Covered Interest Rate Parity: Definition, Calculation, and Example

In the world of finance, covered interest rate parity is a concept that helps determine the relationship between interest rates and exchange rates in the foreign exchange market. It is a fundamental principle that plays a crucial role in international finance and currency trading.

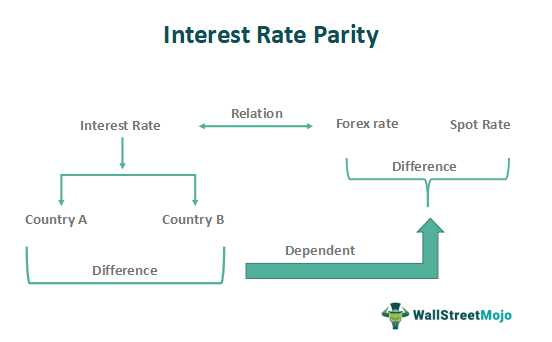

Covered interest rate parity states that the difference between the interest rates of two countries should be equal to the percentage difference between the spot exchange rate and the forward exchange rate. In simpler terms, it means that the interest rate differentials between two currencies should be offset by the expected change in the exchange rate over a certain period.

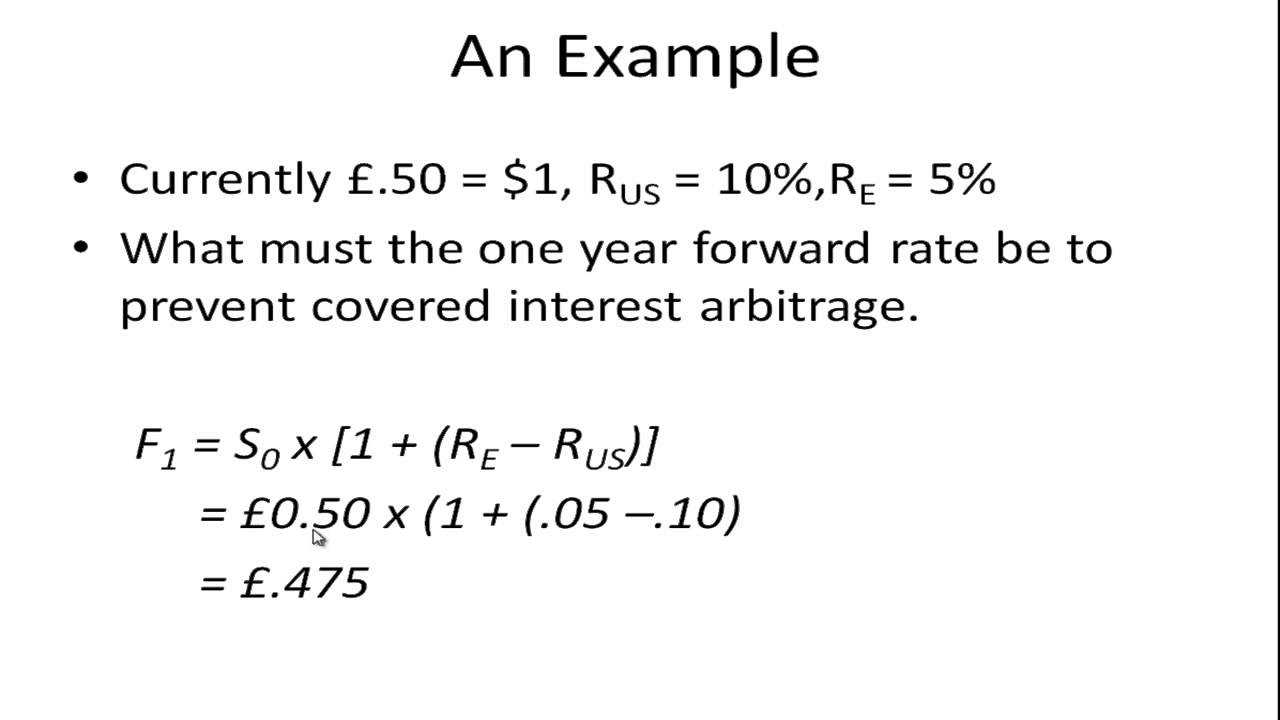

To calculate covered interest rate parity, you need to consider the interest rates of both countries, the spot exchange rate, and the forward exchange rate. The formula for covered interest rate parity is as follows:

Forward Exchange Rate = Spot Exchange Rate x (1 + Foreign Interest Rate) / (1 + Domestic Interest Rate)

Let’s take an example to understand how covered interest rate parity works. Suppose the spot exchange rate between the US dollar and the Euro is 1.10, the domestic interest rate is 2%, and the foreign interest rate is 3%. Using the formula mentioned above, we can calculate the forward exchange rate as:

Forward Exchange Rate = 1.10 x (1 + 0.03) / (1 + 0.02) = 1.121

Covered interest rate parity is an essential concept for investors and traders in the foreign exchange market. It helps them determine whether there is an arbitrage opportunity or not. If the actual forward exchange rate differs from the calculated forward exchange rate, it indicates a potential arbitrage opportunity.

