Conglomerate: All You Need to Know About Definition, Meaning, Creation, and Examples

A conglomerate is a type of corporation that consists of multiple, diverse businesses operating under one parent company. These businesses can be in completely different industries and have little to no relation to each other. The main goal of a conglomerate is to diversify its portfolio and spread its risk across various sectors.

The creation of a conglomerate usually involves acquiring or merging with other companies. This allows the conglomerate to expand its operations and enter new markets. By acquiring companies in different industries, a conglomerate can benefit from economies of scale, shared resources, and cross-selling opportunities.

Meaning and Significance of Conglomerates

Conglomerates play a significant role in the business world. They are often seen as a way to achieve growth and stability. By diversifying their businesses, conglomerates can mitigate the risks associated with being heavily dependent on a single industry or market. This can make them more resilient to economic downturns and changes in consumer preferences.

Conglomerates also have the advantage of being able to leverage their size and resources to negotiate better deals and access new opportunities. They can use their financial strength to invest in research and development, expand their product offerings, and enter new markets. This can lead to increased profitability and competitiveness.

Creation and Formation of Conglomerates

Conglomerates are typically formed through mergers and acquisitions. A conglomerate may acquire other companies that are already established in different industries, or it may merge with another conglomerate to create a larger entity. The process of creating a conglomerate involves careful evaluation of potential targets, negotiation of terms, and integration of acquired businesses.

When forming a conglomerate, the parent company must consider the strategic fit of the acquired businesses and how they can contribute to the overall growth and profitability of the conglomerate. It is important to have a clear vision and strategy for managing the diverse portfolio of businesses and ensuring they can operate synergistically.

Examples of Conglomerate Companies

There are many well-known conglomerate companies around the world. One example is General Electric (GE), which operates in industries such as aviation, healthcare, power, and renewable energy. Another example is Berkshire Hathaway, led by Warren Buffett, which has a diverse portfolio of businesses including insurance, utilities, manufacturing, and retail.

Other examples of conglomerates include Samsung, which operates in electronics, shipbuilding, construction, and more, and Alphabet Inc., the parent company of Google, which has businesses in technology, internet services, and autonomous vehicles.

What is a Conglomerate?

A conglomerate is a type of corporation that consists of multiple, diverse businesses operating in different industries. These businesses are usually acquired through mergers and acquisitions, allowing the conglomerate to expand its portfolio and diversify its revenue streams.

Unlike a traditional corporation that focuses on a single industry or product, a conglomerate operates in various sectors, such as manufacturing, technology, finance, and retail. This diversification helps the conglomerate mitigate risks associated with a specific industry or market, as any downturn in one sector can be offset by the success of another.

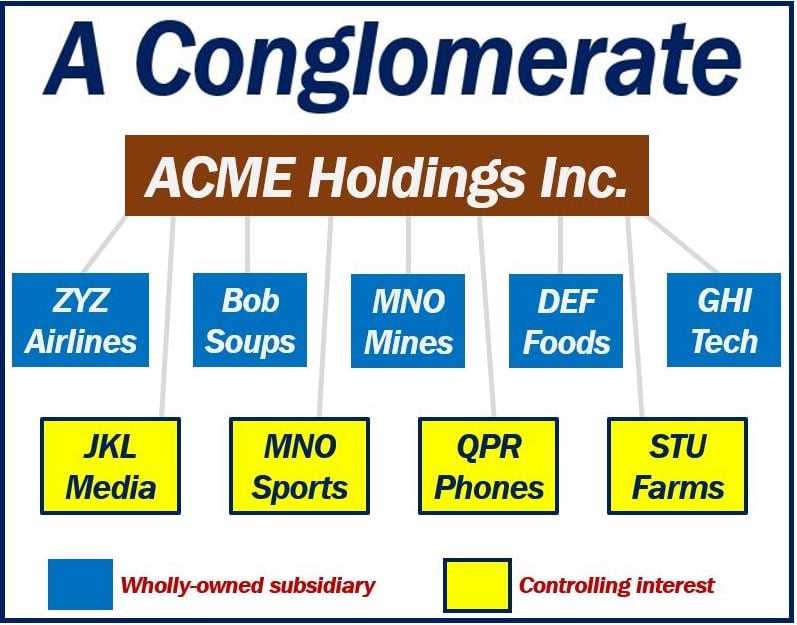

Conglomerates often have a holding company structure, where the conglomerate owns a controlling interest in each of its subsidiary businesses. This allows the conglomerate to exercise control and influence over the operations and strategic decisions of its subsidiaries.

One of the key advantages of a conglomerate is the ability to leverage synergies between its different businesses. By sharing resources, knowledge, and expertise across its subsidiaries, a conglomerate can achieve cost savings, economies of scale, and operational efficiencies. This can lead to increased profitability and competitiveness in the market.

