Bearer Share: Definition, Example, Risks, and Benefits

A bearer share is a type of stock or equity that is owned by whoever physically holds the share certificate. Unlike registered shares, which are tied to the owner’s name and recorded in a company’s shareholder registry, bearer shares do not have an owner’s name associated with them. Instead, they are considered “bearer” because they can be transferred by simply handing over the physical certificate.

Example of Bearer Share

Let’s say Company XYZ issues bearer shares. The company prints physical share certificates and sells them to investors. The investor who physically holds the share certificate is considered the owner of the shares. If the investor wants to sell the shares, they can simply transfer the physical certificate to the buyer, who then becomes the new owner.

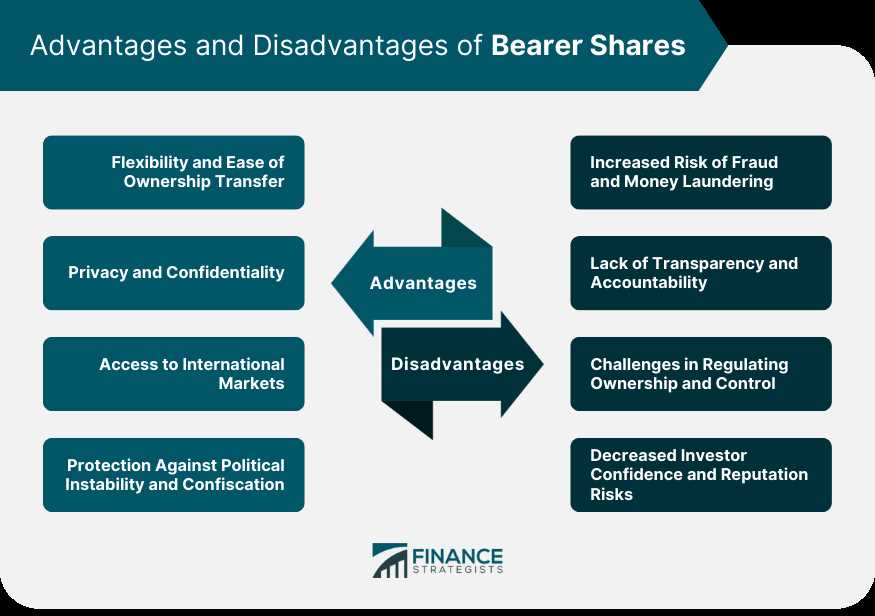

Risks of Bearer Shares

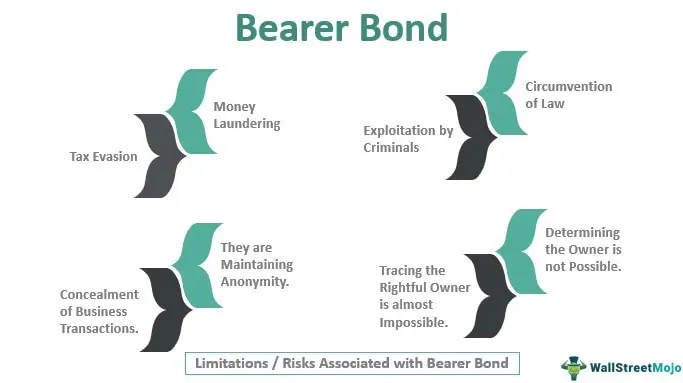

Bearer shares pose several risks, primarily due to their anonymous nature. Since there is no record of ownership, it becomes difficult to track the true owners of the shares. This makes bearer shares attractive to individuals looking to engage in illicit activities, such as money laundering or tax evasion. Additionally, if a bearer share certificate is lost or stolen, the person who possesses it can claim ownership, making it challenging for the rightful owner to recover their shares.

Benefits of Bearer Shares

What is a Bearer Share?

A bearer share is a type of stock or equity security that is owned by whoever physically holds the share certificate. Unlike registered shares, which are tied to a specific owner and recorded in a company’s shareholder registry, bearer shares do not have an owner’s name attached to them.

How do Bearer Shares Work?

Since bearer shares do not have an owner’s name attached to them, they can be easily bought, sold, or transferred without any formal registration or notification. This makes them highly flexible and convenient for investors who value anonymity and want to easily move their assets across borders.

Legal Considerations and Risks

While bearer shares offer certain benefits, they also come with significant risks and legal considerations. Due to their anonymous nature, bearer shares can be used for illegal activities such as money laundering, tax evasion, and terrorist financing. As a result, many jurisdictions have introduced regulations and restrictions on the use of bearer shares.

Some countries have completely banned the issuance and use of bearer shares, while others require strict reporting and disclosure requirements. It is important for investors to understand and comply with the legal framework surrounding bearer shares in their jurisdiction to avoid potential legal consequences.

Benefits of Bearer Shares

Despite the risks and legal considerations, bearer shares can offer certain benefits to investors. These include:

- Privacy and anonymity: Bearer shares allow individuals to maintain their financial privacy and keep their ownership of assets confidential.

