Easement in Gross: Definition, Example, Vs. Easement Appurtenant

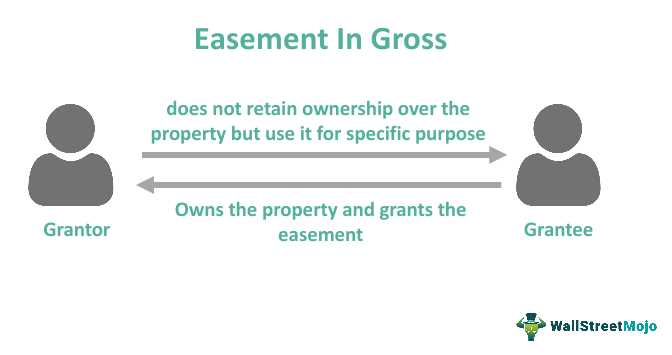

An easement in gross is a type of easement that grants a specific individual or entity the right to use someone else’s property for a specific purpose. Unlike an easement appurtenant, which is attached to a specific piece of land, an easement in gross is not tied to any particular property and can be transferred or assigned to another party.

Definition of Easement in Gross

An easement in gross is a legal right that allows a person or entity to use another person’s property for a specific purpose. This right is granted by the property owner and is typically documented in a written agreement or easement document. The easement in gross is not tied to any specific property and can be transferred or assigned to another party.

Example of Easement in Gross

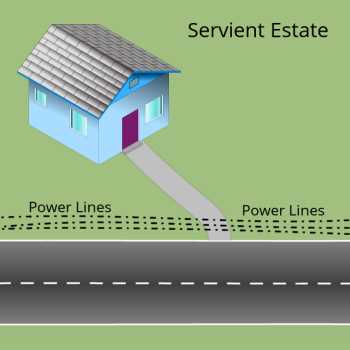

One common example of an easement in gross is a utility easement. A utility company may have an easement in gross that allows them to access and maintain their utility lines on someone else’s property. The easement in gross gives the utility company the right to enter the property and perform necessary maintenance or repairs on their equipment.

Another example of an easement in gross is a hunting or fishing easement. A property owner may grant an easement in gross to a specific individual or group, allowing them to hunt or fish on the property. The easement in gross gives the individual or group the right to access the property for the purpose of hunting or fishing.

Easement in Gross vs. Easement Appurtenant

The main difference between an easement in gross and an easement appurtenant is that an easement in gross is not tied to any specific property, while an easement appurtenant is attached to a specific piece of land. An easement in gross can be transferred or assigned to another party, while an easement appurtenant is typically tied to the ownership of the land.

For example, if a property owner grants an easement in gross to a utility company, the easement can be transferred to another utility company if the original company sells or transfers its assets. In contrast, an easement appurtenant is tied to the ownership of the land and cannot be transferred separately from the land.

Benefits of Easement in Gross for Real Estate Investors

Easements in gross can provide real estate investors with several benefits. By granting an easement in gross, property owners can generate additional income by allowing another party to use their property for a specific purpose. This can be particularly beneficial for properties that have unique features or resources that are valuable to other individuals or businesses.

In addition, easements in gross can increase the market value of a property. If a property has a valuable easement in gross, such as a right of way for a utility company or access to a popular recreational area, potential buyers may be willing to pay a higher price for the property.

Furthermore, easements in gross can provide real estate investors with flexibility. Since easements in gross can be transferred or assigned to another party, investors can potentially sell or lease the easement to generate additional income or negotiate favorable terms with the party using the easement.

What is an Easement in Gross?

An easement in gross is a type of easement that grants a specific individual or entity the right to use or access another person’s property for a particular purpose. Unlike an easement appurtenant, which is attached to a specific piece of land, an easement in gross is not tied to any particular property and can be transferred or assigned to another party.

Typically, an easement in gross is created through a written agreement between the parties involved, such as a property owner and a utility company. The agreement outlines the specific rights and limitations of the easement, including the duration of the easement, the purpose for which it is granted, and any compensation or fees associated with its use.

