What Is Full Costing?

Full costing is an accounting method that takes into account all costs associated with the production of goods or services. It includes both variable costs, which change with the level of production, and fixed costs, which remain constant regardless of the level of production.

With full costing, all costs, including direct materials, direct labor, and overhead costs, are allocated to the products or services being produced. This method provides a more accurate representation of the true cost of production, as it considers all expenses incurred in the manufacturing process.

By including fixed costs in the calculation, full costing allows businesses to better understand the total cost of producing each unit of output. This information is crucial for making informed decisions about pricing, profitability, and resource allocation.

Full costing is widely used in various industries, including manufacturing, construction, and services. It provides a comprehensive view of costs and helps businesses evaluate the financial impact of their operations.

In summary, full costing is an accounting method that considers both variable and fixed costs in determining the total cost of production. It provides a more accurate picture of the expenses incurred in manufacturing goods or providing services, enabling businesses to make informed financial decisions.

Definition and Explanation

Importance of Full Costing

Full costing is essential for accurate financial reporting and decision-making. By considering all costs, it allows businesses to determine the true cost per unit and make informed pricing decisions. It also helps in evaluating the profitability of different products or services, as well as assessing the impact of changes in production volume.

Furthermore, full costing enables businesses to properly allocate their overhead expenses. This ensures that each product or service bears its fair share of the indirect costs, preventing distortions in cost calculations. It also helps in identifying areas of inefficiency and potential cost-saving opportunities.

Overall, full costing provides a comprehensive and accurate view of the cost structure, allowing businesses to make informed financial decisions and improve their profitability.

Advantages and Disadvantages of Full Costing

Full costing is an accounting method that takes into account all costs associated with producing a product or service. This includes both variable costs, which change with the level of production, and fixed costs, which remain constant regardless of production levels. While full costing has its advantages, it also has some disadvantages that should be considered.

Advantages of Full Costing

1. Accurate Cost Calculation: Full costing provides a more accurate calculation of the total cost of producing a product or service. By including both variable and fixed costs, it gives a comprehensive view of the expenses incurred.

3. Compliance with Generally Accepted Accounting Principles (GAAP): Full costing is in line with GAAP, which requires the inclusion of all costs in financial statements. This ensures transparency and consistency in financial reporting.

Disadvantages of Full Costing

1. Difficulty in Allocating Fixed Costs: Allocating fixed costs to individual products or services can be challenging. It often requires the use of allocation methods, which may not accurately reflect the actual usage of resources.

2. Distorted Profit Margins: Full costing can lead to distorted profit margins, especially when there are significant variations in production levels. This is because fixed costs are spread over a larger or smaller number of units, resulting in fluctuating profit margins.

3. Ignoring Opportunity Costs: Full costing does not consider opportunity costs, which are the potential benefits foregone by choosing one alternative over another. This can limit the decision-making process by not accounting for the value of alternative uses of resources.

| Advantages | Disadvantages |

|---|---|

| Accurate cost calculation | Difficulty in allocating fixed costs |

| Better decision making | Distorted profit margins |

| Compliance with GAAP | Ignoring opportunity costs |

Overall, full costing provides a comprehensive view of costs and can aid in decision making. However, it is important to consider the disadvantages and potential limitations of this accounting method.

Accounting Method Vs Variable Costing

Definition and Explanation

Advantages and Disadvantages

Full costing provides a more accurate representation of the total cost of production. It takes into account all costs, including fixed overhead costs, which can be significant for certain industries. This method is useful for financial reporting purposes and helps determine the break-even point for a product or service.

However, full costing may not accurately reflect the cost behavior of a product or service. Fixed overhead costs can be allocated unevenly, resulting in distorted cost figures. This can make it challenging to make informed decisions regarding pricing, product mix, and resource allocation.

Variable costing, on the other hand, provides a clearer picture of the cost behavior of a product or service. It allows businesses to understand the impact of changes in production volume on costs and profitability. Variable costing is particularly useful for decision-making purposes, such as pricing decisions and determining the contribution margin of a product.

