Annualized Income: Definition, Formula, and Example

Annualized income refers to the projected or estimated income for a given period, typically a year. It is a method used to calculate the total income for a shorter period and then extrapolate it to an annual figure. This is particularly useful when dealing with irregular or seasonal income.

The formula for calculating annualized income is relatively straightforward. You take the income earned over a specific period and divide it by the number of months in that period. Then, you multiply that result by 12 to get the annualized income.

Annualized Income = (Income for Specific Period / Number of Months) x 12

For example, let’s say you earned $5,000 in a three-month period. To calculate the annualized income, you would divide $5,000 by 3 to get $1,666.67. Then, you multiply $1,666.67 by 12, resulting in an annualized income of $20,000.

Calculating annualized income is particularly important for individuals with irregular income streams, such as freelancers or self-employed individuals. By annualizing their income, they can better plan for taxes, savings, and expenses.

Annualized income is a financial metric that calculates the projected annual income based on a shorter period of time, such as a month or a quarter. It is commonly used to compare income levels across different time periods or to estimate the annual income for individuals or businesses.

Why is Annualized Income Important?

Secondly, annualized income is useful for comparing income levels across different time periods. For example, if a business wants to compare its monthly income for the current year with the same period in the previous year, annualizing the income can provide a more meaningful comparison.

Additionally, annualized income is often used in investment analysis. When evaluating investment opportunities, investors may annualize the projected income to determine the potential return on investment. This allows them to compare different investment options and make informed decisions.

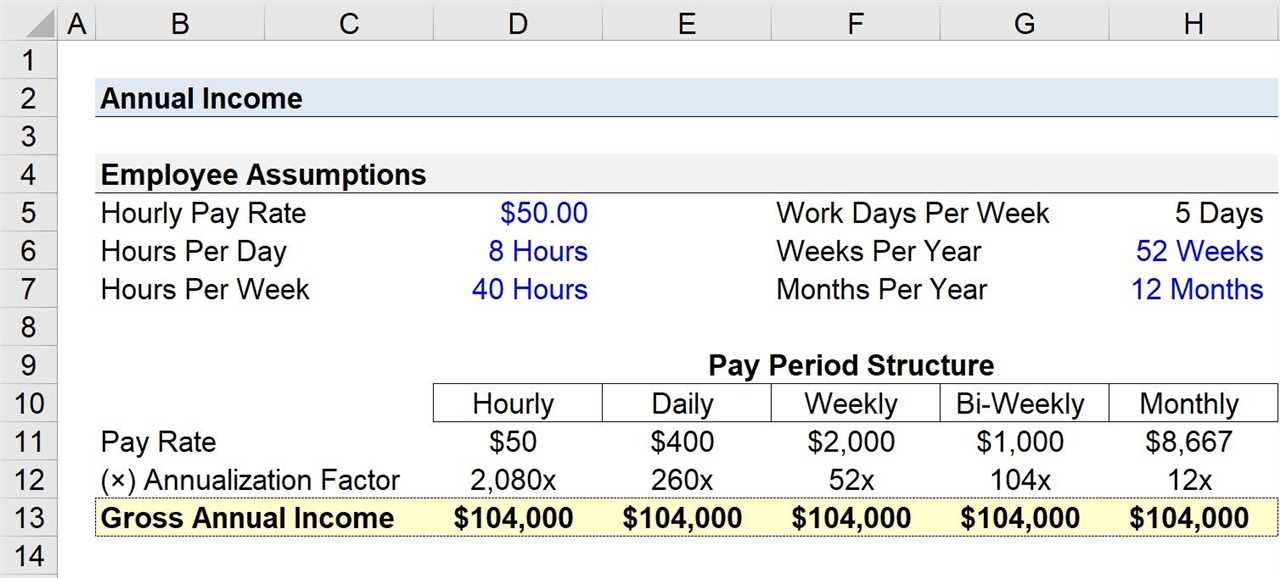

How is Annualized Income Calculated?

The formula for calculating annualized income depends on the time period used to calculate the income. If the income is calculated for a shorter period, such as a month, the formula is:

Annualized Income = Monthly Income x 12

If the income is calculated for a quarter, the formula is:

Annualized Income = Quarterly Income x 4

By multiplying the income by the appropriate factor, the annualized income can be estimated.

Example of Calculating Annualized Income

Let’s say an individual earns $3,000 per month. To calculate their annualized income, we would use the formula:

Annualized Income = $3,000 x 12 = $36,000

Therefore, the individual’s annualized income would be $36,000.

It is important to note that annualized income is an estimate and may not reflect the actual income for the entire year. Factors such as seasonality, economic conditions, and other variables can affect the actual income earned.

Importance of Calculating Annualized Income

Calculating annualized income is an essential financial tool that helps individuals and businesses understand their financial situation and make informed decisions. It provides a clearer picture of their income over a specific period, allowing them to plan for the future and evaluate their financial goals.

1. Financial Planning

By calculating annualized income, individuals can effectively plan their finances. They can determine their average income and use it as a basis for budgeting and saving. This helps them allocate their resources wisely and prioritize their expenses, ensuring that they have enough funds for their needs and goals.

2. Investment Evaluation

Annualized income is crucial when evaluating investment opportunities. It allows individuals and businesses to assess the potential return on investment (ROI) over a specific period. By comparing the annualized income of different investment options, they can make informed decisions about where to allocate their funds and maximize their returns.

3. Loan Applications

When applying for loans, lenders often require borrowers to provide their annualized income. This helps lenders assess the borrower’s ability to repay the loan and determine the loan amount they can offer. Calculating annualized income beforehand allows borrowers to understand their financial capacity and ensure they meet the lender’s requirements.

