Dual Class Stock: Definition, Structure, and Controversy

Dual class stock refers to a type of stock structure in which a company issues two different classes of shares, typically labeled as Class A and Class B. These classes of shares have different voting rights and dividend privileges, giving certain shareholders more control and influence over the company’s decision-making process.

The structure of dual class stock typically involves the issuance of Class B shares to the company’s founders, executives, or other insiders, while Class A shares are made available to the general public for trading on the stock market. Class B shares usually carry multiple votes per share, while Class A shares have only one vote per share.

The controversy surrounding dual class stock arises from the unequal distribution of voting rights and control it creates within a company. Critics argue that this structure allows a small group of shareholders to maintain disproportionate control over the company, potentially leading to decisions that may not align with the interests of other shareholders.

Proponents of dual class stock argue that it provides stability and long-term vision for companies, as founders and key executives can maintain control and make strategic decisions without being influenced by short-term market pressures. They believe that this structure allows companies to focus on long-term growth and innovation, which can ultimately benefit all shareholders in the long run.

However, the debate over dual class stock continues, with regulators and investors expressing concerns about the potential for abuse of power and lack of accountability. Some argue that the concentration of voting power in the hands of a few individuals can lead to conflicts of interest and undermine corporate governance.

Overall, dual class stock is a complex and controversial topic in the world of finance and corporate governance. It raises important questions about the balance between shareholder rights and the need for strong leadership and strategic decision-making within companies.

What is Dual Class Stock?

Dual class stock is a type of stock structure that allows a company to issue different classes of shares, each with different voting rights and privileges. In a dual class stock structure, there are typically two classes of shares: Class A shares and Class B shares.

Class A Shares

Class A shares are typically held by the general public and have fewer voting rights compared to Class B shares. These shares usually have one vote per share and are subject to the same economic rights as Class B shares, such as dividends and capital appreciation.

Class B Shares

Class B shares, on the other hand, are typically held by the company’s founders, executives, or other insiders. These shares usually have multiple votes per share, giving the holders more control over the company’s decision-making process. Class B shares often have superior voting rights, allowing the holders to maintain control even with a minority ownership stake.

However, dual class stock structures have been a subject of controversy. Critics argue that these structures can lead to a lack of accountability and corporate governance, as founders and insiders may prioritize their own interests over those of other shareholders. Additionally, the unequal voting rights can result in a concentration of power in the hands of a few individuals, potentially limiting the influence of other shareholders.

