What is Debt to Capital Ratio?

The debt to capital ratio is a financial ratio that measures the proportion of a company’s capital structure that is financed by debt. It is used to assess a company’s financial leverage and risk. The ratio is calculated by dividing the total debt of a company by the sum of its total debt and total equity.

Debt to capital ratio provides insight into how much of a company’s assets are funded by debt compared to equity. A higher ratio indicates that a larger portion of the company’s capital structure is financed by debt, which can increase the company’s financial risk. On the other hand, a lower ratio suggests that the company relies more on equity financing, which can indicate a lower level of risk.

Investors and analysts use the debt to capital ratio to evaluate a company’s financial health and stability. It helps them understand the company’s ability to meet its debt obligations and assess its overall risk profile. A high debt to capital ratio may indicate that a company is heavily reliant on debt financing and may have difficulty repaying its debts in the event of financial distress.

It is important to note that the debt to capital ratio should be used in conjunction with other financial ratios and metrics to get a comprehensive view of a company’s financial position. It is also important to compare the ratio with industry peers to assess a company’s relative financial leverage.

Definition of Debt to Capital Ratio

The debt to capital ratio is a financial ratio that measures the proportion of a company’s capital structure that is financed by debt. It provides insight into the company’s financial leverage and risk. By comparing the amount of debt to the total capital employed, investors and analysts can assess the company’s ability to meet its financial obligations and evaluate its financial health.

The debt to capital ratio is an important metric used in financial analysis. It helps investors and analysts understand the extent to which a company relies on debt financing to support its operations and growth. A higher debt to capital ratio indicates a greater reliance on debt, which can increase the company’s financial risk.

The debt to capital ratio is calculated by dividing the total debt of a company by the sum of its total debt and total equity. The result is expressed as a percentage, representing the proportion of debt in the company’s capital structure.

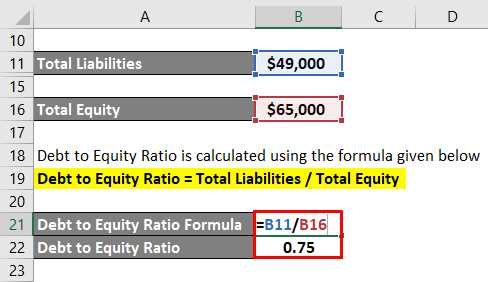

Formula for Calculating Debt to Capital Ratio:

Debt to Capital Ratio = Total Debt / (Total Debt + Total Equity)

Interpreting Debt to Capital Ratio

A low debt to capital ratio suggests that a company has a conservative capital structure with a smaller proportion of debt. This indicates a lower level of financial risk and a greater ability to withstand economic downturns. On the other hand, a high debt to capital ratio indicates a higher level of financial risk and a greater reliance on debt financing.

It is important to note that the interpretation of the debt to capital ratio may vary depending on the industry and the company’s specific circumstances. For example, industries such as utilities and telecommunications tend to have higher debt to capital ratios due to the capital-intensive nature of their operations.

Investors and analysts use the debt to capital ratio as a tool to compare companies within the same industry or to assess a company’s financial health over time. It can also be used to evaluate the impact of changes in a company’s capital structure, such as an increase in debt or equity financing.

Formula for Calculating Debt to Capital Ratio

The debt to capital ratio is a financial ratio that measures the proportion of a company’s capital structure that is financed by debt. It provides insight into the company’s financial leverage and risk. The formula for calculating the debt to capital ratio is:

