What is Annual Turnover?

Annual turnover refers to the measure of how frequently the holdings of a mutual fund are bought and sold within a given year. It is an important metric that investors use to assess the level of trading activity within a fund. The annual turnover rate is expressed as a percentage and represents the total value of securities bought or sold by the fund divided by the average net asset value (NAV) of the fund.

For example, if a mutual fund has an annual turnover rate of 50%, it means that the fund’s holdings have been completely replaced once during the year.

High turnover rates indicate that the fund manager is actively buying and selling securities in an attempt to generate returns. This can result in higher transaction costs and potentially higher taxes for investors. On the other hand, low turnover rates suggest that the fund manager is taking a more passive approach and holding onto securities for longer periods of time.

It is important for investors to consider the annual turnover rate when evaluating a mutual fund. A high turnover rate may not necessarily be a negative factor, as it could indicate an active and skilled fund manager. However, investors should also be aware of the potential costs associated with high turnover rates.

Definition and Explanation

Annual turnover refers to the measure of the buying and selling activity within a mutual fund over a one-year period. It is an important metric used by investors to assess the level of trading activity and potential costs associated with owning a particular mutual fund.

When investors buy and sell shares of a mutual fund, the fund manager must make corresponding transactions in the underlying securities held by the fund. These transactions can generate costs, such as brokerage fees and bid-ask spreads, which can impact the fund’s performance and ultimately the returns received by investors.

