What is Enterprise Value?

Enterprise Value is a financial metric that represents the total value of a company. It is used to determine the theoretical takeover price of a company and is often used by investors to assess the overall value of a business.

Enterprise Value takes into account not only the market value of a company’s equity, but also its debt and other liabilities. It provides a more comprehensive picture of a company’s worth compared to just looking at its market capitalization.

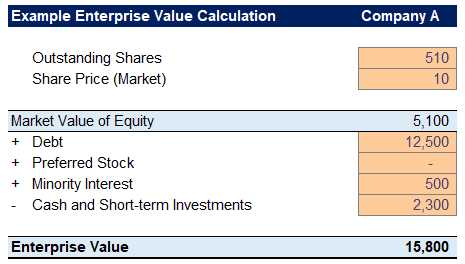

Enterprise Value is calculated by adding a company’s market capitalization to its total debt, minority interest, and preferred equity, and then subtracting its cash and cash equivalents. This calculation helps to capture the true value of a company, as it considers both its equity and debt obligations.

By using Enterprise Value, investors can compare companies of different sizes and capital structures on an equal footing. It allows for a more accurate assessment of a company’s value and can be a useful tool for making investment decisions.

Calculating Enterprise Value

To calculate enterprise value, you need to consider several key factors:

- Market capitalization: Start by determining the market capitalization of the company, which is the total value of its outstanding shares of stock. This can be calculated by multiplying the current stock price by the number of outstanding shares.

- Debt: Next, you need to determine the total debt of the company, including both short-term and long-term debt. This can be found in the company’s financial statements.

- Cash and cash equivalents: Subtract the company’s cash and cash equivalents from its total debt. Cash and cash equivalents include cash on hand, as well as highly liquid assets that can be easily converted into cash.

- Minority interest and preferred equity: If the company has minority interest or preferred equity, add these values to the enterprise value.

Once you have gathered all the necessary information, you can use the formula:

By calculating enterprise value, investors and analysts can get a more accurate picture of a company’s value and its potential for growth. It allows for a more comprehensive analysis of a company’s financial health and can help inform investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.