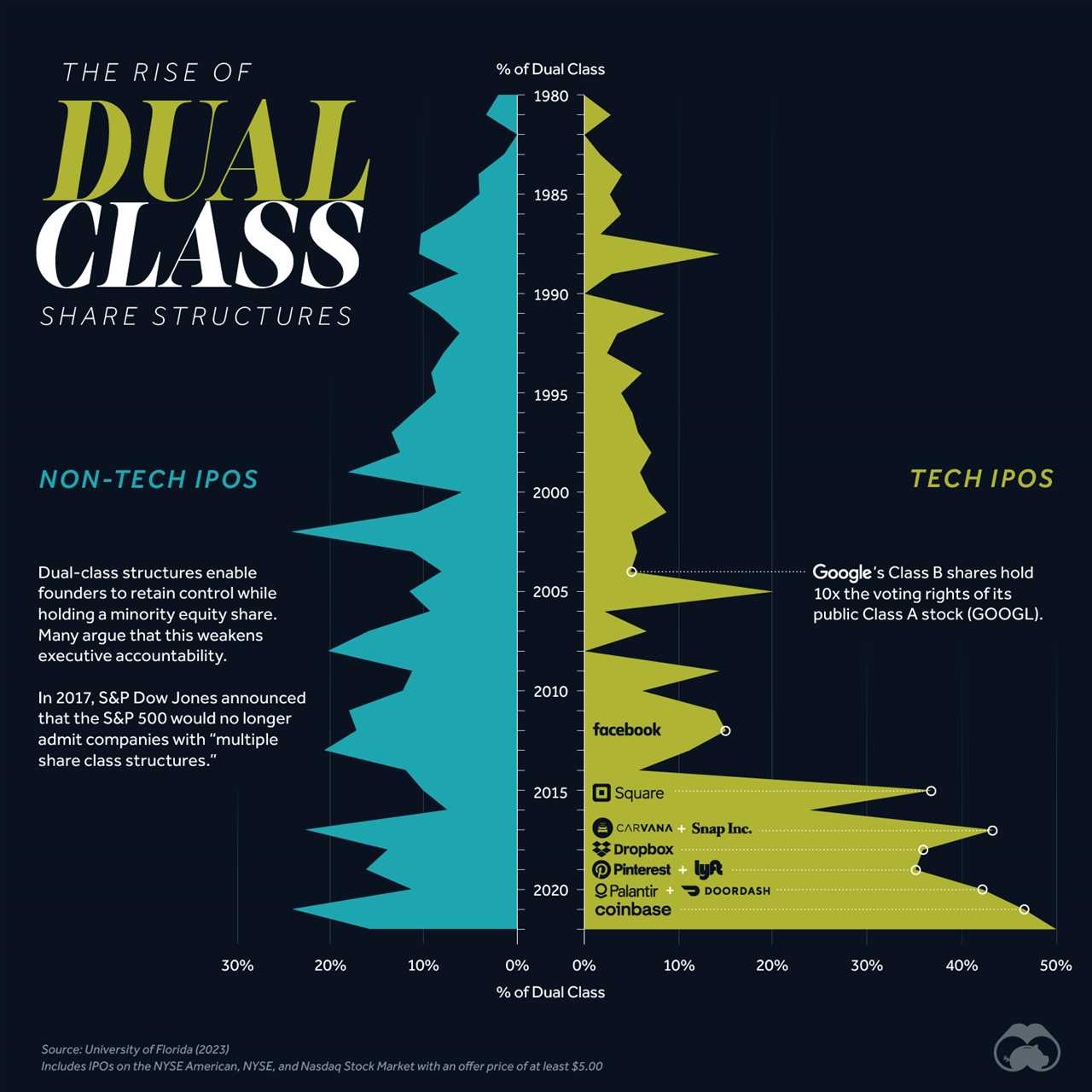

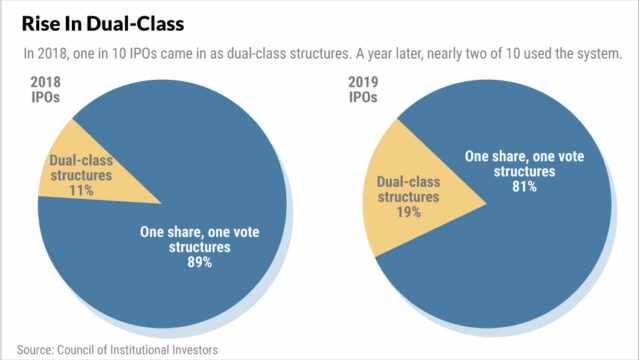

Despite the controversy, dual class stock structures continue to be used by many companies, particularly in the technology sector. It is important for investors to carefully consider the voting rights and governance structure of a company before investing in dual class stock.

| Advantages | Disadvantages |

|---|---|

|

|

The Structure and Features of Dual Class Stock

Dual class stock is a type of stock structure that gives certain shareholders more voting rights and control over a company compared to other shareholders. This structure is commonly used by companies to maintain control and stability, especially in cases where the founders or key executives want to retain decision-making power.

Structure

The structure of dual class stock involves creating two or more classes of shares, typically referred to as Class A and Class B shares. Class A shares are usually held by the general public and have limited voting rights, while Class B shares are held by founders, executives, or other insiders and have superior voting rights.

The key difference between the two classes of shares is the number of votes each share carries. Class A shares usually have one vote per share, while Class B shares have multiple votes per share. For example, a company may give Class B shares 10 votes per share, effectively giving the holders of these shares significantly more voting power compared to Class A shareholders.

In some cases, there may be additional classes of shares with different voting rights, such as Class C or Class D shares. These additional classes are typically created to provide different levels of control or to accommodate specific investor requirements.

Features

Dual class stock structures offer several features that make them attractive to certain companies and investors:

- Control: By issuing dual class stock, founders and key executives can retain control over the company even with a minority ownership stake. This allows them to make long-term strategic decisions without being influenced by short-term market pressures.

- Stability: The dual class structure can provide stability to a company by preventing hostile takeovers or unwanted changes in management. The superior voting rights of Class B shareholders make it difficult for outside investors to gain control of the company.

- Alignment of Interests: Dual class stock can align the interests of the founders and key executives with those of long-term shareholders. Since they have more voting power, they have a stronger incentive to focus on the long-term success and growth of the company.

However, dual class stock structures also have their critics. Some argue that they create an imbalance of power and can lead to poor corporate governance. Critics believe that all shareholders should have equal voting rights and that decisions should be made based on the collective will of the shareholders.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.