Distribution Yield Definition

Distribution yield is a financial metric that measures the income generated by an investment, typically a mutual fund or an exchange-traded fund (ETF). It represents the annual income distribution as a percentage of the investment’s current market price.

The distribution yield is an important indicator for investors who are seeking regular income from their investments. It helps them understand how much income they can expect to receive from their investment relative to its current value.

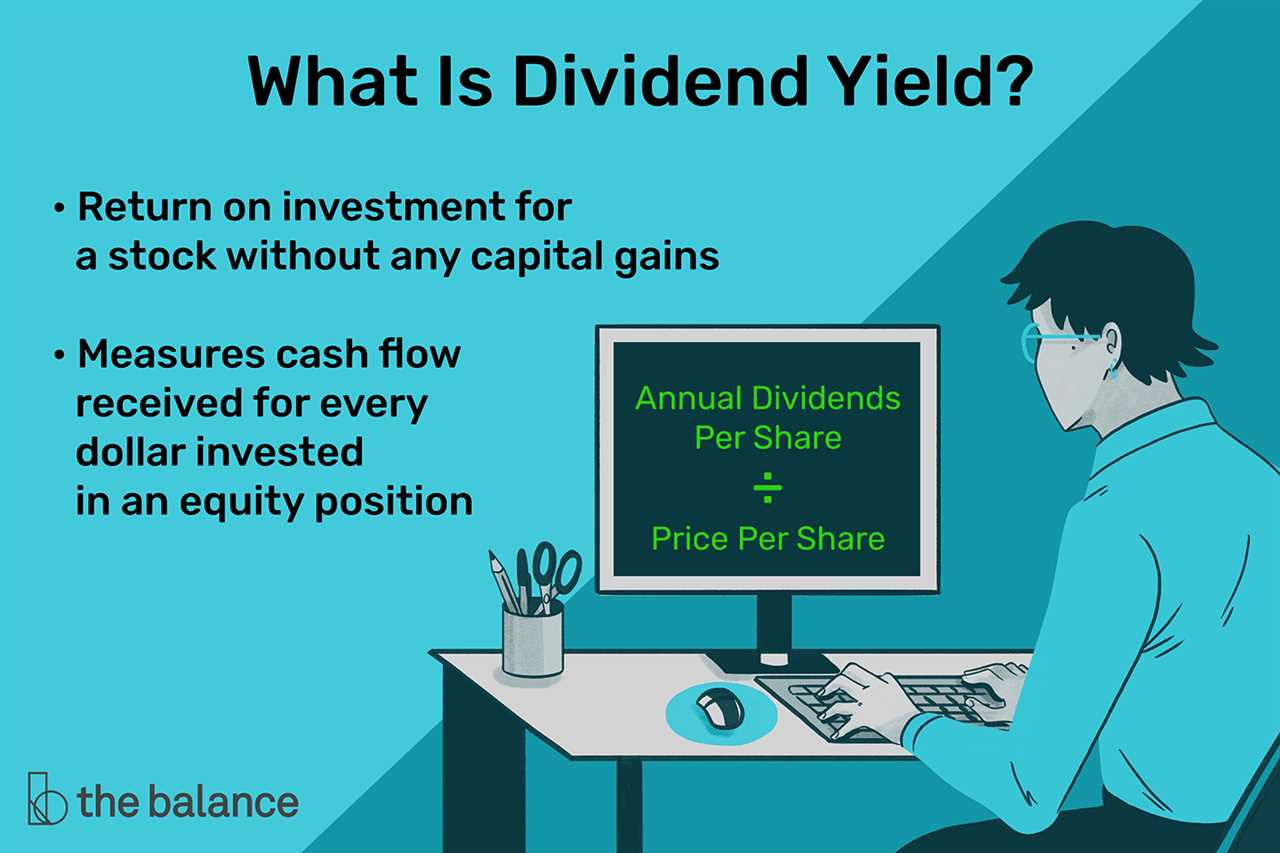

To calculate the distribution yield, you need to know the investment’s annual income distribution and its current market price. The formula for calculating the distribution yield is as follows:

Distribution Yield = (Annual Income Distribution / Current Market Price) * 100%

For example, if a mutual fund has an annual income distribution of $2 and its current market price is $50, the distribution yield would be calculated as:

Distribution Yield = ($2 / $50) * 100% = 4%

This means that the investment has a distribution yield of 4%, indicating that investors can expect to receive 4% of their investment’s value as income on an annual basis.

What Distribution Yield Measures

Distribution Yield is a financial metric that measures the income generated by an investment, typically a mutual fund or an exchange-traded fund (ETF), in the form of dividends or interest payments. It is expressed as a percentage of the investment’s current market price.

The distribution yield is an important measure for investors as it helps them assess the potential income they can earn from their investment. It provides a clear picture of the return on investment in terms of income, which can be particularly useful for income-focused investors such as retirees or those seeking regular cash flow.

Income Generation

The primary purpose of the distribution yield is to indicate the income generation potential of an investment. It takes into account the dividends or interest payments received by the investor over a specific period, typically a year, and divides it by the investment’s current market price.

For example, if a mutual fund has a distribution yield of 4%, it means that the investor can expect to earn 4% of the fund’s current market price in the form of dividends or interest payments over a year. This metric allows investors to compare different investment options and choose the one that offers the highest income potential.

Risk Assessment

Limitations

While the distribution yield is a useful metric, it does have some limitations. Firstly, it only considers the income generated by an investment and does not account for any capital gains or losses. Additionally, it assumes that the investment will continue to generate the same level of income in the future, which may not always be the case.

| Pros | Cons |

|---|---|

| – Provides a clear measure of income generation potential | – Does not consider capital gains or losses |

| – Helps assess risk associated with an investment | – Assumes consistent income generation in the future |

| – Useful for income-focused investors | – Does not account for fees and expenses |

Calculation

The distribution yield is calculated by dividing the annual distribution amount by the current market price of the investment. The annual distribution amount is typically based on the income generated by the investment, such as dividends or interest payments.

To calculate the distribution yield, you need to know the annual distribution amount and the current market price. The formula for calculating the distribution yield is as follows:

Distribution Yield = (Annual Distribution Amount / Current Market Price) x 100%

For example, let’s say you have an investment that pays an annual distribution of $2 per share and the current market price of the investment is $50 per share. To calculate the distribution yield, you would divide the annual distribution amount ($2) by the current market price ($50) and multiply by 100%:

Distribution Yield = ($2 / $50) x 100% = 4%

The distribution yield is an important metric for investors as it provides insight into the income potential of an investment. A higher distribution yield indicates a higher income potential, while a lower distribution yield indicates a lower income potential.

Limitations of the Distribution Yield

Conclusion

The distribution yield is a useful metric for investors to assess the income potential of an investment. By calculating the distribution yield, investors can determine the annual income they can expect to receive relative to the current market price. However, it is important to consider the limitations of the distribution yield and evaluate other factors before making investment decisions.

| Term | Definition |

|---|---|

| Distribution Yield | The percentage of income an investment generates relative to its current market price. |

| Annual Distribution Amount | The income generated by the investment on an annual basis, such as dividends or interest payments. |

| Current Market Price | The current price at which the investment is trading in the market. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.