Anchoring in Investing: A Comprehensive Guide with Real-Life Examples

One strategy to overcome anchoring bias is to gather as much relevant information as possible before making a decision. By considering multiple perspectives and analyzing different data points, investors can avoid fixating on a single piece of information and make a more well-rounded decision.

Another strategy is to set clear criteria for making investment decisions. By establishing specific guidelines and sticking to them, investors can reduce the influence of anchoring bias and make more objective choices.

Real-life examples of anchoring bias in investing can provide valuable insights into how this bias can affect our decision-making. For instance, the dot-com bubble of the late 1990s is a classic example of anchoring bias, as investors anchored their decisions on the skyrocketing stock prices of technology companies without considering their actual value or profitability.

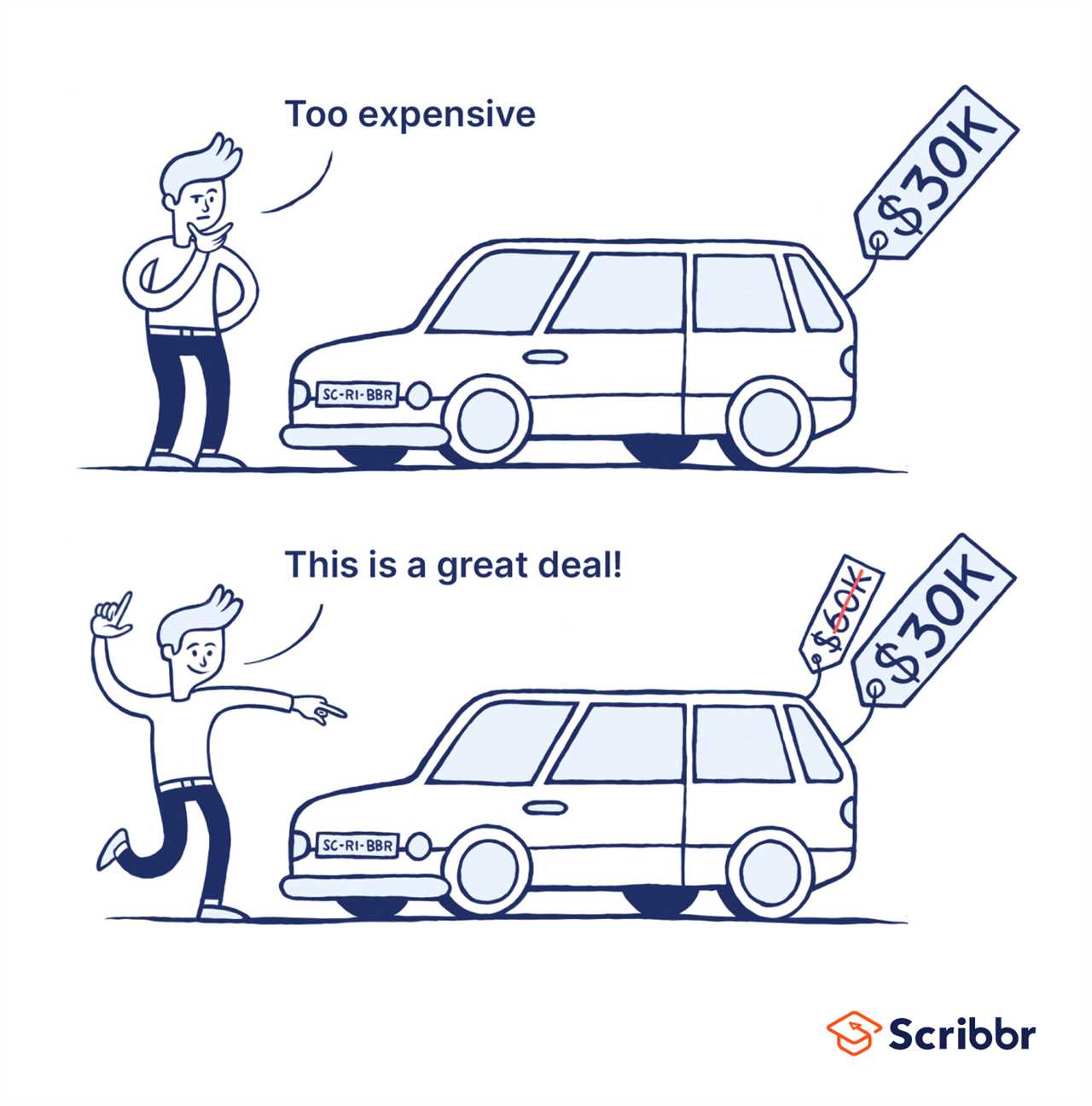

Anchoring bias is a cognitive bias that affects our decision-making process, particularly in investing. It refers to the tendency to rely too heavily on the first piece of information we receive (the anchor) when making decisions, even if that information is irrelevant or arbitrary.

This bias can have a significant impact on investment decisions, as it can lead to irrational behavior and skewed perceptions of value. For example, if an investor hears a stock price mentioned on the news, they may anchor their decision-making process to that price, even if it has no bearing on the stock’s actual value.

One reason anchoring bias occurs is due to our reliance on mental shortcuts or heuristics. When faced with complex decisions, our brains often look for quick and easy ways to make judgments. Anchoring bias is one such shortcut, as it allows us to make decisions based on a single piece of information rather than considering all available data.

