What is Effective Gross Income (EGI)?

Effective Gross Income (EGI) is a financial metric used in real estate investing to determine the profitability of a property. It represents the total income generated by a property after deducting certain expenses. EGI is an important indicator for investors as it provides a clear picture of the property’s revenue potential.

EGI takes into account both the rental income and other sources of income, such as parking fees or laundry services. It is calculated by subtracting the vacancy and credit loss from the potential gross income (PGI). Vacancy and credit loss refer to the income lost due to unoccupied units or tenants who fail to pay rent.

EGI is a crucial factor in evaluating the financial performance of a property. It helps investors assess the property’s ability to generate income and cover operating expenses. By analyzing the EGI, investors can determine the property’s net operating income (NOI), which is a key metric for assessing the property’s profitability.

Definition and Importance of Effective Gross Income (EGI)

Effective Gross Income (EGI) is a crucial financial metric in real estate investing that measures the total income generated by a property after deducting certain expenses. It provides a clear picture of the property’s profitability and is an essential factor in determining its value and potential return on investment.

What is Included in EGI?

Effective Gross Income includes all the revenue streams generated by the property, such as rental income, parking fees, laundry income, and any other income sources directly related to the property. It also includes reimbursements from tenants for common area maintenance (CAM) expenses.

However, EGI does not include income from non-property-related sources, such as interest income, capital gains, or income from other investments. It focuses solely on the income generated by the property itself.

Why is EGI Important?

Effective Gross Income is a vital metric for both real estate investors and property owners. It provides a comprehensive view of the property’s financial performance by considering all the income streams and deducting necessary expenses.

By calculating EGI, investors can assess the property’s income-generating potential and determine its profitability. This information is crucial when making investment decisions, such as buying or selling a property, refinancing, or evaluating the financial feasibility of a real estate project.

EGI also helps property owners and managers to analyze the property’s operational efficiency and identify areas for improvement. By comparing the EGI of different properties or over time, they can assess the effectiveness of their management strategies and make informed decisions to optimize revenue and minimize expenses.

Moreover, lenders and financial institutions often use EGI as a key factor in evaluating the creditworthiness of a property and determining the loan amount and terms. A higher EGI indicates a more stable and profitable property, increasing the chances of securing favorable financing options.

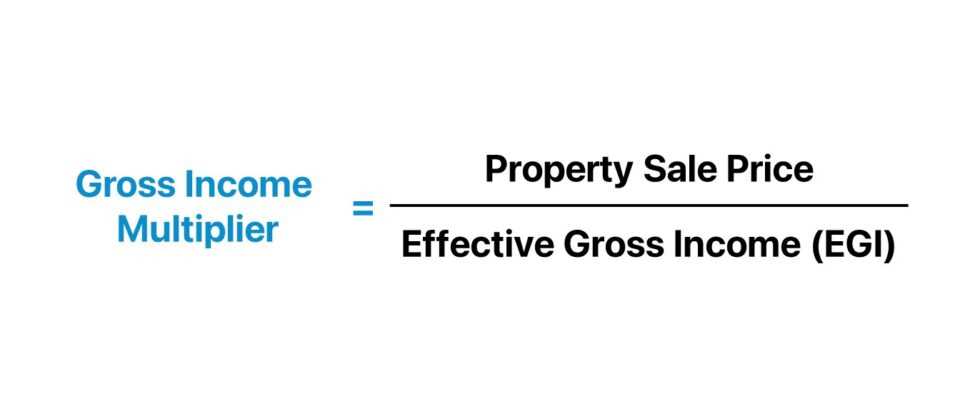

How to Calculate Effective Gross Income (EGI)

Calculating Effective Gross Income (EGI) is an essential step in evaluating the financial performance of a real estate investment. EGI represents the total income generated by a property after accounting for vacancies and collection losses.

To calculate EGI, you need to follow these steps:

Step 1: Determine the Gross Potential Income (GPI)

Gross Potential Income (GPI) is the maximum income a property can generate if it is fully occupied and all tenants pay their rent on time. To calculate GPI, you need to multiply the total number of units by the average monthly rent and then multiply it by 12 (months).

GPI = Total Number of Units × Average Monthly Rent × 12

Step 2: Account for Vacancies and Collection Losses

Vacancies and collection losses are inevitable in real estate investments. To calculate the potential income loss due to vacancies and collection losses, you need to multiply the GPI by the vacancy rate and the collection loss rate.

Income Loss = GPI × (Vacancy Rate + Collection Loss Rate)

Step 3: Calculate the Effective Gross Income (EGI)

To calculate EGI, subtract the income loss from the GPI.

Step 4: Consider Additional Income Sources

In addition to rent, a property may generate income from other sources such as parking fees, laundry facilities, or late fees. These additional income sources should be added to the EGI to get a more accurate representation of the property’s total income.

Step 5: Analyze and Evaluate EGI

Once you have calculated the EGI, you can use it to evaluate the financial performance of the property. EGI provides a clearer picture of the property’s income potential and helps investors make informed decisions about their real estate investments.

By following these steps and accurately calculating the EGI, real estate investors can assess the profitability of their investments and make informed decisions about buying, selling, or managing properties.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.