What is a Home Equity Conversion Mortgage (HECM)?

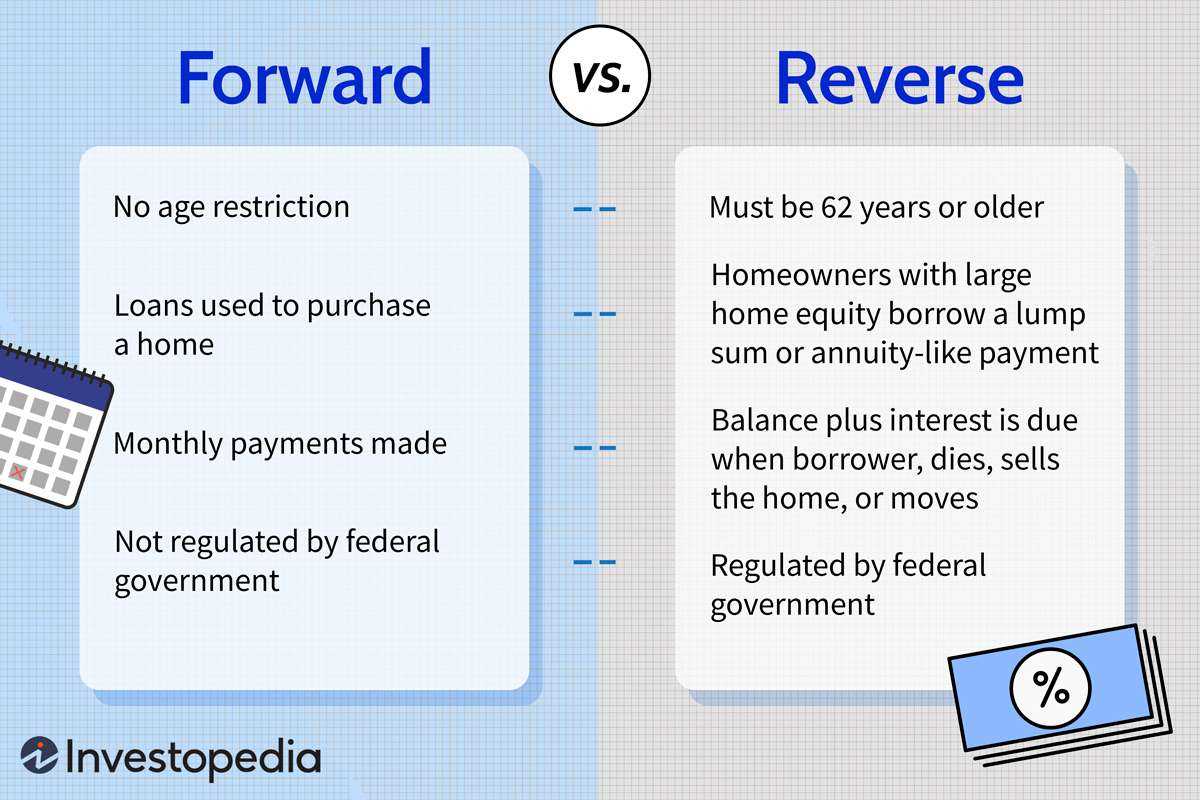

Unlike a traditional mortgage where the homeowner makes monthly payments to the lender, with a HECM, the lender makes payments to the homeowner. These payments can be received in various ways, such as a lump sum, monthly payments, or a line of credit.

HECMs are insured by the Federal Housing Administration (FHA), which provides a level of protection for both the borrower and the lender. This insurance ensures that the borrower will continue to receive payments even if the lender goes out of business or if the loan balance exceeds the value of the home.

| Key Features of a HECM: |

|---|

| No monthly mortgage payments |

| Flexible payment options |

| Insured by the FHA |

| Loan repaid when homeowner sells the home, moves out, or passes away |

Unlike a traditional mortgage, where the homeowner makes monthly payments to the lender, with a HECM, the lender makes payments to the homeowner. These payments can be received in various ways, such as a lump sum, monthly installments, or a line of credit.

Another important aspect to understand is that the amount of money a homeowner can borrow with a HECM is based on several factors, including the age of the homeowner, the value of the home, and current interest rates. The older the homeowner and the more valuable the home, the more money they may be eligible to borrow.

It’s also worth noting that a HECM is a non-recourse loan, which means that the homeowner or their heirs will never owe more than the value of the home at the time the loan is repaid. If the home’s value decreases, the lender cannot seek repayment of the difference from the homeowner or their estate.

| Benefits of a HECM | Considerations of a HECM |

|---|---|

|

|

Eligibility Requirements for a HECM

In order to qualify for a Home Equity Conversion Mortgage (HECM), there are certain eligibility requirements that must be met. These requirements are put in place to ensure that the borrower is able to responsibly manage the loan and meet their financial obligations.

Age Requirement

One of the main eligibility requirements for a HECM is that the borrower must be at least 62 years old. This is because a HECM is specifically designed for senior homeowners who are looking to access the equity in their homes.

Home Ownership

The borrower must also be the owner of the home that they are seeking to use as collateral for the HECM. The home must be their primary residence, meaning that they live in it for the majority of the year.

Note: If the borrower has an existing mortgage on their home, it must be paid off or significantly reduced with the proceeds from the HECM.

Financial Assessment

Another eligibility requirement for a HECM is a financial assessment. This assessment takes into account the borrower’s income, expenses, and credit history to determine their ability to meet the financial obligations of the loan, such as property taxes and insurance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.