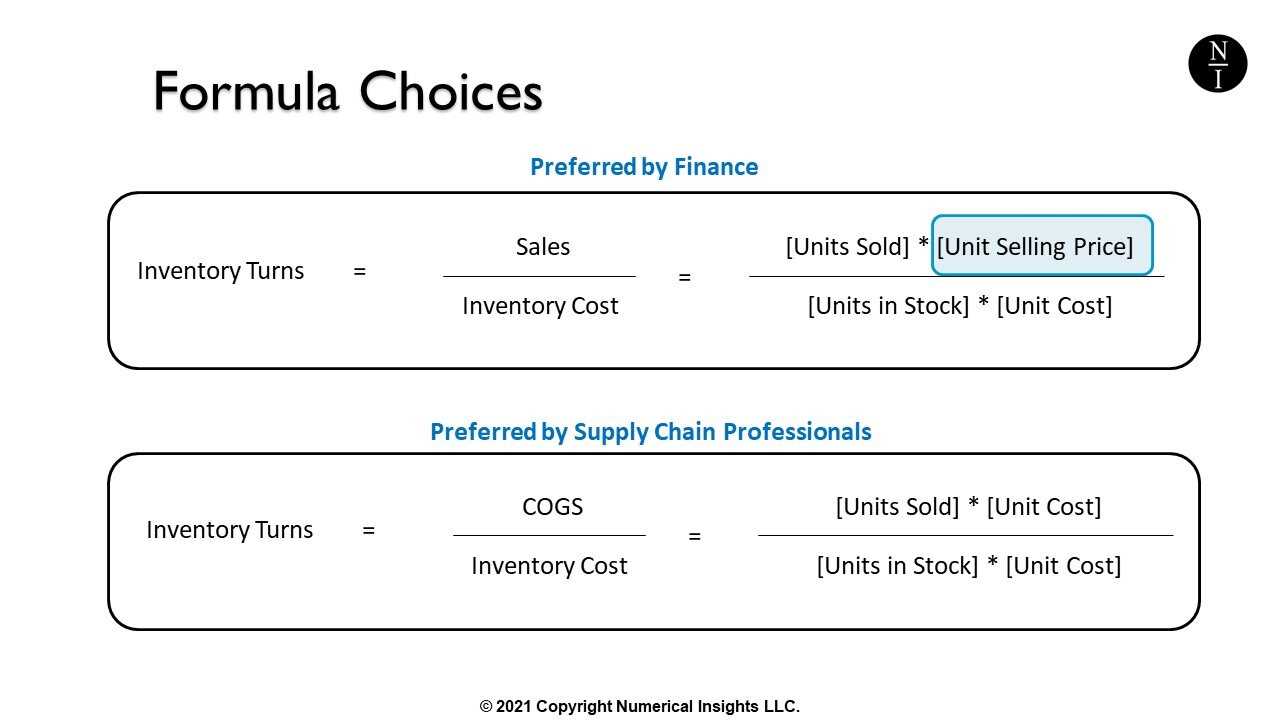

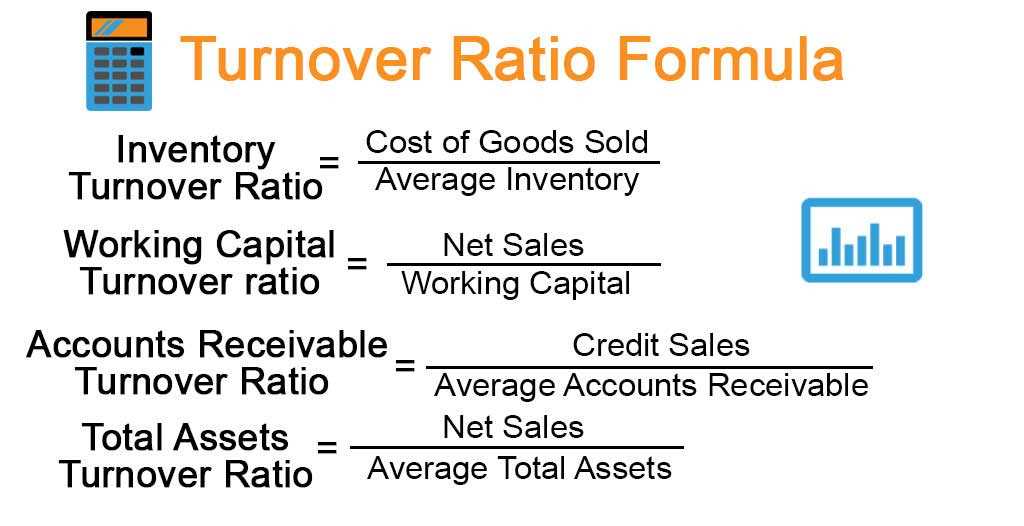

The annual turnover rate is calculated by dividing the total value of securities bought or sold by the fund during the year by the average net asset value (NAV) of the fund over the same period. The result is expressed as a percentage.

A high turnover rate indicates that the fund manager is actively buying and selling securities within the fund. This can potentially lead to higher costs and may indicate a more aggressive investment strategy. On the other hand, a low turnover rate suggests a more passive approach with fewer transactions and potentially lower costs.

Investors should consider the annual turnover rate when evaluating mutual funds as it can impact the fund’s tax efficiency and overall performance. Higher turnover rates may result in greater capital gains distributions, which can be taxable to investors. Additionally, frequent trading can increase transaction costs and potentially erode returns.

It is important to note that the annual turnover rate is just one factor to consider when evaluating a mutual fund. Investors should also assess other metrics such as expense ratio, historical performance, and investment strategy to make informed investment decisions.

Calculation Example

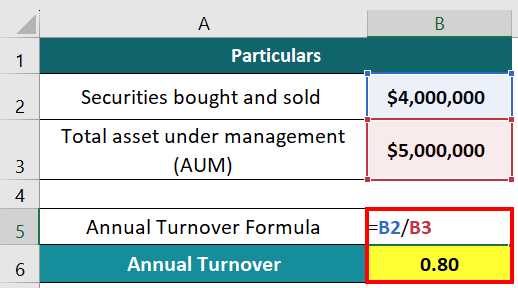

Let’s consider a hypothetical mutual fund called XYZ Growth Fund. To calculate the annual turnover of this fund, we need to gather some information.

First, we need to know the total value of the securities bought and sold by the fund during a specific period, usually a year. Let’s say that XYZ Growth Fund bought and sold securities worth $100 million during the year.

Next, we need to determine the average value of the fund’s assets during that period. Let’s assume that the average value of XYZ Growth Fund’s assets was $500 million.

It is important to note that a high annual turnover rate can indicate that the fund’s portfolio manager is actively buying and selling securities, potentially in an attempt to generate higher returns. However, frequent buying and selling can also result in higher transaction costs and tax implications for investors.

On the other hand, a low annual turnover rate may suggest a more passive investment strategy, where the fund manager holds onto securities for longer periods. This approach may result in lower transaction costs but could also limit the potential for higher returns.

| Total Value of Securities Bought and Sold | Average Value of Assets | Annual Turnover Rate |

|---|---|---|

| $100 million | $500 million | 20% |

Guide to Mutual Funds

Definition and Explanation

Annual turnover is calculated by dividing the total value of securities bought or sold by a mutual fund during a year by the average net asset value (NAV) of the fund. The result is expressed as a percentage. For example, if a mutual fund has a turnover rate of 50%, it means that it buys or sells securities equivalent to half of its portfolio value in a year.

A high turnover rate indicates that the fund is actively buying and selling securities, which can lead to higher transaction costs and taxes. On the other hand, a low turnover rate suggests that the fund is holding onto its investments for a longer period, potentially reducing costs and taxes.

Calculation Example

Let’s say a mutual fund has a total value of securities bought or sold amounting to $10 million during a year, and its average NAV is $100 million. To calculate the annual turnover rate, we divide $10 million by $100 million and multiply by 100. The result is a turnover rate of 10%.

It is important for investors to consider the turnover rate when selecting a mutual fund. A high turnover rate may indicate a more aggressive investment strategy, while a low turnover rate may suggest a more passive approach. Additionally, investors should be aware of the potential costs associated with higher turnover, such as transaction fees and capital gains taxes.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.