It is important to note that an easement in gross does not provide the holder with any ownership rights or control over the property. The property owner retains full ownership and control, but must allow the holder of the easement to use or access the property as specified in the agreement.

Overall, an easement in gross can be a valuable tool for both property owners and those who require access to or use of another person’s property. It allows for the efficient use of land and resources while ensuring that the rights and interests of all parties involved are protected.

Example of Easement in Gross

An easement in gross is a legal right granted to a person or entity to use another person’s property for a specific purpose. This type of easement does not benefit a particular piece of land, but rather an individual or organization. Here is an example to illustrate how an easement in gross works:

Imagine a scenario where a utility company needs access to a landowner’s property to install and maintain power lines. The utility company and the landowner can enter into an agreement that grants the utility company an easement in gross. This easement allows the utility company to access the landowner’s property for the purpose of installing, maintaining, and repairing power lines.

The easement in gross would specify the specific area of the landowner’s property that the utility company can access, as well as any limitations or restrictions on the use of the easement. The landowner would still retain ownership of the property, but the utility company would have the legal right to access the designated area for the specified purpose.

This example demonstrates how an easement in gross can benefit both parties involved. The utility company gains the necessary access to the landowner’s property to provide essential services, while the landowner may receive compensation for granting the easement or benefit from having access to reliable power.

It is important to note that an easement in gross is typically not transferable. This means that if the landowner were to sell the property, the easement would not automatically transfer to the new owner. The utility company would need to negotiate a new easement agreement with the new property owner.

In summary, an easement in gross is a legal right granted to an individual or organization to use another person’s property for a specific purpose. It does not benefit a particular piece of land, but rather a specific individual or entity. This type of easement can be beneficial for both parties involved, as it allows for necessary access to property for a specific purpose.

Easement in Gross vs. Easement Appurtenant

Easement in Gross

One important thing to note about easements in gross is that they are not transferable. This means that if the easement holder sells their property, the easement does not automatically transfer to the new owner. Instead, the new owner would need to negotiate a new easement with the property owner.

