Utilization Fee Definition Example

A utilization fee is a type of fee that is charged to borrowers when they use a line of credit or a loan. It is a fee that is based on the amount of credit that is actually utilized by the borrower. This fee is separate from the interest rate and is typically charged on a regular basis, such as monthly or quarterly.

Definition of Utilization Fee

A utilization fee is a fee that is charged to borrowers based on the amount of credit that they actually use. It is a way for lenders to generate additional revenue from borrowers who are actively using their credit facilities. This fee is separate from the interest rate and is typically a percentage of the amount of credit that is utilized.

Example of Utilization Fee

For example, let’s say a borrower has a line of credit with a utilization fee of 1% per month. If the borrower utilizes $10,000 of their available credit, they would be charged a utilization fee of $100 for that month. If they utilize $20,000, they would be charged a utilization fee of $200, and so on.

Utilization fees can vary depending on the lender and the terms of the credit facility. Some lenders may charge a flat fee based on the amount of credit utilized, while others may charge a percentage of the credit utilized. It is important for borrowers to carefully review the terms and conditions of their credit agreements to understand the specific utilization fee structure.

Definition of Utilization Fee

The utilization fee is a charge that is applied to the portion of a credit line that is actually used by the borrower. It is a fee that is typically assessed on a regular basis, such as monthly or quarterly, and is calculated as a percentage of the outstanding balance.

The utilization fee serves as a way for lenders to generate income from the funds that have been lent out. It compensates the lender for the risk and opportunity cost associated with providing the borrower with access to capital. The fee is typically based on the amount of funds utilized and the interest rate charged on the borrowed amount.

In summary, the utilization fee is a charge that is applied to the portion of a credit line that is actually used by the borrower. It is a way for lenders to generate income from the funds that have been lent out and compensate for the risk and opportunity cost associated with providing access to capital.

Example of Utilization Fee

Let’s say you are a business owner and you need to secure a line of credit from a bank to finance your operations. The bank agrees to provide you with a credit line of $1 million. However, the bank charges a utilization fee of 1% on the amount of credit you actually use.

For example, if you use $500,000 of the credit line, you would be charged a utilization fee of $5,000 ($500,000 * 1%). This fee is typically calculated on a monthly or quarterly basis, depending on the terms of the credit agreement.

The utilization fee is a cost that you incur for the privilege of accessing the funds provided by the bank. It is separate from the interest rate charged on the outstanding balance of the credit line.

By charging a utilization fee, the bank incentivizes you to only use the credit line when necessary and to repay the borrowed funds as soon as possible. This helps to mitigate the bank’s risk and ensures that the credit line is available for other borrowers.

Overall, the utilization fee is an important factor to consider when evaluating the cost of borrowing and managing your business’s cash flow. It is crucial to understand the terms and conditions associated with the utilization fee before entering into a credit agreement with a financial institution.

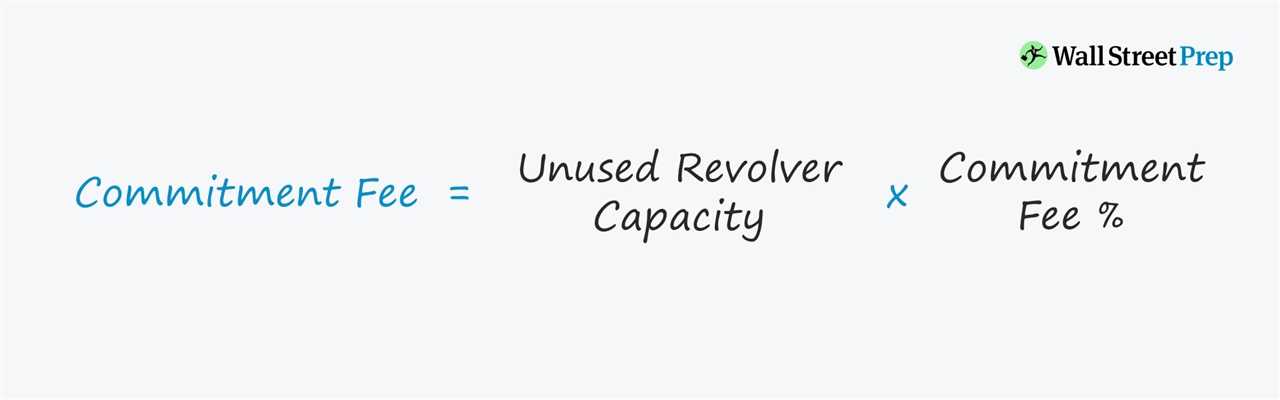

Commitment Fee Definition Example

A commitment fee is a type of fee that a borrower pays to a lender as compensation for the lender’s commitment to provide a loan or credit facility. This fee is typically charged on the unused portion of the loan or credit facility and is meant to compensate the lender for the risk and costs associated with reserving the funds for the borrower.

Example: Let’s say Company XYZ wants to secure a $1 million line of credit from Bank ABC. The line of credit allows Company XYZ to borrow up to $1 million, but the company only plans to use $500,000 initially. In order to secure the availability of the remaining $500,000, Company XYZ agrees to pay Bank ABC a commitment fee of 1% per year on the unused portion of the line of credit. This means that Company XYZ will pay Bank ABC $5,000 per year as compensation for reserving the funds.

The commitment fee serves as an incentive for the lender to provide the loan or credit facility and helps compensate the lender for the potential loss of income that could have been earned if the funds were invested elsewhere. It also helps cover the administrative costs associated with maintaining the credit facility and monitoring the borrower’s compliance with the terms of the agreement.

Note: The commitment fee is different from the utilization fee. While the commitment fee is charged on the unused portion of the loan or credit facility, the utilization fee is charged on the funds that are actually borrowed and utilized by the borrower.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.