Definition of Home Office Expenses

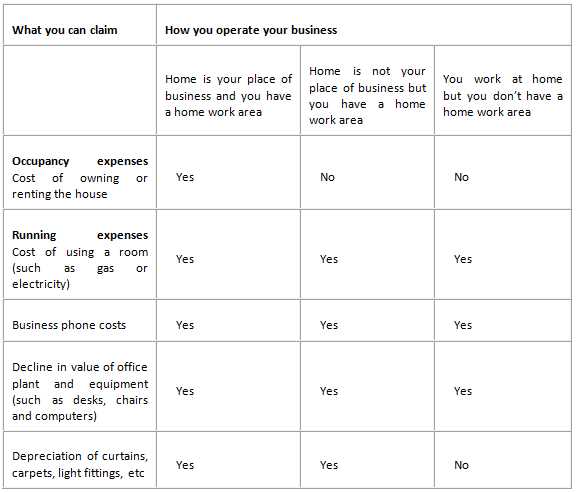

Home office expenses refer to the costs incurred by individuals who use a portion of their home exclusively for business purposes. These expenses can be deducted from taxable income, reducing the overall tax liability for self-employed individuals or those who work from home.

In order to qualify for home office expense deductions, the space must be regularly and exclusively used for business activities. This means that the area cannot be used for personal purposes, such as a guest bedroom or a playroom for children. It must be a dedicated workspace that is used solely for conducting business.

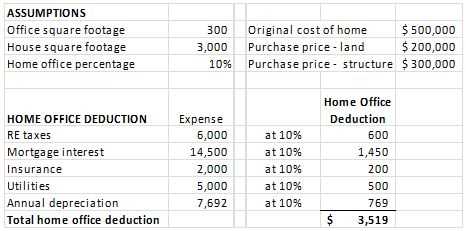

Examples of home office expenses include rent or mortgage interest, property taxes, utilities, insurance, repairs and maintenance, and depreciation. These expenses can be deducted based on the percentage of the home that is used for business purposes. For example, if the home office occupies 10% of the total square footage of the house, then 10% of the eligible expenses can be deducted.

Qualifying for Home Office Expenses

In order to qualify for home office expenses, the space must meet the following criteria:

- The space is used exclusively for business purposes.

- The space is the principal place of business or is used regularly to meet with clients or customers.

- The space is not used for any other purpose, such as personal activities or storage.

It is important to note that employees who work from home may also be eligible for home office expense deductions, but there are additional requirements that must be met. The use of the home office must be for the convenience of the employer, and the employee must not rent any part of their home to their employer.

Calculating Home Office Expenses

Calculating home office expenses involves determining the percentage of the home that is used for business purposes. This can be done by dividing the square footage of the home office by the total square footage of the house. The resulting percentage can then be applied to the eligible expenses to determine the deductible amount.

For example, if the home office occupies 200 square feet and the total square footage of the house is 2,000 square feet, then the percentage would be 10%. If the total eligible expenses for the year amount to $10,000, then $1,000 (10% of $10,000) can be deducted as home office expenses.

| Expense | Amount |

|---|---|

| Rent | $500 |

| Utilities | $200 |

| Insurance | $100 |

| Repairs and Maintenance | $200 |

It is important to keep detailed records and receipts of all home office expenses in order to substantiate the deductions during tax filing. Additionally, consulting with a tax professional or accountant can provide further guidance on maximizing home office expense deductions and ensuring compliance with tax regulations.

Calculation of Home Office Expenses

Calculating home office expenses is an important aspect for individuals who work from home or run a business from their residence. It allows them to determine the portion of their expenses that can be claimed as deductions on their taxes. Here are the key steps to calculate home office expenses:

Step 1: Determine the Square Footage

The first step is to measure the total square footage of your home office space. This includes the area used exclusively for work, such as a separate room or a designated corner in a room.

Step 2: Calculate the Percentage

Next, you need to determine the percentage of your home that is used for your office. To do this, divide the square footage of your office space by the total square footage of your home. Multiply the result by 100 to get the percentage.

Example:

If your home office is 150 square feet and your total home size is 1,500 square feet, the calculation would be as follows:

150 / 1,500 = 0.1

0.1 x 100 = 10%

Step 3: Identify Relevant Expenses

Identify the expenses that are directly related to your home office. These may include rent or mortgage interest, property taxes, utilities, insurance, and repairs. These expenses can be fully or partially allocated to your home office based on the percentage calculated in step 2.

Step 4: Allocate Expenses

Allocate the relevant expenses to your home office based on the percentage calculated. For example, if your total monthly utility bill is $200 and your home office percentage is 10%, you can allocate $20 ($200 x 10%) as a deductible expense.

Step 5: Keep Accurate Records

It is crucial to maintain accurate records of all expenses related to your home office. Keep receipts, invoices, and other relevant documents to support your deductions in case of an audit by the tax authorities.

By following these steps, you can accurately calculate your home office expenses and ensure that you are claiming the appropriate deductions on your taxes. It is recommended to consult with a tax professional or accountant to ensure compliance with tax laws and regulations.

Examples of Home Office Expenses

- Rent or mortgage payments: If you use a specific area of your home exclusively for business purposes, you can deduct a portion of your rent or mortgage payments as a home office expense.

- Utilities: Expenses such as electricity, heating, and water can also be deducted if they are used for your home office. You can calculate the percentage of these expenses based on the square footage of your office compared to the total square footage of your home.

- Internet and phone bills: If you use the internet and phone for your business, you can deduct a portion of these expenses. This can include monthly fees, as well as any additional charges for business-related services.

- Office supplies: Any supplies you purchase specifically for your home office, such as paper, pens, and printer ink, can be deducted as a business expense.

- Insurance: If you have insurance for your home, such as homeowner’s or renter’s insurance, you may be able to deduct a portion of the premiums as a home office expense.

- Repairs and maintenance: If you need to make repairs or perform maintenance on your home office, such as painting the walls or fixing a leaky faucet, these expenses can be deducted.

- Professional services: If you hire professionals, such as accountants or lawyers, to help with your business, the fees you pay for their services can be deducted as a home office expense.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.