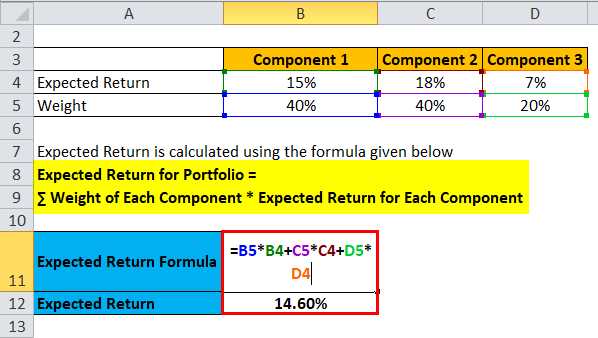

Expected Return Formula

The expected return formula is a mathematical calculation used in finance to estimate the potential return on an investment. It is a key concept in investment analysis and helps investors make informed decisions about where to allocate their money.

How It Works

The expected return formula takes into account the probabilities of different outcomes and the potential returns associated with each outcome. It is calculated by multiplying the probability of each outcome by its corresponding return and summing up the results.

Mathematically, the formula can be expressed as:

Expected Return = (Probability of Outcome 1 * Return of Outcome 1) + (Probability of Outcome 2 * Return of Outcome 2) + … + (Probability of Outcome n * Return of Outcome n)

For example, let’s say an investor is considering two investment options: Option A and Option B. Option A has a 60% chance of generating a 10% return, and a 40% chance of generating a 5% return. Option B has a 30% chance of generating a 15% return, and a 70% chance of generating a 2% return.

To calculate the expected return for Option A, we would use the following formula:

Expected Return for Option A = (0.60 * 0.10) + (0.40 * 0.05) = 0.06 + 0.02 = 0.08 or 8%

Similarly, the expected return for Option B would be:

Expected Return for Option B = (0.30 * 0.15) + (0.70 * 0.02) = 0.045 + 0.014 = 0.059 or 5.9%

Limitations

It is important to note that the expected return formula is based on assumptions and probabilities, and therefore, it is not a guarantee of future returns. The actual returns may vary from the expected returns due to various factors such as market conditions, economic factors, and unforeseen events.

Example

Let’s consider an example to further illustrate the use of the expected return formula. Suppose an investor is considering investing in three stocks: Stock A, Stock B, and Stock C. The investor assigns the following probabilities and expected returns to each stock:

- Stock A: Probability = 0.40, Expected Return = 0.12

- Stock B: Probability = 0.30, Expected Return = 0.08

- Stock C: Probability = 0.30, Expected Return = 0.05

To calculate the expected return for the portfolio, we would use the following formula:

Expected Return = (0.40 * 0.12) + (0.30 * 0.08) + (0.30 * 0.05) = 0.048 + 0.024 + 0.015 = 0.087 or 8.7%

How It Works

The expected return formula is a mathematical calculation used to estimate the potential return on an investment. It takes into account the probability of different outcomes and the potential returns associated with each outcome.

To calculate the expected return, you need to know the probability of each possible outcome and the potential return for each outcome. The formula is as follows:

| Outcome | Probability | Return |

|---|---|---|

| Outcome 1 | P1 | R1 |

| Outcome 2 | P2 | R2 |

| … | … | … |

| Outcome n | Pn | Rn |

The formula to calculate the expected return is:

Expected Return = (P1 * R1) + (P2 * R2) + … + (Pn * Rn)

Where P1, P2, …, Pn are the probabilities of each outcome, and R1, R2, …, Rn are the potential returns associated with each outcome.

By using this formula, investors can make more informed decisions about their investments. It allows them to weigh the potential returns against the probabilities of different outcomes, helping them assess the risk and reward of an investment.

For example, let’s say you are considering investing in a stock. There are three possible outcomes: a 50% chance of a 10% return, a 30% chance of a 5% return, and a 20% chance of a 2% return.

Using the expected return formula, the calculation would be:

Expected Return = (0.5 * 0.1) + (0.3 * 0.05) + (0.2 * 0.02) = 0.05 + 0.015 + 0.004 = 0.069

Therefore, the expected return on this investment would be 6.9%.

It is important to note that the expected return is just an estimate and does not guarantee the actual return on an investment. It is based on probabilities and potential returns, which can change over time. Investors should consider other factors, such as market conditions and their own risk tolerance, when making investment decisions.

Limitations

While the expected return formula is a useful tool for investors, it is important to understand its limitations. Here are some key limitations to consider:

| 1. Assumptions | |

| 2. Accuracy | The expected return formula provides an estimate of future returns, but it is not guaranteed to be accurate. It is based on historical data and statistical analysis, which may not always accurately predict future performance. |

| 3. Risk | |

| 4. External Factors | The expected return formula does not consider external factors that can impact investment returns, such as changes in government regulations, economic conditions, or industry trends. These factors can significantly affect the actual returns of an investment. |

| 5. Diversification | The expected return formula does not account for the benefits of diversification. Diversifying investments across different asset classes and sectors can help reduce risk and potentially improve overall returns, but this is not taken into account by the formula. |

It is important for investors to be aware of these limitations and to use the expected return formula as just one tool in their investment decision-making process. It should be used in conjunction with other analysis and considerations to make well-informed investment choices.

Example

Let’s consider an example to understand how the expected return formula works in practice.

Company XYZ Stock

Suppose you are considering investing in Company XYZ stock. You have analyzed the stock’s historical returns and calculated the probabilities of different potential returns.

Based on your analysis, you have determined that there is a 30% chance the stock will have a return of 10%, a 50% chance of a return of 5%, and a 20% chance of a return of -2%.

To calculate the expected return, you multiply each potential return by its corresponding probability and sum them up:

Expected Return = (10% * 30%) + (5% * 50%) + (-2% * 20%)

Expected Return = 3% + 2.5% + (-0.4%)

Expected Return = 4.1%

Therefore, based on your analysis, the expected return for investing in Company XYZ stock is 4.1%.

Therefore, it is essential to consider the expected return along with other factors and conduct thorough research before making investment decisions.

Example

Let’s consider an example to understand how the expected return formula works. Suppose you are considering investing in two stocks: Stock A and Stock B. Stock A has a 60% chance of providing a return of 10% and a 40% chance of providing a return of -5%. Stock B has a 30% chance of providing a return of 15% and a 70% chance of providing a return of -2%.

- Expected Return for Stock A = (0.60 * 10%) + (0.40 * -5%)

- Expected Return for Stock A = 4%

Similarly, to calculate the expected return for Stock B, you would use the same formula:

- Expected Return for Stock B = (0.30 * 15%) + (0.70 * -2%)

- Expected Return for Stock B = 3.1%

It is important to note that the expected return is just one factor to consider when making investment decisions. Other factors such as risk, volatility, and market conditions should also be taken into account.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.