Contra Account: Definition, Types, and Example

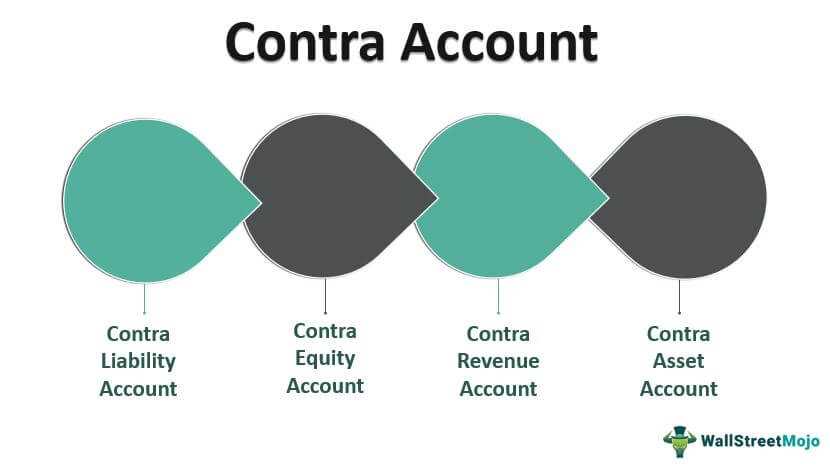

A contra account is a type of account that is used in accounting to offset or reduce the balance of another account. It is typically used to show the opposite effect of the main account and is reported as a deduction from the main account on the financial statements.

Types of Contra Accounts

There are several types of contra accounts that are commonly used in accounting:

| Type | Definition | Example |

|---|---|---|

| Allowance for Doubtful Accounts | Reduces the accounts receivable balance to reflect the estimated amount of uncollectible accounts. | If a company has $10,000 in accounts receivable, but estimates that $1,000 will not be collected, the allowance for doubtful accounts will be $1,000. |

| Accumulated Depreciation | Reduces the value of an asset on the balance sheet to reflect its decrease in value over time. | If a company has a building with a cost of $100,000 and an estimated useful life of 10 years, the accumulated depreciation will be $10,000 per year. |

| Discount on Bonds Payable | Reduces the face value of a bond to reflect the difference between the face value and the amount received from issuing the bond. | If a company issues a bond with a face value of $1,000 but receives only $950, the discount on bonds payable will be $50. |

Example of a Contra Account

By using a contra account, the company can accurately reflect the estimated amount of uncollectible accounts and provide a more realistic picture of its financial position.

Why are Contra Accounts Used?

Contra accounts are used in accounting to provide a more accurate representation of a company’s financial position. They help to offset the balance of the main account and provide a clearer picture of the underlying transactions.

Additionally, contra accounts allow for better analysis and interpretation of financial statements. By separating certain transactions or adjustments from the main account, users of the financial statements can better understand the impact of these items on the overall financial position of the company.

What is a Contra Account?

A contra account is a type of account in accounting that is used to offset the balance of another account. It is created to show the opposite effect of the main account and is used to provide more accurate financial statements.

Contra accounts are typically used to reduce the balance of an asset or liability account. For example, if a company has an accounts receivable account with a balance of $10,000, they may create a contra account called “allowance for doubtful accounts” with a balance of -$500. This contra account offsets the accounts receivable account and shows that the company anticipates that $500 of the accounts receivable will not be collected.

Contra accounts can also be used to offset the balance of an expense account. For example, if a company has an expense account for sales returns and allowances with a balance of $1,000, they may create a contra account called “sales returns and allowances contra” with a balance of -$200. This contra account offsets the expense account and shows that the company expects to receive $200 in returns and allowances.

Contra accounts are important because they provide a more accurate representation of a company’s financial position. They allow for adjustments to be made to the main accounts without affecting the overall balance. This helps to ensure that the financial statements are reliable and reflect the true financial health of the company.

