What Is a Premium Bond?

The premium on a bond is the amount by which the purchase price exceeds the face value. It is usually expressed as a percentage of the face value. For example, if a bond has a face value of $1,000 and is purchased for $1,050, the premium would be $50 or 5% of the face value.

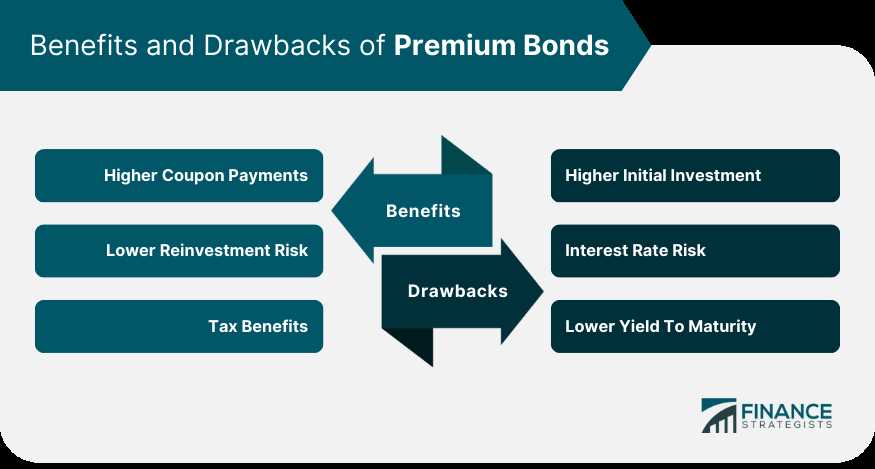

Investors may be willing to pay a premium for a bond for several reasons. One reason is that the bond may offer a higher interest rate than other bonds with similar risk profiles. Another reason is that the bond may have certain features or benefits that make it more attractive, such as a call provision or a sinking fund.

When a premium bond matures, the investor receives the full face value of the bond, regardless of the premium paid. However, the total return on the investment may be lower than the premium paid if the bond’s interest payments are lower than the premium amount.

It is important for investors to consider the yield of a premium bond when making investment decisions. The yield is the annual interest rate divided by the purchase price. A premium bond with a lower yield may not provide as much income as a bond with a lower premium but a higher yield.

In summary, a premium bond is a bond that is issued at a price higher than its face value. Investors pay a premium to purchase the bond and receive periodic interest payments and the full face value of the bond at maturity. The premium on a bond is the amount by which the purchase price exceeds the face value. Investors may be willing to pay a premium for a bond due to higher interest rates or other attractive features. The yield of a premium bond should be considered when making investment decisions.

Definition

A premium bond is a type of fixed income security that is issued by a government or corporation and offers a higher interest rate or coupon payment compared to other bonds in the market. The term “premium” refers to the fact that the bond is priced higher than its face value.

When an investor purchases a premium bond, they are essentially paying more than the face value of the bond. This premium is typically paid upfront and is in addition to the regular interest payments or coupons that the investor will receive over the life of the bond.

Unlike discount bonds, which are priced below their face value, premium bonds have a higher initial cost. This higher cost is justified by the higher interest rate or coupon payment that the bond offers. The higher interest rate compensates the investor for the additional amount they paid for the bond.

Investors may choose to invest in premium bonds for various reasons. Some investors may be attracted to the higher interest rate or coupon payment, which can provide a greater return compared to other bonds. Others may prefer the stability and security offered by government-issued premium bonds.

How Premium Bonds Work

Premium bonds are a type of investment that is issued by the government or a corporation. When you purchase a premium bond, you are essentially lending money to the issuer. In return, the issuer promises to pay you back the principal amount at a future date, along with periodic interest payments.

When you buy a premium bond, you will receive regular interest payments, typically on a semi-annual or annual basis. The interest rate on premium bonds is usually fixed, meaning it does not change over the life of the bond. This provides investors with a predictable income stream.

At the maturity date of the bond, the issuer will repay you the face value of the bond. This is the original amount that you lent to the issuer. In addition to the face value, you will also receive any remaining interest payments that are due.

Yield

The yield of a premium bond is an important factor to consider when investing in fixed income securities. Yield refers to the return on investment that an investor can expect to receive from holding a premium bond. It is expressed as a percentage and is calculated by dividing the annual interest payments by the bond’s market price.

When a bond is issued at a premium, it means that its market price is higher than its face value. This premium is paid by investors because the bond offers a higher coupon rate than the prevailing market interest rates. The coupon rate is the fixed annual interest rate that the bond issuer promises to pay to bondholders.

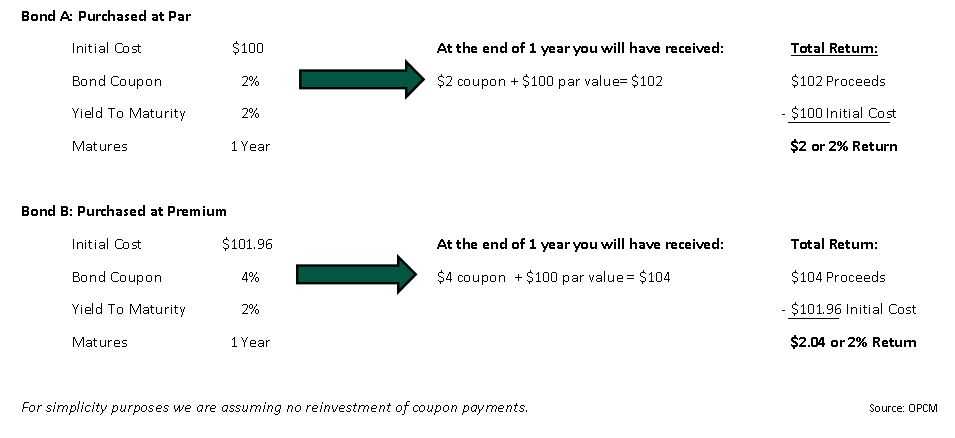

The yield of a premium bond is influenced by several factors, including the bond’s coupon rate, its market price, and the time remaining until maturity. Generally, the yield of a premium bond will be lower than its coupon rate because investors are paying a premium for the higher interest payments.

Investors should carefully consider the yield of a premium bond before making an investment decision. A higher yield can indicate a higher return on investment, but it may also indicate a higher level of risk. It is important to assess the creditworthiness of the bond issuer and the overall market conditions to determine if the yield is appropriate for the level of risk.

What Is Yield in Premium Bonds?

Yield is a crucial factor to consider when investing in premium bonds. It refers to the return on investment that an investor can expect to receive from holding these bonds. The yield is usually expressed as a percentage and represents the annual interest or dividend income earned from the bond.

There are two types of yield associated with premium bonds: current yield and yield to maturity.

1. Current Yield: The current yield is calculated by dividing the annual interest or dividend payment by the current market price of the bond. It provides investors with a snapshot of the bond’s return at a specific point in time. For example, if a premium bond has an annual interest payment of $50 and is currently trading at $1,000, the current yield would be 5% ($50/$1,000).

2. Yield to Maturity: The yield to maturity takes into account the bond’s price, coupon rate, and time remaining until maturity. It represents the total return an investor can expect to earn if the bond is held until maturity. Unlike the current yield, the yield to maturity considers the capital gain or loss that may occur if the bond is bought at a premium or discount to its face value. It is a more comprehensive measure of the bond’s yield.

Investors should carefully consider both the current yield and yield to maturity when evaluating premium bonds. The current yield provides a quick assessment of the bond’s return in the short term, while the yield to maturity offers a more accurate representation of the bond’s overall return over its entire lifespan.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.