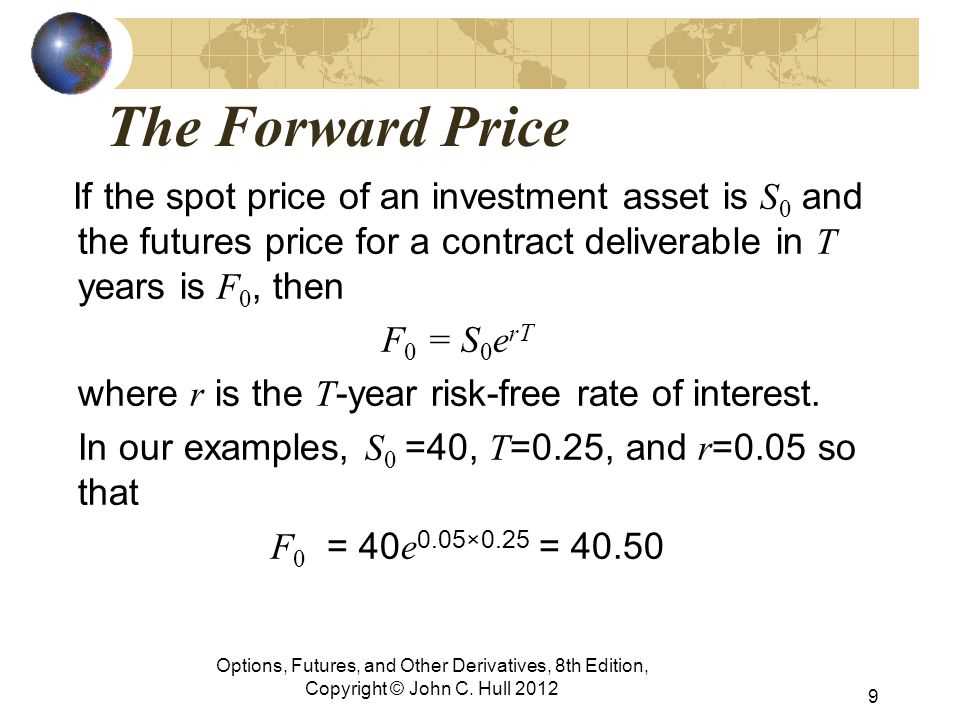

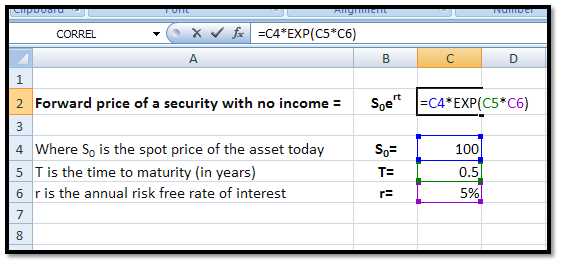

| Security | Forward price = Spot price * e^(r * T) |

These formulas provide a starting point for calculating the forward price, but adjustments may need to be made based on market conditions and other factors.

It is important to note that forward price calculation is not an exact science and involves certain assumptions and uncertainties. Market participants use their judgment and analysis to estimate the forward price, taking into account various factors and market conditions.

Overall, forward price calculation plays a crucial role in financial markets, allowing participants to manage risk, make informed investment decisions, and plan for future transactions.

Forward price calculation is a crucial concept in finance and investment. It refers to the process of determining the future price of an asset or security based on the current market conditions. This calculation is particularly important for investors and traders who engage in forward contracts, which are agreements to buy or sell an asset at a predetermined price in the future.

One key aspect of forward price calculation is the consideration of various factors that can influence the future price of the asset. These factors include interest rates, dividends, storage costs, and market expectations. By taking into account these factors, investors can estimate the future price of the asset and make informed decisions about their investments.

Factors Affecting Forward Price Calculation

1. Interest Rates: Interest rates play a significant role in forward price calculation. Higher interest rates can increase the cost of carrying the asset, leading to a higher forward price. Conversely, lower interest rates can reduce the cost of carrying the asset, resulting in a lower forward price.

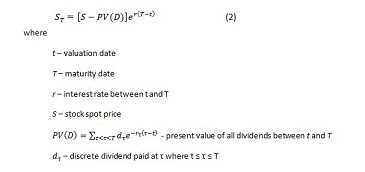

2. Dividends: If the underlying asset pays dividends, it can affect the forward price calculation. Higher dividends can decrease the forward price, as investors receive cash flows during the holding period. On the other hand, lower dividends can increase the forward price.

