Definition and Functionality of Outlay Cost

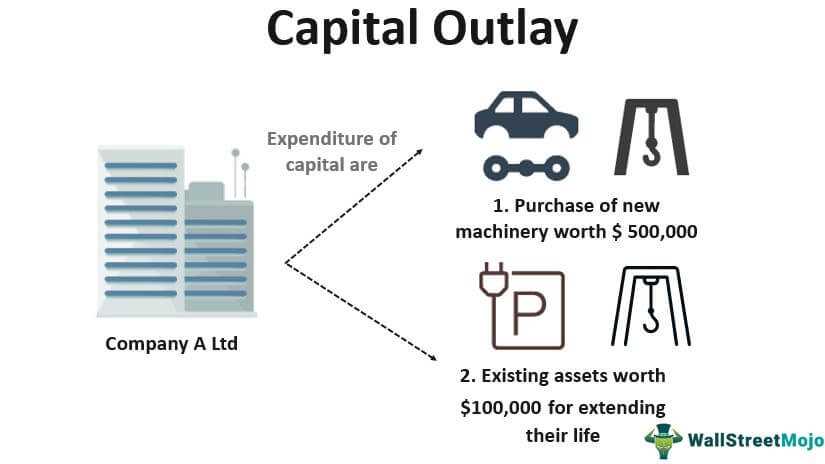

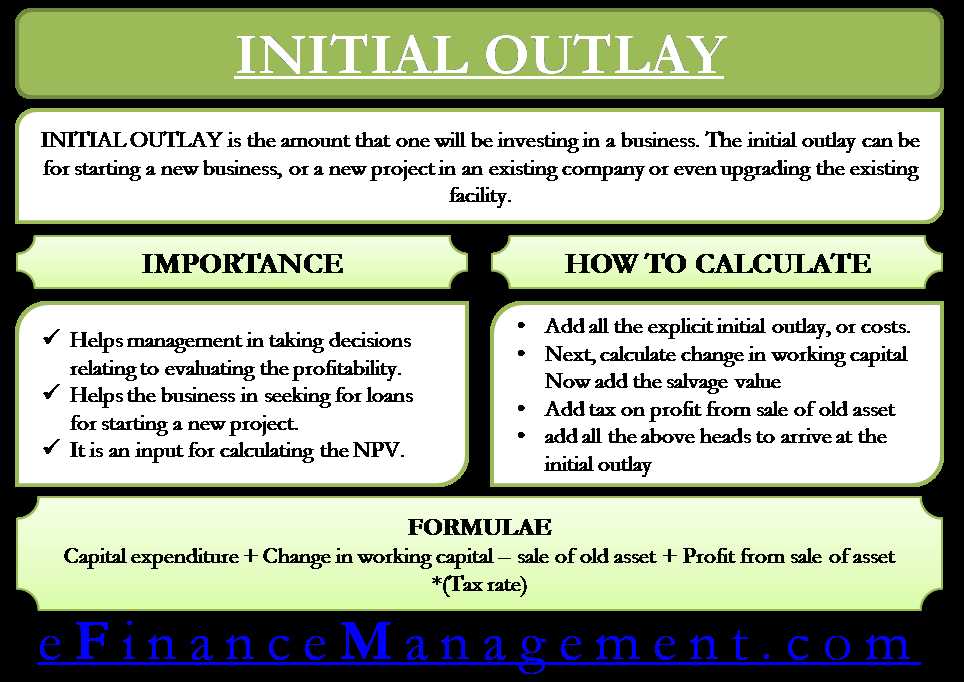

The outlay cost is a term commonly used in corporate finance to refer to the total amount of money spent on acquiring or producing a particular asset or resource. It represents the initial investment or expenditure required to obtain the asset or resource.

Moreover, the functionality of outlay cost extends beyond the initial investment phase. It also plays a crucial role in ongoing financial management and decision-making. By tracking and analyzing the outlay cost, businesses can assess the efficiency and effectiveness of their investments and make adjustments or improvements as necessary.

CORPORATE FINANCE BASICS

2. Time Value of Money: Discover the concept of time value of money and how it affects investment decisions. Learn about present value, future value, and the calculation of interest rates.

3. Capital Budgeting: Explore the process of capital budgeting, which involves evaluating and selecting investment projects. Understand the techniques used to assess the profitability and feasibility of investment opportunities.

5. Capital Structure: Understand the concept of capital structure and its impact on a company’s financial performance. Learn about the trade-off between debt and equity financing and the optimal capital structure for a company.

6. Working Capital Management: Learn how to effectively manage a company’s working capital, including cash, inventory, and accounts receivable. Understand the importance of liquidity and the impact of working capital on a company’s profitability.

7. Risk and Return: Explore the relationship between risk and return in corporate finance. Understand the concept of risk and how it is measured. Learn about the risk-return trade-off and the importance of diversification in managing risk.

8. Financial Markets and Institutions: Gain insights into the role of financial markets and institutions in corporate finance. Learn about the different types of financial markets, such as stock markets and bond markets, and the functions of financial institutions, such as banks and investment firms.

Corporate Finance Basics

Corporate finance is a field of finance that deals with the financial decisions made by corporations. It involves analyzing the financial aspects of a company, such as investments, capital structure, and financial planning, to maximize shareholder value.

Importance of Corporate Finance

Key Concepts in Corporate Finance

There are several key concepts in corporate finance that are essential to understand:

- Time Value of Money: This concept recognizes that the value of money changes over time due to factors such as inflation and interest rates. It is important to consider the time value of money when making financial decisions.

- Cost of Capital: The cost of capital is the rate of return required by investors to invest in a company. It is used to evaluate the profitability of potential investments and determine the appropriate capital structure.

- Capital Budgeting: Capital budgeting involves analyzing and selecting investment projects that will generate the highest returns for a company. It helps companies allocate their financial resources efficiently.

Overall, corporate finance is a fundamental aspect of running a successful business. It helps companies make sound financial decisions, manage their resources effectively, and maximize shareholder value.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.