Covered Interest Rate Parity (CIRP) is an important concept in international finance that helps determine the relationship between interest rates, exchange rates, and the cost of borrowing between two countries. It is based on the principle that, in a perfectly efficient market, the returns from investing in different currencies should be equal after adjusting for exchange rate changes.

Under CIRP, the interest rate differential between two countries should be equal to the forward exchange rate premium or discount. This means that if the interest rate in one country is higher than the other, the forward exchange rate should reflect this difference to ensure that investors do not have an arbitrage opportunity.

Arbitrage is the practice of taking advantage of price differences in different markets to make a profit. In the context of CIRP, if there is a discrepancy between the interest rate differential and the forward exchange rate, investors can borrow in the currency with the lower interest rate, convert it to the currency with the higher interest rate, invest it, and then convert it back at the forward exchange rate to make a risk-free profit.

To understand CIRP, let’s consider an example:

Example:

Suppose the interest rate in the United States is 2% per annum, while the interest rate in the United Kingdom is 3% per annum. The current spot exchange rate is 1.3 USD/GBP, and the one-year forward exchange rate is 1.35 USD/GBP.

If the forward exchange rate is not equal to 1.05 (1 + 0.05), there would be an arbitrage opportunity. Investors could borrow 1 USD, convert it to 0.769 GBP (1 / 1.3), invest it in the UK at a 3% interest rate, and then convert it back to USD at the forward exchange rate of 1.35. The investor would receive 1.035 USD, making a risk-free profit of 0.035 USD.

However, in an efficient market, such arbitrage opportunities should not exist. Therefore, the forward exchange rate should be adjusted to ensure that the interest rate differential is reflected accurately.

Calculation of Covered Interest Rate Parity

Covered Interest Rate Parity (CIRP) is a financial concept that compares interest rates and exchange rates between two countries to determine if there is an opportunity for arbitrage. It is based on the principle that in an efficient market, the returns from investing in different currencies should be equalized.

The formula for calculating Covered Interest Rate Parity is as follows:

Forward Exchange Rate = Spot Exchange Rate x (1 + Foreign Interest Rate) / (1 + Domestic Interest Rate)

Where:

- Forward Exchange Rate is the expected exchange rate at a future date.

- Spot Exchange Rate is the current exchange rate.

- Foreign Interest Rate is the interest rate in the foreign country.

- Domestic Interest Rate is the interest rate in the domestic country.

The calculation determines the exchange rate that would make the returns from investing in different currencies equal. If the actual exchange rate is different from the calculated forward exchange rate, there is an opportunity for arbitrage.

For example, let’s assume the spot exchange rate between the US dollar and the British pound is 1.3, the US interest rate is 2%, and the UK interest rate is 3%. Using the formula, we can calculate the forward exchange rate as follows:

Forward Exchange Rate = 1.3 x (1 + 0.03) / (1 + 0.02) = 1.3313

By calculating Covered Interest Rate Parity, investors can identify potential arbitrage opportunities and take advantage of them to make profits in the foreign exchange market.

Example of Covered Interest Rate Parity

Let’s consider an example to better understand the concept of covered interest rate parity.

Scenario:

Suppose an investor wants to invest in a foreign currency, specifically the Euro (EUR). The investor has $1,000,000 and wants to determine whether it is more profitable to invest in the Euro or in their domestic currency, the US Dollar (USD).

Market Conditions:

Currently, the spot exchange rate between the USD and EUR is 1.10. The interest rate in the US is 2%, while the interest rate in the Eurozone is 1.5%. The investor plans to invest the funds for one year.

Calculating Covered Interest Rate Parity:

To determine whether it is more profitable to invest in the Euro or the USD, we can use the covered interest rate parity formula:

Forward Exchange Rate = Spot Exchange Rate × (1 + Foreign Interest Rate) / (1 + Domestic Interest Rate)

Let’s calculate the forward exchange rate:

Forward Exchange Rate = 1.10 × (1 + 0.015) / (1 + 0.02)

Forward Exchange Rate = 1.10 × 1.015 / 1.02

Forward Exchange Rate = 1.105 / 1.02

Forward Exchange Rate = 1.0843

Therefore, the forward exchange rate is approximately 1.0843.

Interpretation:

Since the calculated forward exchange rate (1.0843) is higher than the current spot exchange rate (1.10), it indicates that investing in the Euro would yield a higher return compared to investing in the US Dollar. Therefore, the investor should convert their $1,000,000 into Euros and invest in the Eurozone.

By utilizing the covered interest rate parity concept, investors can make informed decisions regarding currency investments, taking into account interest rate differentials and exchange rate movements.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.