3. Storage Costs: For assets that require storage, such as commodities, storage costs can impact the forward price calculation. Higher storage costs can increase the forward price, as investors need to account for the expenses associated with storing the asset until the contract’s expiration.

4. Market Expectations: Market expectations about the future price of the asset can also influence forward price calculation. If investors anticipate an increase in the asset’s price, the forward price may be higher to reflect this expectation. Conversely, if investors expect a decrease in the asset’s price, the forward price may be lower.

It is important to note that forward price calculation is based on assumptions and estimates, and the actual future price of the asset may differ from the calculated forward price. Therefore, investors should carefully consider the risks and uncertainties associated with forward contracts and make informed decisions based on their analysis of the market conditions and factors affecting the forward price.

Forward Price Calculation: Formulas

Forward price calculation is an important concept in finance that allows investors to determine the future price of an asset or security. It is particularly useful for those who engage in forward contracts, which are agreements to buy or sell an asset at a predetermined price in the future.

1. Forward Price Formula

The most basic formula for calculating the forward price is as follows:

| Forward Price | = | Spot Price | + | (Risk-Free Interest Rate | – | Dividends) | × | Time to Maturity |

|---|

This formula takes into account the spot price of the asset, which is the current market price, and adjusts it for the risk-free interest rate and any dividends that may be paid during the life of the contract. The result is then multiplied by the time to maturity of the contract to determine the forward price.

2. Forward Price Formula with Continuous Compounding

In some cases, the risk-free interest rate is compounded continuously rather than at discrete intervals. In such cases, the formula for calculating the forward price is slightly different:

| Forward Price | = | Spot Price | × | e | ^(Risk-Free Interest Rate | – | Dividends) | × | Time to Maturity |

|---|

3. Forward Price Formula with Continuous Compounding and Dividends

If the asset pays dividends during the life of the contract, the formula for calculating the forward price becomes:

| Forward Price | = | (Spot Price | – | Present Value of Dividends) | × | e | ^(Risk-Free Interest Rate | × | Time to Maturity) |

|---|

By using these formulas, investors can accurately calculate the forward price of an asset or security, allowing them to make informed decisions about entering into forward contracts. It is important to note that these formulas are based on certain assumptions and may not always accurately predict future prices.

Key Formulas for Calculating Forward Prices

Calculating forward prices involves the use of several key formulas. These formulas are essential for determining the future price of an asset or security. Here are some of the most important formulas used in forward price calculation:

1. Spot Price

2. Risk-Free Interest Rate

The risk-free interest rate is the rate of return on an investment with no risk of default. It is an important factor in forward price calculation as it determines the cost of carrying the asset until the forward contract expires. The risk-free interest rate is denoted as r.

3. Time to Maturity

The time to maturity is the remaining time until the forward contract expires. It is usually measured in years. The time to maturity is denoted as T.

4. Dividend Yield

The dividend yield is the annual dividend payment divided by the spot price of the asset. It represents the return on holding the asset in terms of dividends. The dividend yield is denoted as q.

5. Cost of Carry

6. Forward Price

By using these key formulas, investors and traders can accurately calculate the forward price of an asset or security. This information is crucial for making informed investment decisions and managing risk in the financial markets.

Forward Price Calculation: Example

Let’s consider an example to better understand the concept of forward price calculation. Suppose you are a wheat farmer and you want to sell your wheat crop at a future date to minimize the risk of price fluctuations. You enter into a forward contract with a buyer to sell your wheat at a fixed price after three months.

The current spot price of wheat is $100 per bushel, and you expect the price to increase due to high demand and limited supply. You agree on a forward price of $120 per bushel with the buyer.

After three months, the spot price of wheat has indeed increased to $150 per bushel. To calculate the forward price, you need to consider the spot price, interest rates, and the time remaining until the contract’s expiration.

Using the formula for forward price calculation:

- Forward Price = Spot Price * (1 + Interest Rate)^(Time)

Let’s assume the interest rate is 5% and the time remaining until the contract’s expiration is 0.25 years (3 months).

Forward Price = $150 * (1 + 0.05)^(0.25) = $150 * 1.0125 = $151.88 per bushel.

Forward price calculation is a useful tool for managing price risk in various industries, including commodities, currencies, and interest rates. It allows market participants to hedge against price fluctuations and make informed decisions based on future price expectations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.