What is Homeowners Insurance?

Homeowners insurance is a type of property insurance that provides financial protection to homeowners in the event of damage or loss to their property. It is designed to cover the cost of repairing or rebuilding a home, as well as replacing personal belongings that may be damaged or stolen.

Homeowners insurance policies typically include coverage for a variety of perils, such as fire, theft, vandalism, and natural disasters like hurricanes or earthquakes. It may also provide liability coverage in case someone is injured on your property and decides to sue you for damages.

Types of Homeowners Insurance Policies

There are several types of homeowners insurance policies available, each offering different levels of coverage. The most common types include:

| Type of Policy | Description |

|---|---|

| HO-1 | This is a basic policy that provides coverage for a limited number of perils. |

| HO-2 | This policy provides coverage for a broader range of perils than HO-1. |

| HO-3 | This is the most common type of policy, offering coverage for most perils, except those specifically excluded. |

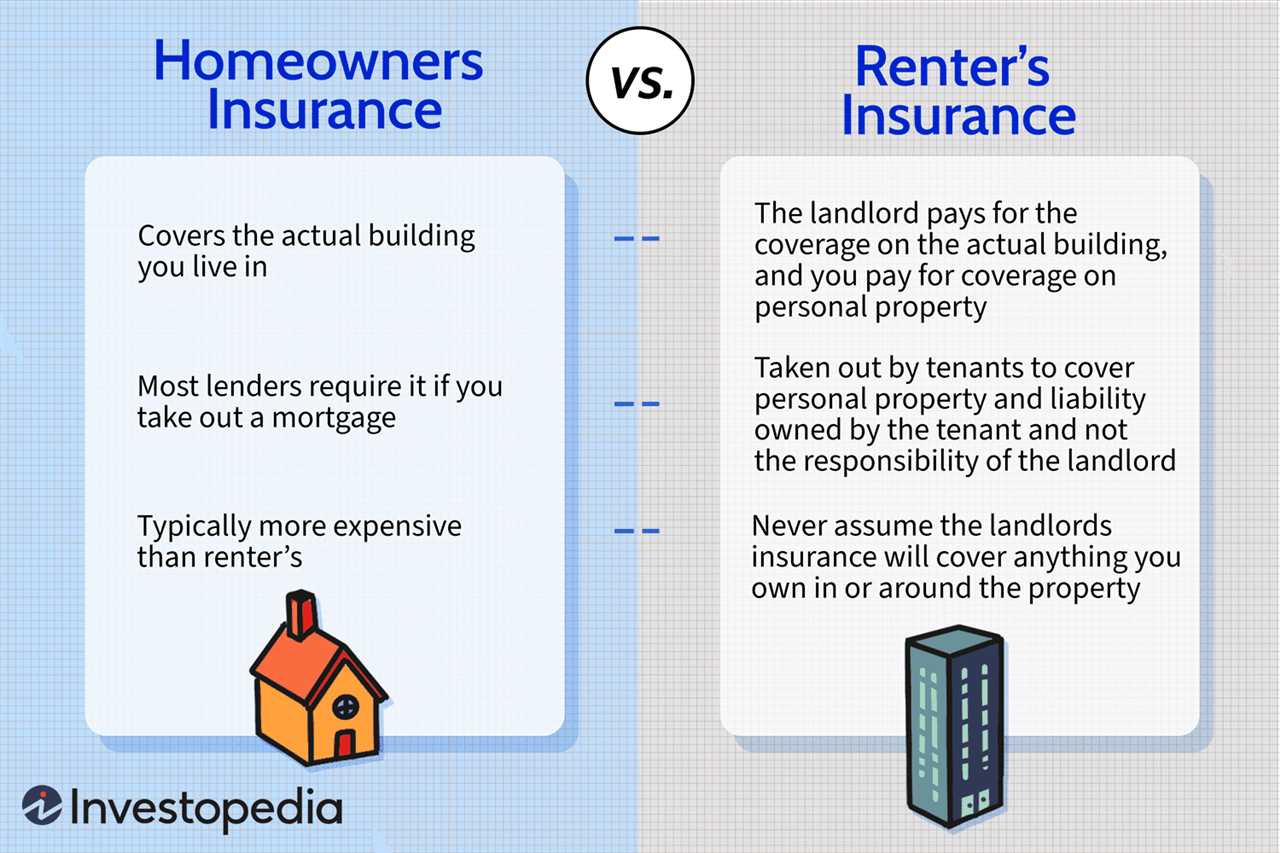

| HO-4 | This policy is designed for renters and provides coverage for personal belongings, liability, and additional living expenses. |

| HO-5 | This is a comprehensive policy that provides coverage for all perils, unless they are specifically excluded. |

Factors Affecting Homeowners Insurance Premiums

The cost of homeowners insurance premiums can vary based on several factors, including:

- The location and age of the home

- The size and construction of the home

- The value of the home and its contents

- The deductible amount chosen by the homeowner

- The homeowner’s claims history

- The presence of safety features, such as smoke detectors or a security system

How Does Homeowners Insurance Work?

Policy Coverage

A homeowners insurance policy typically provides coverage for several different types of perils, including fire, theft, vandalism, and natural disasters such as hurricanes or earthquakes. It may also include liability coverage, which protects the homeowner in the event that someone is injured on their property and sues for damages.

Claims Process

In the event of damage or loss to the insured property, homeowners must file a claim with their insurance company to receive compensation. The claims process typically involves documenting the damage or loss, providing proof of ownership or value of the items, and working with the insurance company to determine the appropriate compensation.

Once the claim is approved, the insurance company will typically provide the homeowner with the funds necessary to repair or replace the damaged or lost property. The amount of compensation will depend on the coverage limits and deductibles outlined in the policy.

Premiums and Deductibles

Homeowners insurance is typically paid for through annual premiums. The cost of the premiums will depend on a variety of factors, including the location and value of the home, the coverage limits desired, and the homeowner’s claims history.

In addition to the annual premiums, homeowners may also be responsible for paying a deductible. The deductible is the amount that the homeowner must pay out of pocket before the insurance company will provide compensation. A higher deductible will typically result in lower premiums, while a lower deductible will result in higher premiums.

Why Do You Need Homeowners Insurance?

Homeowners insurance is an essential protection for anyone who owns a home. It provides financial coverage in case of damage or loss to your property, as well as liability coverage for accidents that may occur on your property.

One of the main reasons why you need homeowners insurance is to protect your investment. Your home is likely one of the biggest investments you will make in your lifetime, and it is important to safeguard it against unexpected events. With homeowners insurance, you can have peace of mind knowing that you are financially protected in case of damage from fire, theft, vandalism, or natural disasters.

Additionally, homeowners insurance provides liability coverage. This means that if someone gets injured on your property and decides to sue you, your insurance will help cover the legal fees and any damages awarded. Without homeowners insurance, you could be held personally responsible for these expenses, which can be financially devastating.

Furthermore, if you have a mortgage on your home, your lender will likely require you to have homeowners insurance. This is because the lender wants to protect their investment as well. In the event of a total loss, the insurance will help cover the outstanding balance on your mortgage, ensuring that you are not left with a large debt.

Lastly, homeowners insurance can also provide coverage for your personal belongings. If your belongings are damaged or stolen, your insurance can help replace them. This can be especially important if you have valuable items such as electronics, jewelry, or artwork.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.