However, managing a conglomerate can be complex due to the diverse nature of its businesses. Each subsidiary may have its own unique challenges and requirements, requiring effective management and coordination from the conglomerate’s leadership team.

The Meaning and Significance of Conglomerates

Conglomerates are large corporations that operate in multiple industries or sectors. They are formed through the acquisition or merger of different companies that may have unrelated business activities. The main purpose of conglomerates is to diversify their operations and reduce risks by entering into various industries.

One of the key advantages of conglomerates is their ability to leverage synergies between their different business units. By combining resources, expertise, and networks from various industries, conglomerates can create economies of scale and scope. This can lead to cost savings, increased market power, and improved competitiveness.

Conglomerates also play a significant role in the global economy. They have the financial resources and expertise to invest in new technologies, research and development, and innovation. This allows them to drive economic growth, create jobs, and contribute to technological advancements.

| Advantages of Conglomerates | Disadvantages of Conglomerates |

|---|---|

| – Diversification of risks | – Lack of focus and specialization |

| – Synergies and economies of scale | – Difficulty in managing diverse businesses |

| – Enhanced competitiveness | – Potential for conflicts of interest |

| – Ability to invest in new technologies | – Regulatory and antitrust concerns |

However, conglomerates also face challenges and risks. Their diverse business portfolio can make it difficult to manage and allocate resources effectively. They may lack focus and specialization, which can lead to inefficiencies and suboptimal performance in certain industries.

There is also a potential for conflicts of interest within conglomerates. Different business units may have competing objectives or priorities, which can hinder decision-making and strategic alignment. Regulatory and antitrust concerns are also common, as conglomerates may face scrutiny for their market dominance and potential anti-competitive practices.

Creation and Formation of Conglomerates

A conglomerate is typically formed through the process of mergers and acquisitions. This occurs when two or more companies come together to create a new entity. The goal of forming a conglomerate is to diversify the business portfolio and expand into new industries.

When a merger takes place, two companies combine their assets, liabilities, and operations to form a single entity. This can be achieved through a stock swap, where the shareholders of one company receive shares in the new conglomerate in exchange for their existing shares. Alternatively, a cash payment may be made to acquire the shares of the merging company.

In an acquisition, one company purchases another company outright. This can be done through a cash payment or by exchanging shares of the acquiring company for shares of the target company. The acquiring company gains control over the target company and its assets, allowing it to integrate the operations and expand its business.

Once the merger or acquisition is complete, the conglomerate may restructure its operations to streamline efficiency and eliminate redundancies. This can involve consolidating departments, reducing staff, or selling off non-core assets. The goal is to create a more efficient and profitable business model that leverages the strengths of each individual company within the conglomerate.

Conglomerates may also pursue organic growth by investing in new business ventures or expanding existing operations. This can involve launching new products or services, entering new markets, or acquiring smaller companies in related industries. By continually seeking growth opportunities, conglomerates can adapt to changing market conditions and maintain a competitive advantage.

In summary, conglomerates are created through mergers and acquisitions, allowing companies to diversify their business portfolios and expand into new industries. Through strategic restructuring and organic growth, conglomerates can leverage the strengths of their individual companies to achieve long-term success.

Examples of Conglomerate Companies

There are numerous examples of conglomerate companies that have achieved success in various industries. These companies have diversified their operations and expanded their reach through strategic acquisitions and mergers. Here are some notable examples:

1. General Electric (GE)

General Electric is a multinational conglomerate that operates in various sectors, including aviation, healthcare, power, renewable energy, and more. The company has a diverse portfolio of businesses and has been successful in adapting to changing market conditions.

2. Berkshire Hathaway

Berkshire Hathaway is a conglomerate led by renowned investor Warren Buffett. The company owns a wide range of businesses, including insurance, railroads, utilities, manufacturing, and retail. Berkshire Hathaway is known for its long-term investment approach and has consistently delivered strong financial performance.

3. Samsung Group

Samsung Group is a South Korean conglomerate that operates in various industries, including electronics, shipbuilding, construction, and more. The company is known for its innovation and has become a global leader in the technology sector.

4. Alphabet Inc.

Alphabet Inc. is the parent company of Google and several other subsidiaries. It operates in various sectors, including internet services, technology, and advertising. Alphabet Inc. has a diverse portfolio of businesses and has been successful in leveraging its dominant position in the online search market.

5. Tata Group

Tata Group is an Indian multinational conglomerate that operates in various sectors, including automotive, steel, telecommunications, and more. The company has a long history and is known for its ethical business practices and commitment to social responsibility.

These are just a few examples of conglomerate companies that have achieved success through diversification and strategic management. Each of these companies has leveraged its resources and expertise to expand into new markets and industries, demonstrating the potential for growth and success in the conglomerate business model.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.