However, variable costing does not comply with generally accepted accounting principles (GAAP) and is not suitable for external financial reporting. It may also underestimate the total cost of production by excluding fixed overhead costs.

In summary, the choice between full costing and variable costing depends on the specific needs and objectives of a business. Full costing provides a comprehensive view of costs but may not accurately reflect cost behavior, while variable costing focuses on variable costs and helps with decision-making but is not suitable for external financial reporting.

Differences and Similarities between Full Costing and Variable Costing

Full costing and variable costing are two different accounting methods used to calculate the cost of producing goods or services. While they have some similarities, they also have several key differences.

Differences:

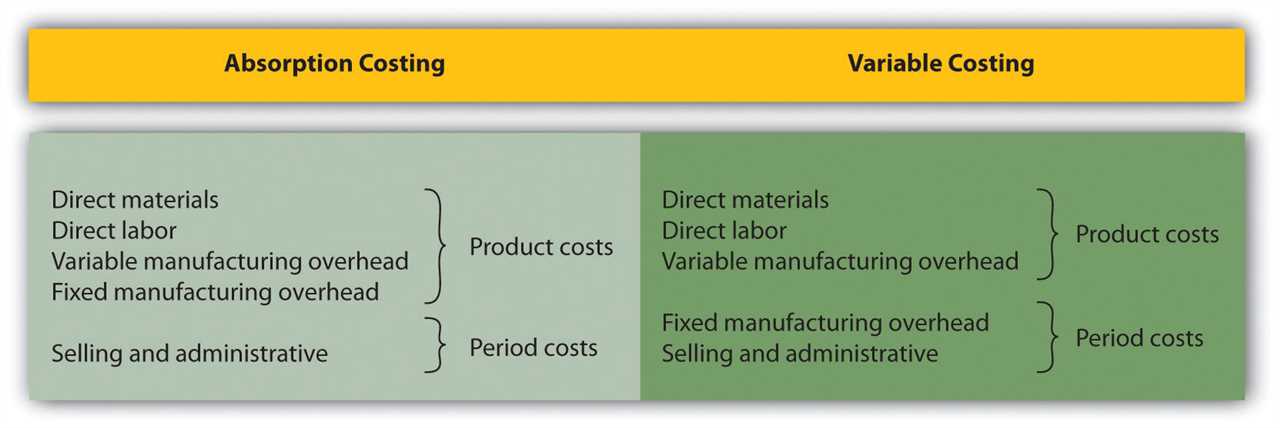

- Treatment of Fixed Manufacturing Overhead: Full costing includes fixed manufacturing overhead as part of the product cost, while variable costing treats it as a period expense.

- Inventory Valuation: Full costing values inventory at its full cost, including both variable and fixed manufacturing costs. In contrast, variable costing values inventory at its variable cost only.

- Profit Calculation: Full costing calculates profit by deducting the full cost of goods sold from sales revenue, while variable costing calculates profit by deducting only the variable cost of goods sold.

Similarities:

- Direct Costs: Both full costing and variable costing consider direct costs, such as direct materials and direct labor, as part of the product cost.

- Indirect Costs: Both methods allocate indirect costs, such as manufacturing overhead, to the product cost.

- Income Statement Presentation: Both methods present the cost of goods sold and gross profit on the income statement.

Benefits and Limitations

Additionally, full costing is required by generally accepted accounting principles (GAAP) for external financial reporting purposes. By using this method, businesses can ensure compliance with regulatory requirements and provide accurate financial statements to stakeholders.

Moreover, full costing can help businesses allocate overhead costs more accurately. By assigning fixed costs to products based on a predetermined allocation base, such as direct labor hours or machine hours, companies can better understand the true cost of each product and adjust pricing accordingly.

However, full costing also has its limitations. One major drawback is that it may distort the profitability of individual products, especially if there is a significant difference in the proportion of fixed costs allocated to each product. This can lead to incorrect pricing decisions and potentially result in losses for the business.

Furthermore, full costing relies on estimates and assumptions when allocating overhead costs, which can introduce inaccuracies into the cost calculations. This is particularly problematic if the allocation base chosen does not accurately reflect the actual consumption of resources by each product.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.