What Are Index Futures: Definition, Types, and How to Profit

Definition of Index Futures:

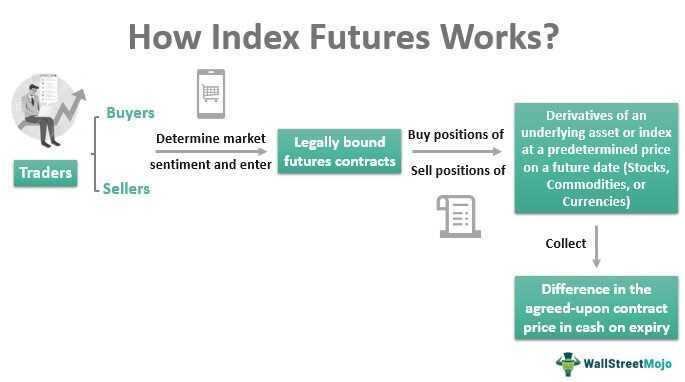

Index futures are derivative contracts that derive their value from an underlying stock index. They represent an agreement to buy or sell the index at a predetermined price on a future date. The value of an index futures contract is based on the performance of the underlying index.

Types of Index Futures:

There are various types of index futures contracts available for trading. Some of the most popular ones include:

– S&P 500 Futures: Based on the performance of the 500 largest publicly traded companies in the United States.

– Dow Jones Industrial Average Futures: Based on the performance of 30 large, publicly traded companies in the United States.

– Nasdaq 100 Futures: Based on the performance of the 100 largest non-financial companies listed on the Nasdaq stock exchange.

How to Profit from Index Futures:

Investors can profit from index futures in several ways:

– Speculation: Traders can speculate on the future direction of the index and profit from their correct predictions.

– Hedging: Investors can use index futures to hedge their existing stock portfolio against market downturns.

– Arbitrage: Traders can take advantage of price discrepancies between the index futures and the underlying index to make risk-free profits.

Overall, index futures provide investors with an opportunity to gain exposure to the broader market and potentially profit from its movements. However, it is important to note that trading futures involves risks and requires careful analysis and risk management.

Definition of Index Futures

Index futures are financial contracts that allow investors to speculate on the future direction of a specific stock market index. These contracts are standardized agreements to buy or sell an underlying index at a predetermined price on a future date.

Investors can profit from index futures by taking either a long or short position. A long position involves buying index futures with the expectation that the underlying index will rise in value. On the other hand, a short position involves selling index futures with the expectation that the underlying index will decline in value.

Overall, index futures are an important tool for investors looking to profit from the movements of the stock market. They offer opportunities for both short-term traders and long-term investors to participate in the market and potentially generate returns.

Types of Index Futures

Index futures are available for a wide range of stock market indices, allowing traders to speculate on the future direction of the overall market or specific sectors. Here are some of the most common types of index futures:

1. S&P 500 Futures:

S&P 500 futures are based on the Standard & Poor’s 500 Index, which includes 500 of the largest publicly traded companies in the United States. This index is widely regarded as a benchmark for the overall performance of the U.S. stock market.

2. Dow Jones Industrial Average (DJIA) Futures:

Dow Jones Industrial Average (DJIA) futures are based on the Dow Jones Industrial Average, which consists of 30 large, publicly traded companies in various industries. This index is often used as a gauge of the overall health of the U.S. stock market.

3. Nasdaq-100 Futures:

Nasdaq-100 futures are based on the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq stock exchange. This index is heavily weighted towards technology companies.

4. Russell 2000 Futures:

Russell 2000 futures are based on the Russell 2000 Index, which includes 2000 small-cap companies in the United States. This index is often used as a barometer for the performance of small-cap stocks and the overall health of the U.S. economy.

5. FTSE 100 Futures:

FTSE 100 futures are based on the FTSE 100 Index, which consists of the 100 largest companies listed on the London Stock Exchange. This index is widely used as a benchmark for the performance of the UK stock market.

These are just a few examples of the many types of index futures available for trading. Each index represents a different segment of the market, allowing traders to diversify their portfolios and take advantage of various market trends.

How to Profit from Index Futures

Trading index futures can be a profitable venture if done correctly. Here are some strategies to help you make the most out of your index futures trading:

1. Research and Analysis: Before entering any trade, it is essential to conduct thorough research and analysis of the market. Study the historical performance of the index, identify trends, and analyze the factors that can impact its future movement.

2. Develop a Trading Plan: A well-defined trading plan is crucial for success in index futures trading. Determine your risk tolerance, set profit targets, and establish stop-loss levels to manage your trades effectively.

3. Use Technical Indicators: Utilize technical indicators such as moving averages, MACD, and RSI to identify entry and exit points. These indicators can help you gauge the momentum and strength of the market, enabling you to make informed trading decisions.

4. Practice Risk Management: Risk management is vital in index futures trading. Never risk more than you can afford to lose and always use stop-loss orders to limit potential losses. Diversify your portfolio to spread the risk across different indices.

5. Stay Updated: Keep yourself updated with the latest news and events that can impact the index you are trading. Economic reports, corporate earnings, and geopolitical developments can all influence the market, so stay informed to make timely trading decisions.

6. Monitor Market Liquidity: Pay attention to the liquidity of the index futures market. Higher liquidity ensures better execution of trades and tighter bid-ask spreads, reducing trading costs and maximizing potential profits.

7. Practice Discipline: Emotions can cloud judgment and lead to impulsive trading decisions. Stick to your trading plan, avoid chasing losses, and maintain discipline throughout your trading journey.

By following these strategies and continuously improving your trading skills, you can increase your chances of profiting from index futures trading. Remember, trading involves risks, and it is essential to educate yourself and practice responsible trading.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.