Benefits of Evergreen Loans

Evergreen Loans offer numerous benefits to borrowers, making them an attractive option for those in need of financial assistance. Here are some key advantages:

1. Flexible Repayment Terms

Evergreen Loans provide borrowers with the flexibility to choose repayment terms that suit their financial situation. Whether you prefer a shorter repayment period or need more time to repay, Evergreen Loans can accommodate your needs.

2. Competitive Interest Rates

One of the main advantages of Evergreen Loans is the competitive interest rates they offer. These loans often come with lower interest rates compared to other types of financing, saving borrowers money in the long run.

3. Quick and Convenient Application Process

Applying for an Evergreen Loan is a straightforward and hassle-free process. With online applications available, borrowers can easily submit their information and receive a decision within a short period of time. This makes Evergreen Loans a convenient option for those in urgent need of funds.

4. No Collateral Required

Unlike some other types of loans, Evergreen Loans do not require borrowers to provide collateral. This means that borrowers do not have to put their assets at risk in order to secure the loan. This can be particularly beneficial for individuals who do not have valuable assets to use as collateral.

5. Use Funds for Various Purposes

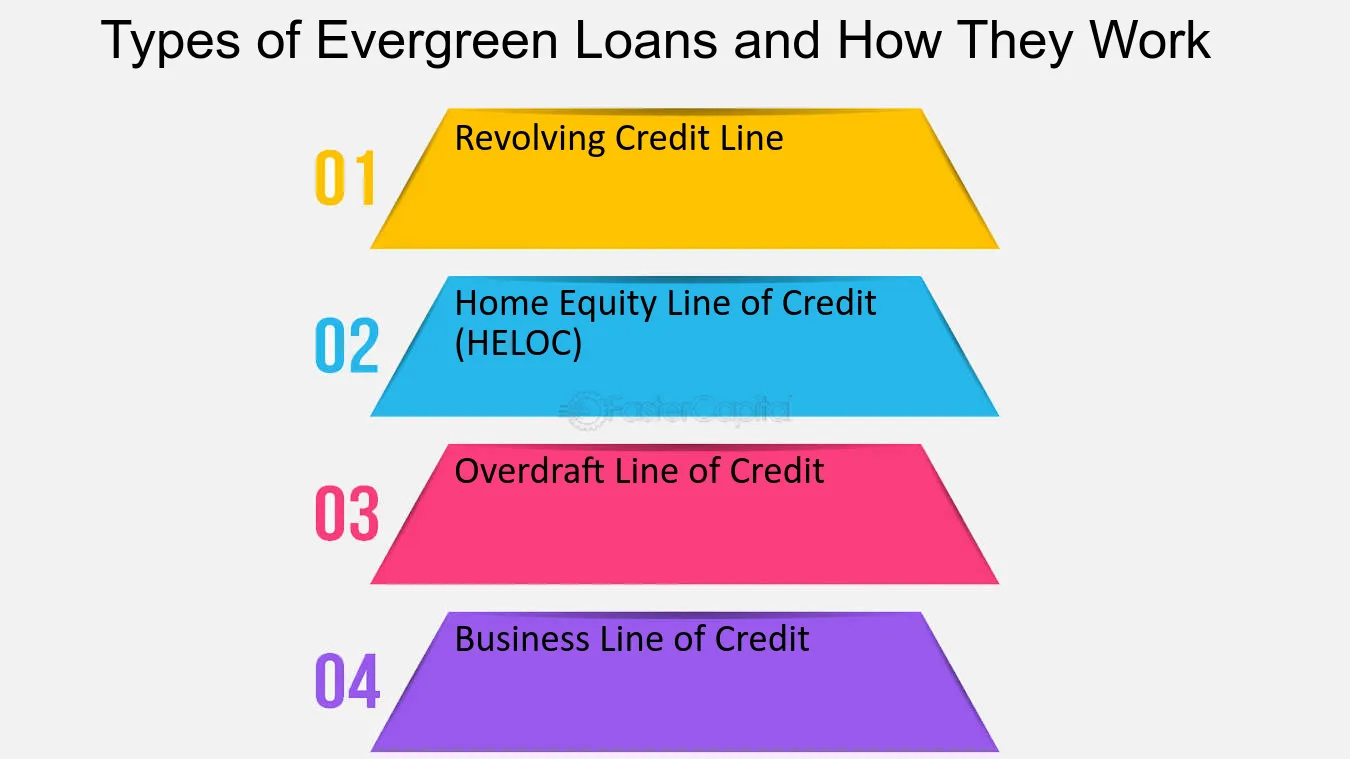

How Evergreen Loans Work

Evergreen Loans are a type of loan that allows borrowers to access funds for any purpose, without having to provide collateral. These loans are typically unsecured, meaning they are not backed by any assets such as a house or car.

When you apply for an Evergreen Loan, the lender will evaluate your creditworthiness based on factors such as your credit score, income, and employment history. If approved, you will receive a loan amount based on your eligibility and the lender’s terms.

Once you have been approved for an Evergreen Loan, you will receive the funds in a lump sum. You can then use the funds for any purpose, such as home improvements, debt consolidation, or unexpected expenses.

Repayment terms for Evergreen Loans vary depending on the lender and the loan amount. Typically, these loans have fixed interest rates and monthly installment payments. It is important to carefully review the terms and conditions of the loan before accepting the funds.

To repay an Evergreen Loan, you will need to make regular monthly payments for the duration of the loan term. It is important to make these payments on time to avoid late fees and negative impacts on your credit score.

If you encounter financial difficulties and are unable to make your loan payments, it is important to contact your lender as soon as possible. They may be able to work with you to find a solution, such as adjusting your payment schedule or offering a forbearance period.