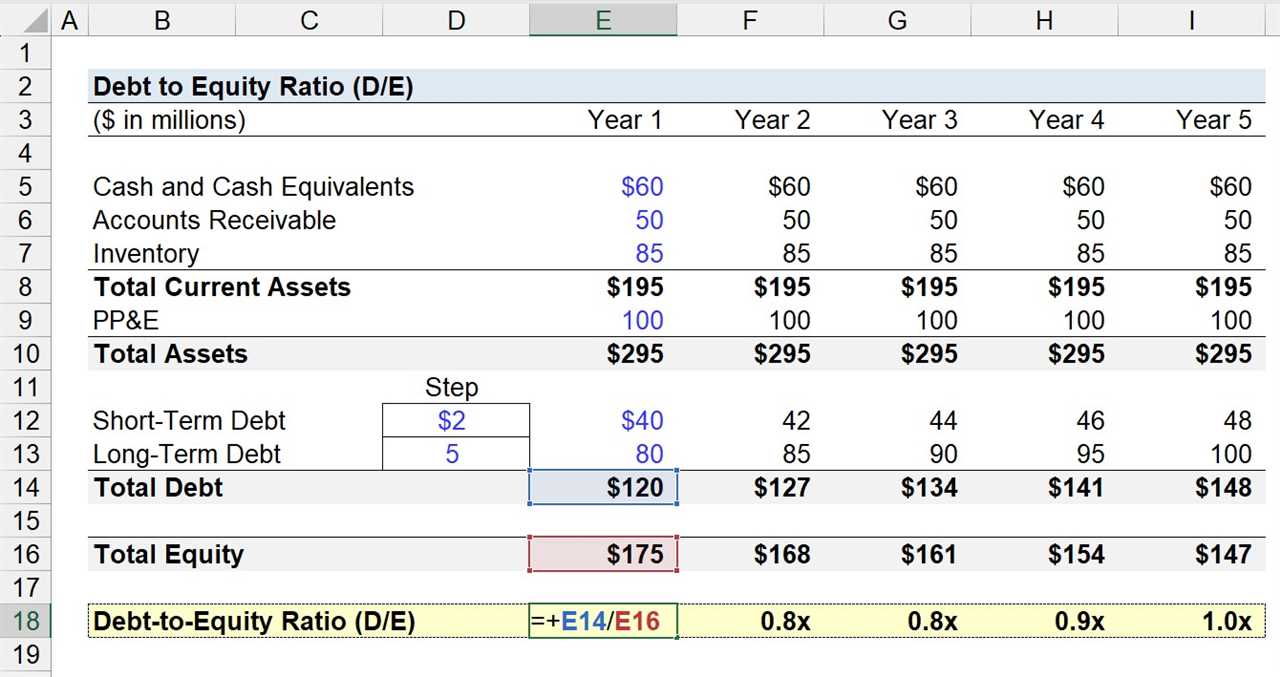

Debt to Capital Ratio = Total Debt / (Total Debt + Total Equity)

The total debt includes both short-term and long-term debt obligations of the company. It can include bank loans, bonds, and other forms of debt. The total equity represents the shareholders’ equity in the company, which includes common stock, retained earnings, and additional paid-in capital.

The debt to capital ratio is expressed as a percentage, indicating the proportion of the company’s capital structure that is financed by debt. A higher ratio indicates a higher level of debt relative to equity, which may imply higher financial risk for the company.

For example, let’s consider a company with $50 million in total debt and $100 million in total equity. The debt to capital ratio would be calculated as:

Debt to Capital Ratio = $50 million / ($50 million + $100 million) = 0.33 or 33%

This means that 33% of the company’s capital structure is financed by debt, while the remaining 67% is financed by equity. This ratio provides valuable information for investors and analysts to assess the company’s financial health and risk profile.

Example of Debt to Capital Ratio Calculation

Let’s take a hypothetical company, ABC Corporation, to illustrate the calculation of the debt to capital ratio. ABC Corporation has total debt of $10 million and total capital of $30 million.

To calculate the debt to capital ratio, we use the formula:

Debt to Capital Ratio = Total Debt / Total Capital

Plugging in the values for ABC Corporation:

Debt to Capital Ratio = $10 million / $30 million

Simplifying the calculation:

Debt to Capital Ratio = 0.3333

The debt to capital ratio for ABC Corporation is 0.3333, or 33.33%. This means that 33.33% of the company’s capital is financed through debt.

Interpreting the debt to capital ratio:

A higher debt to capital ratio indicates that a larger portion of the company’s capital is financed through debt, which may indicate higher financial risk. On the other hand, a lower debt to capital ratio suggests that the company relies more on equity financing, which may indicate lower financial risk.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.