Easement Appurtenant

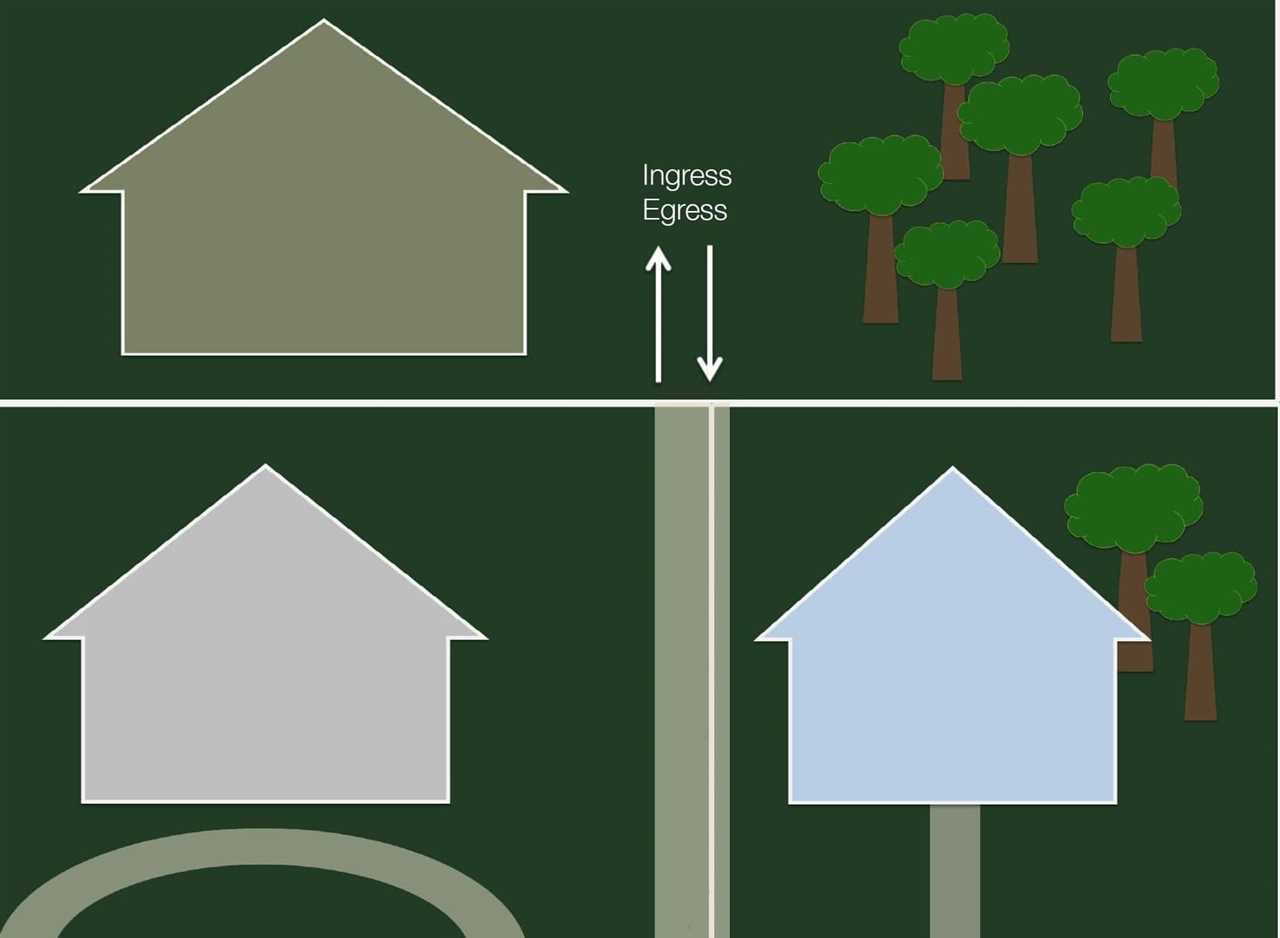

On the other hand, an easement appurtenant is a type of easement that is attached to a specific piece of property. This means that the easement is tied to the land itself, rather than an individual or entity. Easements appurtenant are often created to provide access to a landlocked property, allowing the owner to pass through a neighboring property to reach their land.

Unlike easements in gross, easements appurtenant are transferable. This means that if the property with the easement is sold, the easement automatically transfers to the new owner. The new owner is then responsible for upholding the terms of the easement.

Key Differences

The main difference between easements in gross and easements appurtenant is the way they are attached to property. Easements in gross are not tied to a specific piece of property and are not transferable, while easements appurtenant are attached to a specific piece of property and are transferable.

Another difference is the purpose of the easement. Easements in gross are often granted for utility purposes or specific personal use, while easements appurtenant are typically created to provide access to a landlocked property.

Benefits of Easement in Gross for Real Estate Investors

1. Increased Property Value

One of the main benefits of easements in gross is the potential to increase property value. By granting an easement to a utility company or another entity, investors can attract potential buyers or tenants who value the convenience and accessibility provided by the easement. This can result in higher property values and increased demand.

2. Additional Income Streams

Easements in gross can also provide real estate investors with additional income streams. By leasing or selling the rights to the easement, investors can generate passive income without the need for active property management. This can be particularly beneficial for investors who own large properties or properties in high-demand areas.

3. Flexibility in Property Use

Another advantage of easements in gross is the flexibility they offer in property use. Investors can negotiate the terms of the easement to ensure that it aligns with their investment goals and plans for the property. This can include restrictions on the type of activities allowed on the easement or the ability to modify or terminate the easement if necessary.

4. Diversification of Investment Portfolio

Easements in gross can also provide real estate investors with an opportunity to diversify their investment portfolios. By investing in properties with easements, investors can spread their risk across different asset classes and industries. This can help protect against market fluctuations and provide a more stable and balanced investment portfolio.

5. Potential Tax Benefits

Depending on the jurisdiction, there may be potential tax benefits associated with easements in gross. Investors should consult with a tax professional to understand the specific tax implications and advantages of easements in their area. These benefits can include deductions for easement-related expenses or potential property tax reductions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.