- Flexibility and ease of transfer: Bearer shares can be easily bought, sold, or transferred without the need for formal registration or notification.

- International diversification: Bearer shares can be used to hold assets in different jurisdictions, allowing for international diversification of investments.

Overall, bearer shares can be a useful tool for certain investors who value privacy and flexibility. However, it is important to carefully consider the legal and regulatory environment before using bearer shares and to ensure compliance with all applicable laws and regulations.

Example of Bearer Share

A bearer share is a type of security that is owned by whoever physically possesses the share certificate. Unlike registered shares, which are tied to the name of the shareholder in the company’s records, bearer shares do not have an owner recorded in any official documentation.

Here is an example to illustrate how bearer shares work:

- Company XYZ issues 1,000 bearer shares.

- John purchases 100 bearer shares from Company XYZ.

- John receives a physical share certificate that represents his ownership of the 100 bearer shares.

- John can now transfer the ownership of the shares by physically handing over the share certificate to another person.

- If John decides to sell his shares, he can simply give the share certificate to the buyer, who then becomes the new owner of the shares.

It is important to note that bearer shares can be easily transferred without any formalities or paperwork, making them highly liquid. However, this also means that the ownership of bearer shares can be easily transferred anonymously, which can raise concerns about money laundering and tax evasion.

In recent years, many jurisdictions have introduced stricter regulations on bearer shares to mitigate these risks. Some countries have even banned the issuance of new bearer shares altogether.

Overall, this example demonstrates how bearer shares function as a form of ownership that can be easily transferred through physical possession of the share certificate, providing flexibility and anonymity to the shareholders.

Risks of Bearer Shares

Bearer shares carry certain risks that investors should be aware of before considering this type of investment. These risks include:

1. Lack of transparency: Bearer shares can be easily transferred without any record or documentation, making it difficult to track the ownership and control of the shares. This lack of transparency can create opportunities for illegal activities such as money laundering, tax evasion, and fraud.

2. Risk of theft or loss: Bearer shares are physical documents that can be easily stolen, lost, or destroyed. If a bearer share certificate is stolen or lost, the person who possesses it can claim ownership of the shares, potentially leading to disputes and legal complications.

3. Limited legal protection: Bearer shares offer limited legal protection to investors. Since ownership of the shares is determined by physical possession of the share certificate, there is a risk that the shares can be transferred without the knowledge or consent of the rightful owner. This lack of legal protection can leave investors vulnerable to fraudulent transfers and unauthorized transactions.

4. Difficulty in enforcing rights: Bearer shares can make it difficult for investors to enforce their rights as shareholders. Since the ownership of the shares is not recorded in any official register, it can be challenging to prove ownership and exercise shareholder rights such as voting, receiving dividends, or participating in decision-making processes.

5. Regulatory and compliance risks: Bearer shares are subject to increased regulatory scrutiny due to their potential misuse for illegal activities. Many jurisdictions have implemented stricter regulations and reporting requirements for bearer shares to prevent money laundering and tax evasion. Investors holding bearer shares may face additional compliance burdens and regulatory risks.

6. Limited access to financial services: Bearer shares are becoming less popular in the financial industry due to their associated risks. As a result, investors holding bearer shares may face challenges in accessing financial services such as banking, investment, and brokerage services. Financial institutions may refuse to work with individuals or entities holding bearer shares due to the increased compliance and reputational risks.

Considering these risks, investors should carefully evaluate the potential benefits and drawbacks of investing in bearer shares and seek professional advice before making any investment decisions.

Benefits of Bearer Shares

Bearer shares offer several benefits to investors and companies alike. Here are some of the key advantages:

1. Anonymity and Privacy

One of the main benefits of bearer shares is the anonymity and privacy they provide. Since the ownership of bearer shares is not recorded, it is difficult to trace the true owner of the shares. This can be advantageous for individuals or companies who wish to keep their ownership interests confidential.

2. Ease of Transfer

3. Flexibility

Bearer shares offer flexibility in terms of ownership and control. Since the ownership is not recorded, it is easier to divide ownership among multiple individuals or entities. This can be useful in situations where a company wants to attract multiple investors or when there is a need to change ownership quickly.

4. Avoidance of Estate Taxes

In some jurisdictions, bearer shares can be used to avoid or minimize estate taxes. By holding assets in the form of bearer shares, individuals can transfer their wealth to their heirs without triggering tax liabilities. However, it is important to note that the use of bearer shares for tax avoidance purposes may be subject to legal restrictions in certain jurisdictions.

5. International Investment

Bearer shares can facilitate international investment by providing a convenient and flexible way to hold and transfer shares. They can be easily transported across borders, allowing investors to take advantage of investment opportunities in different jurisdictions. This can be particularly beneficial for individuals or companies engaged in global business activities.

While bearer shares offer these advantages, it is important to note that they also come with certain risks and considerations. It is crucial for investors and companies to fully understand the legal and regulatory framework surrounding bearer shares in their jurisdiction before utilizing them.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.