Nasdaq 100 Index Explained

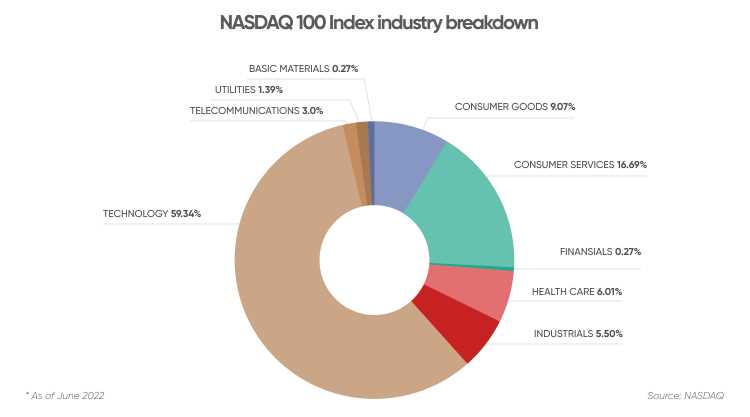

The Nasdaq 100 Index is a stock market index that includes 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is one of the most widely followed indexes in the world and is often used as a benchmark for the performance of the technology and growth sectors.

What is the Nasdaq 100 Index?

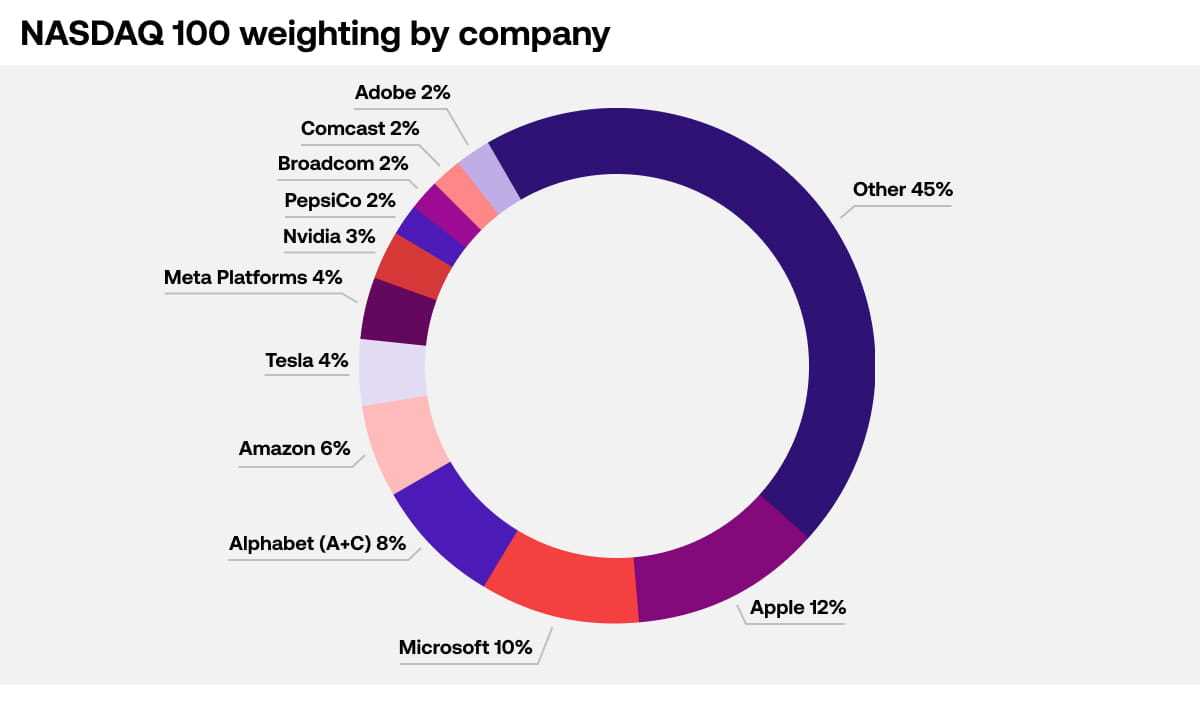

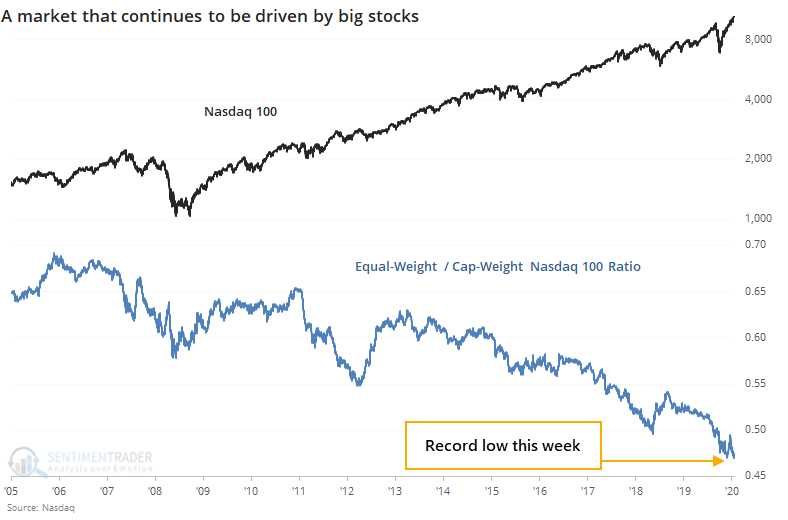

The Nasdaq 100 Index is a market-capitalization-weighted index, meaning that each company’s weight in the index is determined by its market value. This means that larger companies have a greater impact on the index’s performance than smaller companies.

The index is rebalanced annually to ensure that it accurately reflects the current market value of the included companies. This means that companies that have experienced significant growth may see their weight in the index increase, while companies that have declined in value may see their weight decrease.

Why is the Nasdaq 100 Index important?

Additionally, the Nasdaq 100 Index is often used as a benchmark for the performance of technology-focused mutual funds and exchange-traded funds (ETFs). By comparing the performance of these funds to the index, investors can get a sense of how well their investments are performing relative to the broader market.

To understand the weighting of the Nasdaq 100 Index, let’s take a look at an example. Suppose the index consists of only three stocks: Company A, Company B, and Company C. The market values of these companies are as follows:

| Company | Market Value |

|---|---|

| Company A | $100 billion |

| Company B | $50 billion |

| Company C | $25 billion |

The weight of Company A would be calculated as $100 billion divided by $175 billion, which equals 0.5714 or 57.14%. The weight of Company B would be $50 billion divided by $175 billion, which equals 0.2857 or 28.57%. Finally, the weight of Company C would be $25 billion divided by $175 billion, which equals 0.1429 or 14.29%.