Types of Contra Accounts

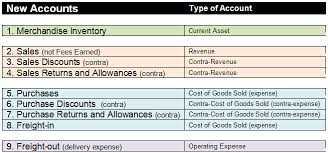

A contra account is a type of account that is used to offset the balance of another account. It is created to show the opposite effect of the account it is associated with. There are several types of contra accounts that are commonly used in accounting:

1. Accumulated Depreciation: This contra account is used to offset the balance of the fixed asset account. It represents the total depreciation expense that has been recorded for a fixed asset over its useful life.

2. Allowance for Doubtful Accounts: This contra account is used to offset the balance of the accounts receivable account. It represents the estimated amount of accounts receivable that is expected to be uncollectible.

3. Sales Returns and Allowances: This contra account is used to offset the balance of the sales revenue account. It represents the amount of sales that have been returned by customers or allowances that have been granted to customers.

4. Discount on Notes Payable: This contra account is used to offset the balance of the notes payable account. It represents the amount of discount that has been given to the borrower for early payment of a note.

5. Accumulated Amortization: This contra account is used to offset the balance of the intangible asset account. It represents the total amortization expense that has been recorded for an intangible asset over its useful life.

6. Reserve for Inventory Obsolescence: This contra account is used to offset the balance of the inventory account. It represents the estimated amount of inventory that is expected to become obsolete or unsellable.

These are just a few examples of the types of contra accounts that can be used in accounting. The specific contra accounts used will vary depending on the nature of the business and the accounting policies of the company.

Example of a Contra Account

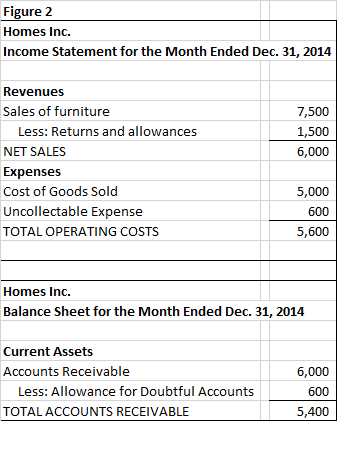

A contra account is a type of account that is used to offset the balance of another account. It is created to show the opposite effect of the original account in the financial statements. Let’s take a look at an example to better understand how a contra account works.

Example:

Company XYZ has a general ledger account called “Allowance for Doubtful Accounts.” This account is a contra account to the Accounts Receivable account. The purpose of the Allowance for Doubtful Accounts is to offset the Accounts Receivable account and reflect the estimated amount of uncollectible accounts.

Let’s say Company XYZ has $100,000 in Accounts Receivable. They estimate that 5% of their accounts will not be collected. To reflect this, they create a contra account called Allowance for Doubtful Accounts with a balance of $5,000.

The Allowance for Doubtful Accounts is shown as a deduction from the Accounts Receivable account on the balance sheet. This allows the financial statements to accurately reflect the estimated amount of uncollectible accounts and provides a more realistic picture of the company’s financial position.

In summary, a contra account is used to offset the balance of another account and show the opposite effect in the financial statements. It helps to provide a more accurate representation of a company’s financial position and allows for better decision-making.

Why are Contra Accounts Used?

A contra account is used in accounting to offset the balance of a related account. It is created to show the opposite effect of the original account and is used to provide a clearer picture of the financial position of a company.

There are several reasons why contra accounts are used:

1. Accuracy in financial reporting:

Contra accounts help in maintaining accurate financial records by separating certain transactions or balances that need to be offset against other accounts. This ensures that the financial statements reflect the true financial position of the company.

2. Transparency and clarity:

3. Compliance with accounting principles:

Contra accounts are used to adhere to the principles of accrual accounting, which requires the recognition of expenses and revenues in the period they occur, rather than when cash is exchanged. By offsetting certain accounts, contra accounts help in accurately reflecting the timing and impact of these transactions.

4. Separation of temporary and permanent accounts:

Contra accounts are often used to separate temporary accounts, such as revenue and expense accounts, from permanent accounts, such as asset and liability accounts. This separation allows for easier analysis and tracking of the company’s financial performance over time.

5. Adjustments and corrections:

Contra accounts are also used to make adjustments and corrections to financial statements. For example, if an error is discovered in an account, a contra account can be created to offset the incorrect balance and show the correct balance in a separate account.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.