Marginal Profit Calculation Formula and Definition

Marginal profit is a financial metric that measures the additional profit gained from producing and selling one additional unit of a product or service. It is an important concept in economics and accounting, as it helps businesses determine the profitability of their operations and make informed decisions about production levels and pricing strategies.

The formula for calculating marginal profit is:

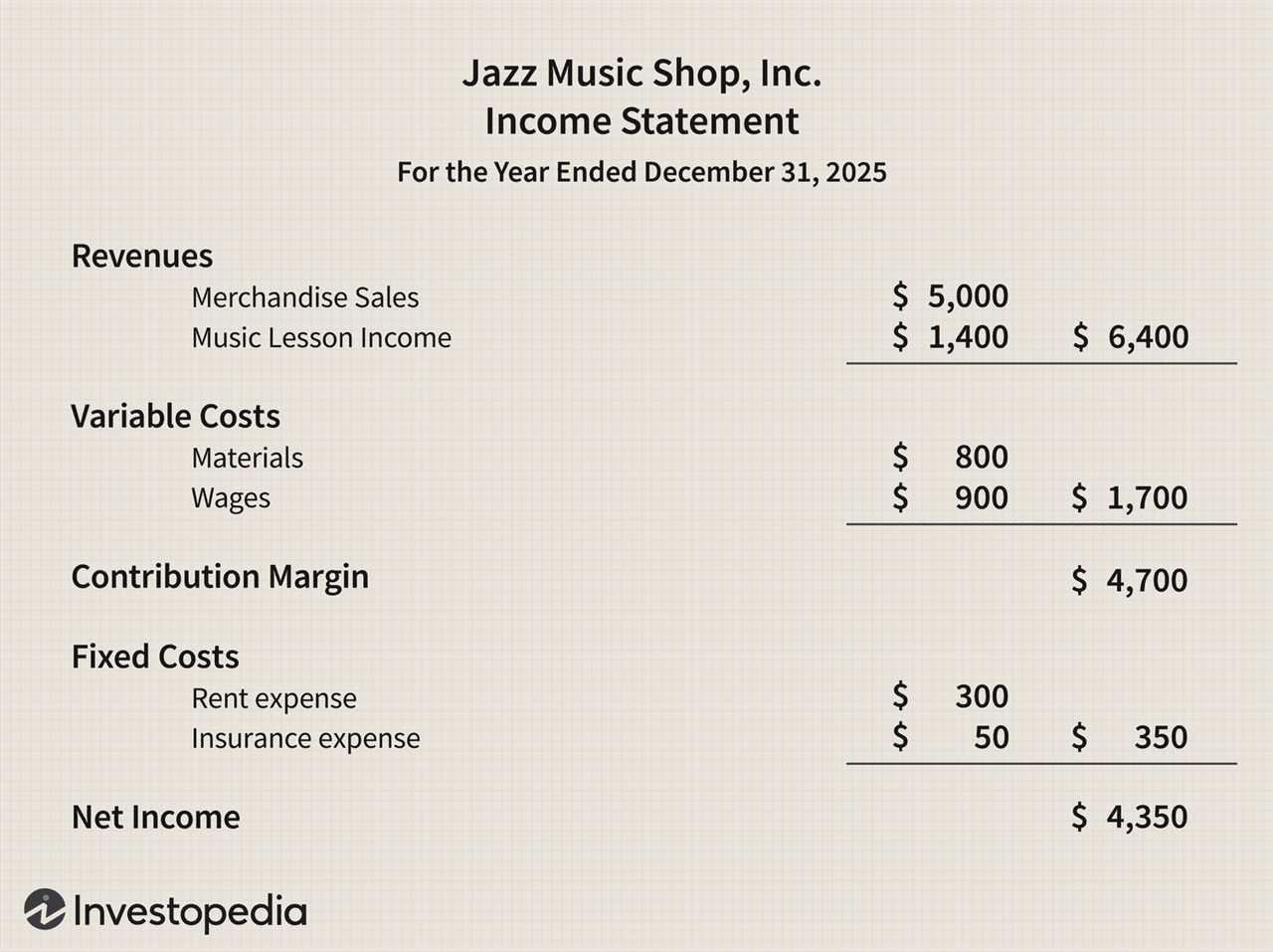

To calculate the marginal profit, you need to know the revenue generated from selling one additional unit and the cost incurred in producing that unit. The revenue can be calculated by multiplying the price of the product by the quantity sold, while the cost can include both variable costs (such as raw materials and labor) and fixed costs (such as rent and utilities).

Marginal profit is calculated by subtracting the variable costs associated with producing the additional unit from the revenue generated by selling that unit. Variable costs are the costs that vary with the level of production, such as raw materials, direct labor, and direct overhead expenses.

Importance of Marginal Profit

Secondly, marginal profit analysis can also help businesses identify opportunities for cost savings and efficiency improvements. By analyzing the variable costs associated with each additional unit of output, a company can identify areas where costs can be reduced or eliminated, thereby increasing overall profitability.

Calculating Marginal Profit

To calculate marginal profit, you need to know the revenue generated by selling one additional unit of a product or service and the variable costs associated with producing that additional unit. The formula for calculating marginal profit is as follows:

| Revenue | – | Variable Costs | = | Marginal Profit |

|---|

Once you have calculated the marginal profit, you can use this information to make informed decisions about pricing, production levels, and cost-saving measures.

Calculating Marginal Profit

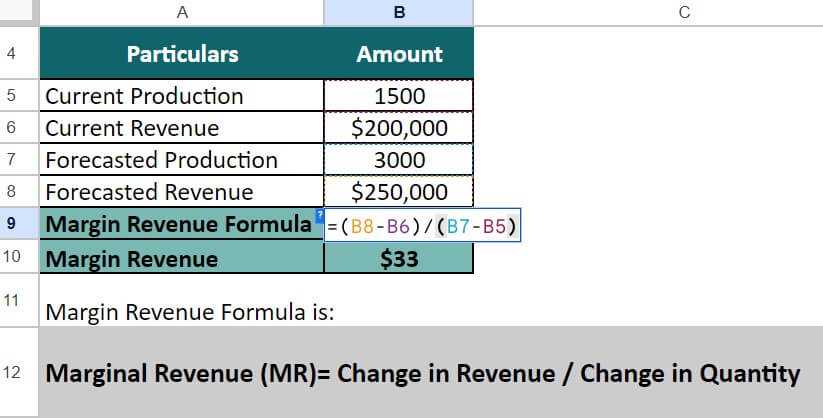

To calculate marginal profit, you need to have data on the total revenue and total cost associated with producing and selling a certain quantity of goods or services. The formula for calculating marginal profit is:

The change in total revenue is calculated by subtracting the total revenue of the previous quantity from the total revenue of the current quantity. Similarly, the change in total cost is calculated by subtracting the total cost of the previous quantity from the total cost of the current quantity.

For example, let’s say a company sells 100 units of a product and generates a total revenue of $10,000. The total cost associated with producing and selling these 100 units is $8,000. The company decides to increase production and sells 101 units. The total revenue from selling these additional units is $1,100, and the total cost is $900.

Using the formula, we can calculate the marginal profit:

By calculating marginal profit, businesses can assess the profitability of their operations and make informed decisions about their production and pricing strategies. It provides valuable insights into the incremental impact of producing and selling additional units and helps businesses optimize their resources and maximize their profits.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.