The Basics of Liquidation

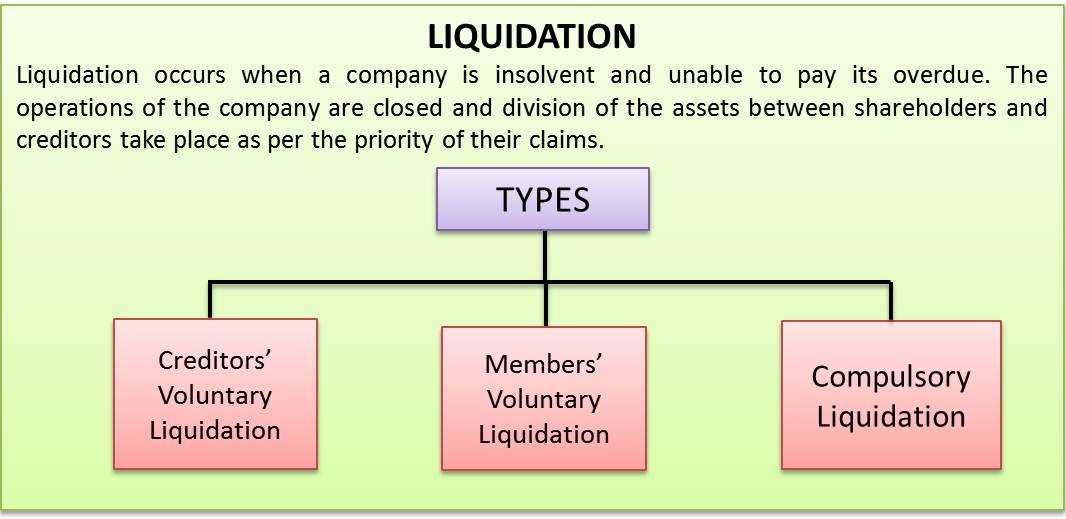

Liquidation is a process that occurs when a company or organization is unable to pay off its debts and is forced to sell off its assets in order to repay its creditors. It is often seen as a last resort for a struggling business, as it involves the complete dissolution of the company.

During the liquidation process, the company’s assets are sold off and the proceeds are used to pay off its debts. This can include selling off physical assets such as property, equipment, and inventory, as well as intangible assets such as patents, trademarks, and intellectual property.

There are two main types of liquidation: voluntary liquidation and compulsory liquidation. Voluntary liquidation occurs when the company’s shareholders or directors decide to wind up the company and appoint a liquidator to oversee the process. Compulsory liquidation, on the other hand, is initiated by a court order in response to a creditor’s petition.

Once the liquidation process begins, the liquidator takes control of the company’s affairs and works to sell off its assets in an orderly manner. The liquidator has a duty to act in the best interests of the company’s creditors and must ensure that the assets are sold for their fair market value.

After the assets have been sold and the debts have been repaid, any remaining funds are distributed to the company’s shareholders. However, it is important to note that in most cases, there is little to no money left for shareholders after the debts have been settled.

It is also worth mentioning that liquidation can have significant implications for employees, as it often leads to job losses. Employees may be entitled to certain rights and protections under employment laws, such as redundancy pay or notice periods, depending on the jurisdiction in which the liquidation takes place.

The Process of Liquidation

When a company is facing financial distress or is unable to meet its obligations, it may choose to undergo the process of liquidation. This involves the sale of the company’s assets in order to pay off its debts and distribute any remaining funds to its shareholders. The process of liquidation can be complex and involves several steps.

1. Assessment and Valuation of Assets

The first step in the liquidation process is to assess and value the company’s assets. This includes both tangible assets, such as equipment and property, and intangible assets, such as intellectual property and goodwill. An independent appraiser may be hired to determine the value of these assets.

2. Appointment of a Liquidator

Once the assets have been assessed, a liquidator is appointed to oversee the liquidation process. The liquidator is typically a licensed insolvency practitioner or an attorney with expertise in bankruptcy law. Their role is to ensure that the liquidation is conducted in accordance with the relevant laws and regulations.

3. Sale of Assets

After the appointment of a liquidator, the next step is to sell the company’s assets. This can be done through various methods, such as auctions, private sales, or negotiations with potential buyers. The proceeds from the sale of assets are used to repay the company’s creditors.

