What is a Viatical Settlement?

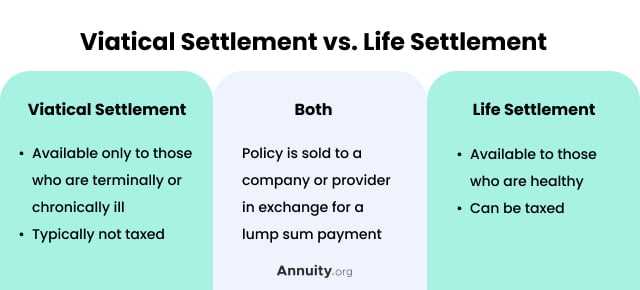

Viatical settlements are designed to provide immediate financial relief to individuals who are facing significant medical expenses or other financial burdens due to their illness. By selling their life insurance policy, they can access a portion of its value while they are still alive.

How does it work?

The process of a viatical settlement involves several steps. First, the policyholder applies to a viatical settlement provider and provides them with the necessary documentation, including medical records and the insurance policy details.

Once the value of the policy is determined, the viatical settlement provider makes an offer to the policyholder. If the offer is accepted, the policyholder sells their policy to the provider and receives a lump sum payment.

Benefits of a Viatical Settlement

There are several benefits to consider when exploring a viatical settlement:

- Financial Relief: A viatical settlement can provide immediate funds to cover medical expenses, living costs, or other financial obligations.

- No Repayment: Unlike a loan, the money received from a viatical settlement does not need to be repaid. It is a non-recourse transaction.

- Flexibility: The funds received from a viatical settlement can be used in any way the policyholder chooses, providing them with the freedom to address their specific needs.

- Peace of Mind: Knowing that financial burdens are alleviated can provide peace of mind to the policyholder and their loved ones during a difficult time.

Overall, a viatical settlement can be a valuable financial option for individuals with life-threatening illnesses who are in need of immediate financial assistance. It allows them to access a portion of their life insurance policy’s value and use the funds to ease their financial burdens.

The Process of a Viatical Settlement

When considering a viatical settlement, it is important to understand the process involved. Here is a step-by-step guide to help you navigate through the viatical settlement process:

| Step 1: | Research and Gather Information |

| Step 2: | Contact a Viatical Settlement Provider |

| Step 3: | Initial Consultation |

| Step 4: | Provide Documentation |

| Step 5: | Underwriting Process |

| Step 6: | Offer and Negotiation |

| Step 7: | Acceptance and Contract Signing |

| Step 8: | Approval and Funding |

| Step 9: | Transfer of Ownership |

| Step 10: | Receive Funds |

Each step in the process is crucial and requires careful attention. It is recommended to work with a reputable viatical settlement provider who can guide you through each stage and ensure a smooth transaction.

Benefits of a Viatical Settlement

A viatical settlement offers several benefits to policyholders who are facing a terminal illness or other serious medical condition. Here are some of the key advantages:

- Financial Relief: A viatical settlement provides policyholders with a lump sum of cash that can be used to cover medical expenses, pay off debts, or improve their quality of life.

- Access to Funds: Unlike traditional life insurance policies, which only pay out upon the death of the policyholder, a viatical settlement allows policyholders to access a portion of their policy’s death benefit while they are still alive.

- Flexible Use of Funds: Policyholders have the freedom to use the funds from a viatical settlement in any way they choose. They can use the money to seek alternative treatments, travel, or spend quality time with loved ones.

- Peace of Mind: Knowing that financial burdens are taken care of can provide policyholders and their families with peace of mind during a challenging time.

- No Repayment: The funds received from a viatical settlement are not required to be repaid. Once the settlement is complete, the policyholder no longer has any financial obligations related to the policy.

- Privacy: Unlike other financial options, such as loans or public assistance programs, a viatical settlement is a private transaction that does not require disclosure of personal financial information.

- Quick Access to Funds: The process of obtaining a viatical settlement is typically faster than other financial options. Once the necessary paperwork is completed, policyholders can receive their funds in a matter of weeks.

Overall, a viatical settlement can provide individuals with the financial resources they need to navigate their medical journey with greater ease and peace of mind.