As you can see, the larger the market value of a company, the higher its weight in the index. This means that the performance of larger companies will have a greater impact on the overall performance of the Nasdaq 100 Index.

Trading Guide for Nasdaq 100 Index

Are you interested in trading the Nasdaq 100 Index? This comprehensive guide will provide you with all the information you need to get started.

What is the Nasdaq 100 Index?

The Nasdaq 100 Index is a stock market index that includes 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is a benchmark for the technology sector and is widely followed by investors and traders.

How to Trade the Nasdaq 100 Index

Trading the Nasdaq 100 Index can be done through various financial instruments, such as exchange-traded funds (ETFs), futures contracts, and options. Here are some key steps to consider:

- Choose a Trading Platform: Select a reliable online trading platform that offers access to the Nasdaq 100 Index. Make sure the platform provides real-time data, charting tools, and order execution capabilities.

- Develop a Trading Plan: Define your trading goals, risk tolerance, and preferred trading style. Create a plan that outlines your entry and exit strategies, as well as risk management techniques.

- Analyze the Market: Use technical and fundamental analysis to identify potential trading opportunities. Monitor the performance of individual stocks within the index and keep an eye on market trends and news.

- Execute Your Trades: Once you have identified a trading opportunity, place your trades according to your trading plan. Monitor your positions closely and make adjustments as needed.

- Manage Your Risk: Implement risk management techniques, such as setting stop-loss orders and diversifying your portfolio. Always be prepared for potential losses and never risk more than you can afford to lose.

- Review and Learn: Regularly review your trading performance and learn from both your successful and unsuccessful trades. Continuously improve your trading skills and adapt your strategies as needed.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.