Eligibility for Evergreen Loans

1. Credit Score

A good credit score is one of the key factors that lenders consider when determining eligibility for Evergreen Loans. A higher credit score demonstrates your ability to manage debt and make timely payments. Lenders typically look for a credit score of 600 or above, but some may have stricter requirements.

2. Income and Employment

Lenders want to ensure that you have a stable source of income to repay the loan. They will ask for proof of employment and may require a minimum income threshold. This helps them assess your ability to make regular loan payments without financial strain.

3. Debt-to-Income Ratio

Your debt-to-income ratio is another important factor that lenders consider. This ratio compares your monthly debt payments to your monthly income. Lenders typically prefer a debt-to-income ratio of 43% or lower, although some may be more flexible.

If you meet the eligibility requirements, you can proceed with the application process for an Evergreen Loan. It’s always a good idea to compare different lenders and their terms to ensure you choose the best option for your financial needs.

Application Process for Evergreen Loans

Applying for an Evergreen Loan is a simple and straightforward process. Here are the steps you need to follow:

- Research: Start by researching different lenders that offer Evergreen Loans. Look for reputable institutions with good customer reviews and competitive interest rates.

- Gather Documents: Before applying, gather all the necessary documents such as identification, proof of income, and any other required financial information. This will help speed up the application process.

- Fill out the Application: Once you have chosen a lender, visit their website or branch to fill out the loan application. Provide accurate and complete information to avoid any delays or complications.

- Submit Supporting Documents: Along with the application, you may need to submit supporting documents such as bank statements, tax returns, or employment verification. Make sure to provide all the requested documents promptly.

- Wait for Approval: After submitting your application and supporting documents, the lender will review your information and make a decision. This process may take a few days, so be patient.

- Review Loan Terms: If your loan application is approved, carefully review the loan terms and conditions. Make sure you understand the interest rate, repayment schedule, and any additional fees or charges.

- Sign the Loan Agreement: Once you are satisfied with the loan terms, sign the loan agreement. This legally binds you to repay the loan according to the agreed-upon terms.

- Receive Funds: After signing the loan agreement, the lender will disburse the funds to your designated bank account. The time it takes to receive the funds may vary depending on the lender.

- Repay the Loan: Finally, make timely repayments according to the agreed-upon schedule. This will help you maintain a good credit history and avoid any penalties or late fees.

Remember, the application process may vary slightly depending on the lender, so it’s always a good idea to check their specific requirements and guidelines. By following these steps, you can successfully apply for an Evergreen Loan and access the funds you need for your financial goals.

Tips for Success with Evergreen Loans

Evergreen Loans can be a great financial tool for individuals and businesses looking to fund long-term projects or investments. To make the most of your Evergreen Loan experience, consider the following tips:

1. Understand Your Needs

Before applying for an Evergreen Loan, take the time to evaluate your financial needs and goals. Determine how much funding you require and how long you will need to repay the loan. This will help you choose the right loan amount and repayment terms.

2. Research Lenders

3. Review Loan Terms Carefully

Before signing any loan agreement, carefully review the terms and conditions of the Evergreen Loan. Pay attention to the interest rate, repayment schedule, and any additional fees or charges. Make sure you fully understand the terms before committing to the loan.

4. Create a Repayment Plan

To ensure successful repayment of your Evergreen Loan, create a realistic repayment plan. Consider your cash flow and budget to determine how much you can afford to repay each month. Stick to your plan to avoid any missed payments or penalties.

5. Use the Funds Wisely

6. Monitor Your Progress

Regularly monitor your progress with the Evergreen Loan to ensure you are on track with your repayment plan. Keep track of your payments, interest charges, and remaining balance. This will help you stay organized and make any necessary adjustments to your plan.

7. Seek Professional Advice

If you’re unsure about any aspect of your Evergreen Loan, don’t hesitate to seek professional advice. Consult with a financial advisor or loan expert who can provide guidance and answer any questions you may have.

By following these tips, you can maximize the benefits of your Evergreen Loan and increase your chances of success. Remember to always borrow responsibly and make informed decisions about your financial future.

Managing Your Evergreen Loan

Once you have successfully obtained an Evergreen Loan, it is important to manage it effectively to ensure financial success. Here are some tips to help you manage your Evergreen Loan:

1. Create a Budget:

Develop a budget that includes your loan repayment amount. This will help you stay on track and ensure that you are able to make your loan payments on time.

2. Set Up Automatic Payments:

Consider setting up automatic payments for your Evergreen Loan. This will ensure that your payments are made on time and you won’t have to worry about missing a payment.

3. Track Your Spending:

Keep track of your expenses and make sure you are not overspending. By monitoring your spending habits, you can identify areas where you can cut back and allocate more funds towards your loan repayment.

4. Pay More Than the Minimum:

If possible, try to pay more than the minimum monthly payment. By paying more, you can reduce the overall interest you pay and pay off your loan faster.

5. Communicate with Your Lender:

If you are facing financial difficulties or anticipate any changes in your financial situation, it is important to communicate with your lender. They may be able to offer assistance or provide alternative repayment options.

6. Avoid Taking on Additional Debt:

While you have an Evergreen Loan, it is advisable to avoid taking on additional debt. This will help you maintain financial stability and prevent any additional financial strain.

7. Stay Organized:

Keep all loan-related documents organized and easily accessible. This includes loan statements, repayment schedules, and any correspondence with your lender. Being organized will help you stay on top of your loan and avoid any potential issues.

8. Regularly Review Your Loan:

Periodically review your loan terms and conditions to ensure that you are still on track and that there are no unexpected changes. This will help you stay informed and make any necessary adjustments to your repayment strategy.

By following these tips, you can effectively manage your Evergreen Loan and work towards achieving your financial goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.