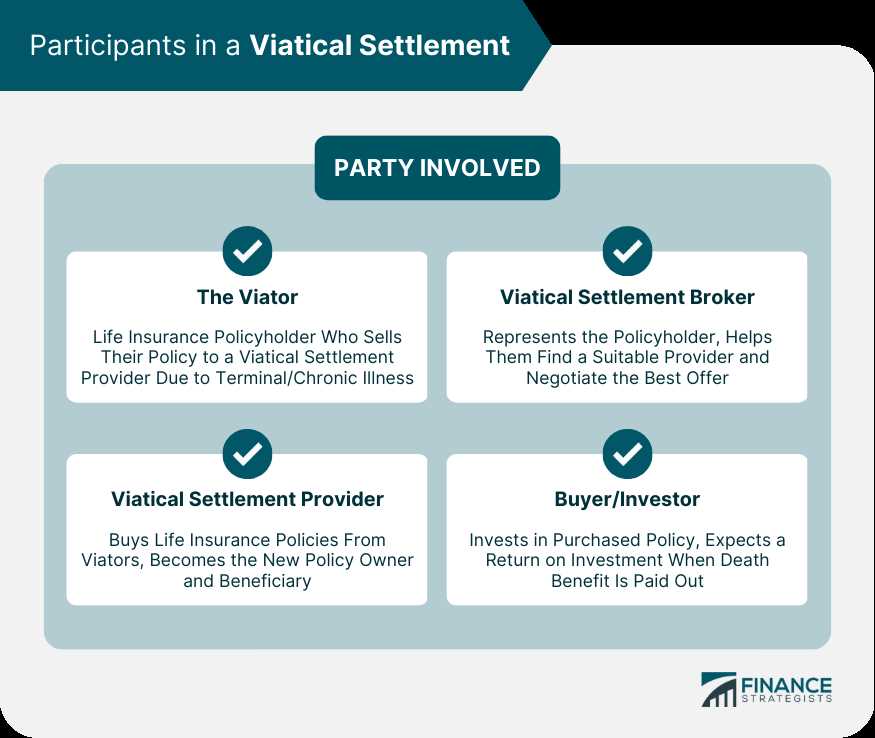

When considering a viatical settlement, it is important to understand the role of viatical settlement providers. These are companies or individuals who facilitate the process of selling a life insurance policy to a third party in exchange for a lump sum payment.

Viatical settlement providers act as intermediaries between the policyholder and the investor or buyer. They help navigate the complex process of selling a policy, ensuring that all necessary paperwork is completed and that the transaction is conducted in accordance with applicable laws and regulations.

What Services Do Viatical Settlement Providers Offer?

Viatical settlement providers offer a range of services to policyholders looking to sell their life insurance policies. These services typically include:

- Securing offers: Providers reach out to potential buyers or investors to obtain offers for the policy.

- Negotiating the best deal: Providers negotiate with buyers to secure the best possible offer for the policyholder.

- Assisting with paperwork: Providers help with the completion of all necessary paperwork, including the application, medical records, and policy documentation.

- Coordinating the transaction: Providers oversee the entire process, ensuring that all parties involved are kept informed and that the transaction is completed smoothly.

Choosing a Viatical Settlement Provider

When choosing a viatical settlement provider, it is important to consider several factors:

- Experience and reputation: Look for providers with a proven track record and positive reviews from previous clients.

- Licensing and accreditation: Ensure that the provider is licensed and accredited by relevant authorities, such as state insurance departments.

- Transparency and communication: Choose a provider that is transparent about their fees and processes and maintains open communication throughout the transaction.

- Competitive offers: Compare offers from different providers to ensure you are getting the best possible deal for your policy.

What is a Viatical Settlement Provider?

A viatical settlement provider is a company or entity that specializes in facilitating viatical settlements. These providers act as intermediaries between the policyholder, who is looking to sell their life insurance policy, and potential investors or buyers.

Once the value of the policy is determined, the viatical settlement provider markets the policy to potential investors or buyers. They negotiate the terms of the sale, including the purchase price and any additional conditions or requirements.

Viatical settlement providers also handle the paperwork and legal aspects of the transaction. They ensure that all necessary documentation is completed and submitted correctly to transfer ownership of the policy from the policyholder to the buyer.

It is important to choose a reputable and trustworthy viatical settlement provider when considering selling your life insurance policy. Look for providers that are licensed and regulated by the appropriate authorities, and consider seeking recommendations or reviews from other policyholders who have used their services.

How to Choose a Viatical Settlement Provider

1. Experience and Reputation

Look for a provider with a proven track record in the industry. Check their experience and reputation by reading reviews and testimonials from previous clients. A reputable provider will have a history of successfully completing viatical settlements and delivering on their promises.

2. Licensing and Accreditation

Ensure that the provider is licensed and accredited in your state. This will give you peace of mind knowing that they adhere to the necessary regulations and guidelines. You can check their licensing information on the state insurance department’s website.

3. Financial Stability

4. Transparent and Fair Practices

Choose a provider that is transparent about their fees, charges, and the entire settlement process. They should provide you with clear and detailed information about how they determine the value of your policy and what percentage of the face value they offer. Avoid providers that use aggressive sales tactics or pressure you into making a decision.

5. Customer Service

Consider the level of customer service provided by the viatical settlement provider. They should be responsive to your inquiries, provide regular updates on the progress of your settlement, and address any concerns or issues you may have. Good communication and support throughout the process are essential.

By considering these factors and conducting thorough research, you can choose a viatical settlement provider that meets your needs and ensures a smooth and successful transaction.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.