What is a 12b-1 Fund?

The 12b-1 fee is typically a percentage of the fund’s assets, and it is deducted from the fund’s net assets. This means that investors do not have to pay the fee directly out of their own pockets, but it does reduce the overall return on their investment.

Definition and Purpose

The purpose of a 12b-1 fund is to help mutual funds attract and retain investors by providing resources for marketing and distribution. The fees collected through the 12b-1 fee are used to pay for advertising, sales literature, and other promotional activities that help raise awareness of the fund and attract new investors.

Additionally, the 12b-1 fee can also be used to compensate brokers and financial advisors who sell the fund to investors. This creates an incentive for these professionals to recommend the fund to their clients.

How Does a 12b-1 Fund Work?

When an investor buys shares in a mutual fund that charges a 12b-1 fee, a portion of their investment is used to cover the marketing and distribution expenses of the fund. This fee is typically deducted from the fund’s assets on an ongoing basis, usually on an annual basis.

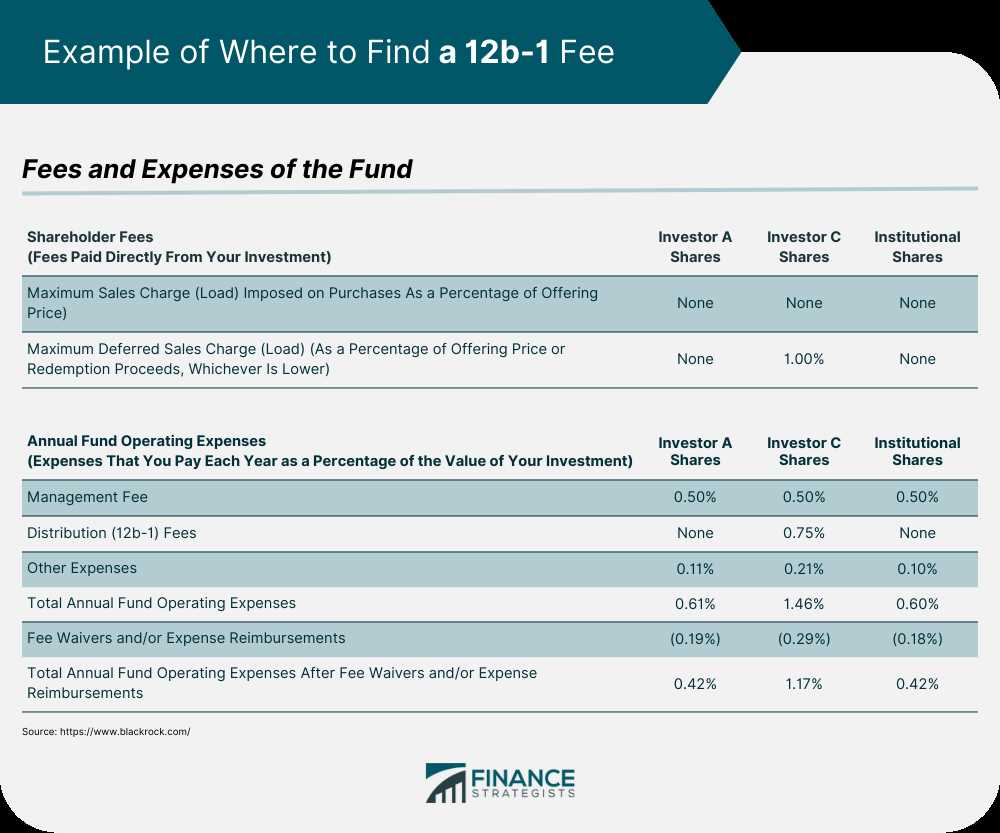

The 12b-1 fee is disclosed in the fund’s prospectus, which is a document that provides detailed information about the fund’s investment objectives, strategies, fees, and risks. Investors should carefully review the prospectus before investing to understand the impact of the 12b-1 fee on their investment returns.