4. Tax Planning

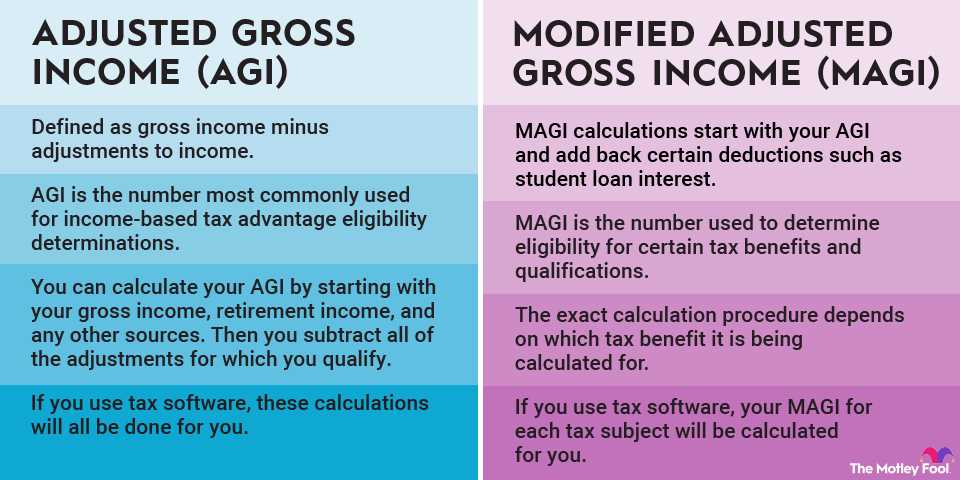

Annualized income is essential for tax planning purposes. By knowing their annualized income, individuals and businesses can estimate their tax liability and plan their expenses accordingly. This helps them take advantage of tax deductions and credits, minimizing their tax burden and maximizing their savings.

5. Business Performance Evaluation

For businesses, calculating annualized income is crucial for evaluating their financial performance. It helps them assess their revenue and profitability over a specific period, identify trends, and make strategic decisions. Annualized income provides a benchmark for measuring the success of the business and identifying areas for improvement.

Formula for Calculating Annualized Income

- Step 1: Determine the income earned over the chosen time period. This can include wages, salaries, bonuses, commissions, rental income, investment income, and any other sources of income.

- Step 2: Calculate the number of periods in a year. For example, if the chosen time period is three months, there are four quarters in a year, so the number of periods would be 4.

- Step 3: Divide the income earned over the chosen time period by the number of periods in a year. This will give you the average income per period.

- Step 4: Multiply the average income per period by the number of periods in a year. This will give you the annualized income.

Here is the formula in mathematical terms:

Annualized Income = (Income earned over chosen time period / Number of periods in a year) * Number of periods in a year

By using this formula, individuals and businesses can get a clearer picture of their financial situation and make more informed decisions about their income and expenses. It is particularly useful for individuals with irregular income or those who have experienced significant changes in their income over the course of a year.

Example of Calculating Annualized Income

Step 1: Calculate Monthly Income

- Monthly salary: $3,000

- Quarterly bonus: $2,000 / 3 (since it is received every 3 months) = $666.67

- Total monthly income: $3,000 + $666.67 = $3,666.67

Step 2: Calculate Annualized Income

- Total monthly income: $3,666.67

- Number of months in a year: 12

- Annualized income: $3,666.67 x 12 = $43,999.99

So, your annualized income would be approximately $43,999.99. This figure represents your average income over the course of a year, taking into account both your regular monthly salary and any additional income you receive.

Calculating your annualized income can be helpful for various financial purposes, such as determining your eligibility for loans or mortgages, setting savings goals, and evaluating your overall financial stability. It provides a more comprehensive view of your income and allows you to make more informed financial decisions.

Income Categories: [INCOME CATEGORIES catname]

1. Salary

Salary refers to the fixed amount of money that an individual earns on a regular basis for their employment. This can include monthly or annual salaries, as well as any additional bonuses or incentives.

2. Hourly Wages

Hourly wages are the amount of money that an individual earns per hour of work. This category is often applicable to individuals who are paid on an hourly basis, such as part-time or temporary workers.

3. Commission

Commission is a form of income that is based on a percentage of sales or transactions. This category is commonly used for individuals who work in sales or marketing roles, where their income is directly tied to their performance.

4. Rental Income

Rental income refers to the money earned from renting out properties or assets. This category is applicable to individuals or companies who own real estate or other assets that generate rental income.

5. Investment Income

Investment income includes any earnings from investments, such as stocks, bonds, or mutual funds. This category is relevant for individuals or companies who have invested their money and receive dividends, interest, or capital gains.

6. Self-Employment Income

Self-employment income is the money earned by individuals who work for themselves or own their own business. This category includes income from freelancing, consulting, or any other form of self-employment.

7. Other Income

Other income encompasses any additional sources of income that do not fall into the above categories. This can include income from side jobs, royalties, or any other miscellaneous sources of earnings.

| Income Category | Description |

|---|---|

| Salary | Fixed amount earned on a regular basis for employment |

| Hourly Wages | Amount earned per hour of work |

| Commission | Income based on a percentage of sales or transactions |

| Rental Income | Money earned from renting out properties or assets |

| Investment Income | Earnings from investments such as stocks, bonds, or mutual funds |

| Self-Employment Income | Money earned from working for oneself or owning a business |

| Other Income | Additional sources of income not falling into the above categories |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.