4. Distribution of Funds

Once the assets have been sold and the creditors have been paid, any remaining funds are distributed to the shareholders. The distribution of funds is typically done in accordance with the company’s capital structure and the rights of the shareholders.

It is important to note that the priority of payments in a liquidation is determined by the relevant laws and regulations. Creditors with secured claims, such as banks with mortgages on the company’s property, are typically paid first, followed by unsecured creditors, such as suppliers and employees. Shareholders are usually the last to receive any remaining funds, if there are any.

Implications of Liquidation

Liquidation can have significant implications for all parties involved, including shareholders, creditors, employees, and the company itself. Here are some key implications to consider:

- Loss of value: Liquidation often results in a loss of value for shareholders. When a company is liquidated, its assets are sold off to repay creditors, and any remaining funds are distributed to shareholders. However, the amount shareholders receive is typically much less than the value of their original investment.

- Job losses: Liquidation can lead to job losses for employees of the company. When a company is unable to continue operating, it may be forced to lay off its employees. This can have a significant impact on the livelihoods of those affected.

- Impact on creditors: Creditors of a company in liquidation may not receive full repayment of their debts. The funds generated from the sale of the company’s assets are used to repay creditors, but if the company’s liabilities exceed its assets, creditors may only receive a fraction of what they are owed.

- Legal consequences: Liquidation involves a formal legal process, and failure to comply with the necessary requirements can result in legal consequences for the company’s directors. Directors have a duty to act in the best interests of the company’s creditors during the liquidation process.

- Impact on the market: The liquidation of a company can have broader implications for the market as a whole. It can erode investor confidence, leading to a decrease in stock prices and potentially affecting other companies in the same industry.

- Opportunity for restructuring: While liquidation is often seen as a last resort, it can also provide an opportunity for a company to restructure and potentially emerge stronger. In some cases, a company may be able to negotiate with creditors and develop a plan to repay its debts, allowing it to continue operating.

Overall, liquidation is a complex process with wide-ranging implications. It is important for all parties involved to carefully consider the potential consequences and explore alternatives before proceeding with liquidation.

Alternatives to Liquidation

While liquidation may seem like the only option for a struggling business, there are actually several alternatives that can be explored before resorting to this drastic measure. These alternatives can help preserve the value of the company and potentially avoid the complete dissolution of assets.

1. Restructuring: One alternative to liquidation is restructuring the company. This involves making changes to the organization’s operations, management, or financial structure in order to improve its financial stability. Restructuring can include downsizing, cost-cutting measures, or refinancing debt. By implementing these changes, the company may be able to turn its financial situation around and avoid liquidation.

2. Bankruptcy: Another alternative to liquidation is filing for bankruptcy. Bankruptcy provides a legal framework for businesses to reorganize their debts and assets in order to repay creditors. This can be done through a Chapter 11 bankruptcy, which allows the company to continue operating while developing a plan to repay its debts. By filing for bankruptcy, the company may be able to negotiate with creditors and potentially avoid liquidation.

3. Selling the Business: Instead of liquidating the company, another option is to sell the business to a new owner. This can be done through a merger or acquisition, where another company purchases the struggling business and takes over its operations. Selling the business can provide an opportunity for the company to continue operating under new management and potentially recover from its financial difficulties.

4. Debt Restructuring: Debt restructuring involves renegotiating the terms of the company’s debts with its creditors. This can include reducing interest rates, extending repayment periods, or forgiving a portion of the debt. By restructuring its debts, the company may be able to alleviate its financial burden and avoid liquidation.

5. Turnaround Management: Turnaround management involves bringing in outside experts to assess the company’s financial situation and develop a plan to improve its performance. These experts can provide guidance on cost-cutting measures, operational changes, or strategic initiatives that can help turn the company around. By implementing the recommendations of turnaround management, the company may be able to avoid liquidation and regain financial stability.

6. Asset Sale: If the company is unable to continue operating, another alternative is to sell its assets. This can involve selling off inventory, equipment, or property to generate funds that can be used to repay debts. By selling its assets, the company may be able to satisfy its creditors and avoid the need for liquidation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.