Functionality and Benefits

The functionality of a 12b-1 fund allows mutual funds to effectively market themselves and attract new investors. By charging a fee to cover marketing and distribution expenses, the fund can allocate resources towards promoting the fund and providing compensation to brokers and financial advisors.

For investors, the benefits of a 12b-1 fund include access to a professionally managed investment vehicle and the potential for diversification. Additionally, the marketing and distribution efforts funded by the 12b-1 fee can help increase the visibility and credibility of the fund, potentially leading to higher returns.

However, it is important for investors to consider the impact of the 12b-1 fee on their overall investment returns. The fee can reduce the net asset value of the fund and lower the investor’s return. Therefore, investors should carefully evaluate the costs and benefits of investing in a 12b-1 fund before making a decision.

Definition and Purpose

The purpose of a 12b-1 fund is to cover the costs associated with marketing and distributing the mutual fund. These costs can include advertising, sales commissions, and other promotional activities. The fee is typically a percentage of the fund’s assets and is deducted from the fund’s net assets on an ongoing basis.

One of the main goals of a 12b-1 fund is to attract new investors and retain existing ones. By charging a fee for marketing and distribution, the fund can allocate resources to promote its products and services, which can help increase its assets under management. This, in turn, can lead to higher revenues and potentially higher returns for investors.

Another purpose of the 12b-1 fee is to compensate financial intermediaries, such as brokers and financial advisors, who sell the mutual fund to investors. These intermediaries play a crucial role in distributing the fund and providing investment advice to clients. The 12b-1 fee can serve as a way to incentivize these intermediaries to promote the fund and provide ongoing support to investors.

It is important to note that the 12b-1 fee is not the only fee associated with a mutual fund. Investors may also be subject to management fees, administrative fees, and other expenses. These fees can vary depending on the fund and should be carefully considered when making investment decisions.

| Pros | Cons |

|---|---|

| – Helps fund marketing and distribution efforts | – Can increase the overall cost of investing |

| – Can attract new investors and retain existing ones | – May not always result in higher returns for investors |

| – Provides compensation to financial intermediaries | – Can create conflicts of interest for financial advisors |

How Does a 12b-1 Fund Work?

When an investor purchases shares of a 12b-1 fund, a portion of their investment is used to pay the 12b-1 fee. This fee is separate from other fees associated with mutual funds, such as management fees and administrative expenses. The 12b-1 fee is disclosed in the fund’s prospectus and is typically expressed as a percentage of the fund’s net assets.

The 12b-1 fee is used to cover various expenses related to marketing and distribution, including advertising, sales commissions, and shareholder servicing. These expenses help promote the fund and attract new investors. The fund’s distributor, such as a brokerage firm or financial advisor, receives compensation for their efforts in selling the fund.

Some investors may question the value of the 12b-1 fee, as it can reduce the overall return of the fund. However, proponents argue that the fee helps support the distribution of the fund and can lead to increased assets under management, which may benefit all shareholders in the long run.

Functionality and Benefits

A 12b-1 fund operates by using the fees collected from investors to cover various expenses associated with the mutual fund. These expenses can include marketing and distribution costs, as well as administrative fees. The fund’s board of directors determines the specific amount of the 12b-1 fee, which is typically a percentage of the fund’s assets.

The main benefit of a 12b-1 fund is that it allows mutual fund companies to provide ongoing services to investors without charging them directly. This means that investors can benefit from professional management, research, and other services without having to pay additional fees. The 12b-1 fee is deducted from the fund’s assets, so investors don’t have to worry about making separate payments.

Another advantage of a 12b-1 fund is that it can help attract new investors. The marketing and distribution expenses covered by the 12b-1 fee allow mutual fund companies to promote their funds and reach a wider audience. This can lead to increased assets under management and potentially higher returns for existing investors.

Conclusion

Overall, 12b-1 funds provide a way for mutual fund companies to cover their expenses and offer ongoing services to investors. While there are potential drawbacks to consider, such as fees and conflicts of interest, many investors find value in the convenience and benefits provided by these funds.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.