Another factor that contributes to anchoring bias is our desire for consistency and coherence in our decision-making. Once we anchor to a particular piece of information, it becomes challenging to deviate from that anchor, even if new information suggests a different course of action. This can lead to missed opportunities and poor investment outcomes.

To overcome anchoring bias in investing, it is essential to be aware of its existence and actively challenge the initial anchor. This can be done by seeking out additional information, conducting thorough research, and considering multiple perspectives. It is also helpful to set clear investment goals and criteria before making decisions, as this can provide a framework for evaluating options objectively.

Additionally, diversifying investments can help mitigate the impact of anchoring bias. By spreading investments across different asset classes and sectors, investors can reduce their reliance on a single anchor and make more balanced decisions based on a broader range of information.

The Impact of Anchoring on Investment Decisions

Anchoring bias is a cognitive bias that affects investors’ decision-making process. It occurs when individuals rely too heavily on a particular piece of information or reference point (the anchor) when making decisions, even if the anchor is irrelevant or arbitrary.

For example, imagine an investor who purchased a stock at $100 per share. The stock price subsequently drops to $80 per share. Instead of objectively evaluating the current market conditions and the stock’s fundamentals, the investor may anchor their decision on the initial purchase price of $100 per share. They may hold onto the stock, hoping that it will eventually reach $100 again, even if there is no logical reason to believe that it will. This anchoring bias can result in significant losses for the investor.

To overcome anchoring bias in investing, it is important for investors to be aware of this cognitive bias and actively work to mitigate its effects. This can be done by conducting thorough research, using a systematic investment approach, and regularly reassessing investment decisions based on current information and market conditions. It is also helpful to seek diverse perspectives and challenge one’s own assumptions to avoid anchoring on a single reference point.

| Key Takeaways: |

|---|

| Anchoring bias occurs when individuals rely too heavily on a particular piece of information or reference point when making decisions. |

| In investing, anchoring bias can lead to irrational decision-making and prevent investors from accurately evaluating the current market conditions and the true value of an investment. |

| To overcome anchoring bias, investors should be aware of this cognitive bias, conduct thorough research, use a systematic investment approach, and regularly reassess investment decisions based on current information and market conditions. |

Strategies to Overcome Anchoring Bias in Investing

Overcoming anchoring bias in investing is crucial for making rational and informed decisions. Here are some strategies that can help you overcome this cognitive bias:

| 1. Awareness and Recognition | |

| 2. Conduct Independent Research | Instead of relying solely on the information provided by others, conduct your own research and analysis. This will help you form an unbiased opinion and reduce the impact of external anchors. |

| 3. Diversify Your Portfolio | By diversifying your portfolio, you can reduce the influence of a single anchor on your investment decisions. Spread your investments across different asset classes, industries, and geographic regions to minimize the impact of anchoring bias. |

| 4. Set Clear Investment Goals | Establish clear investment goals and stick to your predetermined criteria. This will help you avoid being swayed by irrelevant anchors and stay focused on your long-term objectives. |

| 5. Seek Contrarian Views | Actively seek out alternative viewpoints and opinions that challenge your existing beliefs. This can help you break free from anchoring bias and consider a wider range of possibilities. |

| 6. Use Decision-Making Tools | Utilize decision-making tools, such as checklists or decision matrices, to guide your investment decisions. These tools can provide a structured approach and help you evaluate options objectively. |

| 7. Regularly Review and Update | Regularly review and update your investment decisions based on new information and changing market conditions. This will help you avoid being anchored to outdated or irrelevant information. |

By implementing these strategies, you can minimize the impact of anchoring bias and make more rational investment decisions. Remember, overcoming cognitive biases requires constant vigilance and self-awareness.

Real-Life Examples of Anchoring Bias in Investing

Example 1: Initial Public Offerings (IPOs)

One common example of anchoring bias in investing is seen in the pricing of initial public offerings (IPOs). When a company goes public, its stock is initially priced based on various factors such as market conditions, industry trends, and financial performance. Investors often anchor their valuation of the stock to this initial price, even if new information becomes available that suggests the stock is overvalued or undervalued. This anchoring bias can lead to investors holding onto stocks longer than they should or making poor investment decisions based on outdated information.

Example 2: Stock Market Performance

Another example of anchoring bias in investing is seen in the evaluation of stock market performance. Investors may anchor their expectations of future returns based on past performance, even if market conditions have changed. For example, if a stock has consistently performed well in the past, investors may anchor their expectations to this positive performance and continue to hold the stock, even if there are indications that the stock’s performance may decline in the future. This anchoring bias can lead to missed opportunities and potential losses.

Example 3: Analyst Recommendations

Anchoring bias can also be observed in the reliance on analyst recommendations. Investors may anchor their investment decisions to the recommendations of analysts, even if new information becomes available that contradicts these recommendations. For example, if an analyst gives a “buy” recommendation for a stock, investors may anchor their decision to buy the stock based on this recommendation, even if there are indications that the stock may not perform well in the future. This anchoring bias can lead to investors disregarding important information and making poor investment choices.

Overall, anchoring bias can have a significant impact on investment decisions. It is important for investors to be aware of this cognitive bias and to actively work to overcome it. By seeking out diverse sources of information, regularly reassessing investment decisions, and avoiding reliance on initial anchors, investors can make more informed and rational investment choices.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.