Types of Financial Instruments

Equity Instruments

Equity instruments represent ownership in a company and provide shareholders with a claim on the company’s assets and earnings. Common examples of equity instruments include stocks and shares. Investing in equity instruments can offer the potential for capital appreciation and dividends.

Debt Instruments

Debt instruments represent loans made by an investor to a borrower, who agrees to repay the principal amount plus interest over a specified period of time. Examples of debt instruments include bonds, treasury bills, and certificates of deposit. Investing in debt instruments can provide a steady income stream through interest payments.

Derivative Instruments

Derivative instruments derive their value from an underlying asset or benchmark. They are often used for hedging purposes or speculative trading. Common examples of derivative instruments include options, futures, and swaps. Investing in derivative instruments can offer opportunities for leverage and risk management.

Commodity Instruments

Commodity instruments allow investors to trade or invest in physical commodities such as gold, oil, or agricultural products. These instruments can be in the form of futures contracts, exchange-traded funds (ETFs), or commodity-based mutual funds. Investing in commodity instruments can provide exposure to different asset classes and diversify a portfolio.

Currency Instruments

Currency instruments involve trading or investing in foreign currencies. This can be done through the forex market or currency-based ETFs. Investing in currency instruments can provide opportunities for speculation and hedging against currency risk.

Real Estate Instruments

Real estate instruments allow investors to participate in the real estate market without directly owning physical properties. These instruments can include real estate investment trusts (REITs), real estate mutual funds, or real estate crowdfunding platforms. Investing in real estate instruments can offer diversification and potential income through rental yields.

| Instrument Type | Examples |

|---|---|

| Equity Instruments | Stocks, shares |

| Debt Instruments | Bonds, treasury bills, certificates of deposit |

| Derivative Instruments | Options, futures, swaps |

| Commodity Instruments | Gold, oil, agricultural products |

| Currency Instruments | Foreign currencies |

| Real Estate Instruments | REITs, real estate mutual funds, real estate crowdfunding |

Each type of financial instrument has its own characteristics, risks, and potential rewards. It is important for investors to carefully consider their investment goals, risk tolerance, and time horizon before choosing which instruments to include in their portfolio.

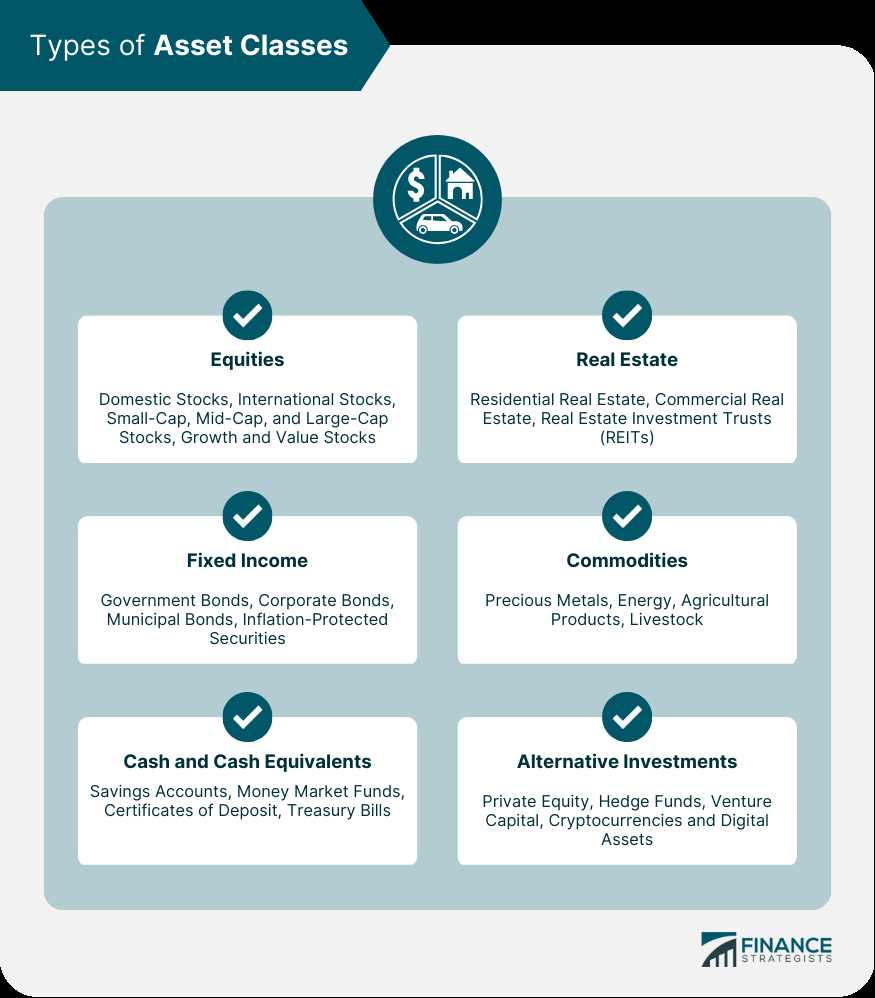

Asset Classes

There are several main asset classes that investors can choose from:

1. Stocks:

2. Bonds:

Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. When you buy a bond, you are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

3. Commodities:

Commodities are raw materials or primary agricultural products that can be bought and sold, such as gold, oil, wheat, and coffee. Investing in commodities can provide diversification and act as a hedge against inflation.

4. Real Estate:

Real estate refers to physical properties such as residential homes, commercial buildings, and land. Investing in real estate can offer potential income through rental payments and the potential for capital appreciation over time.

5. Mutual Funds:

Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets. They offer a convenient way for individual investors to access a wide range of asset classes and benefit from professional management.

6. Exchange-Traded Funds (ETFs):

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They provide investors with exposure to various asset classes and can be bought and sold throughout the trading day.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.