What are Federal Funds?

Federal funds refer to the reserves that commercial banks hold at the Federal Reserve. These funds are used by banks to meet their reserve requirements and to lend to other banks overnight to maintain their required level of reserves. Federal funds are an essential tool for managing the liquidity in the banking system.

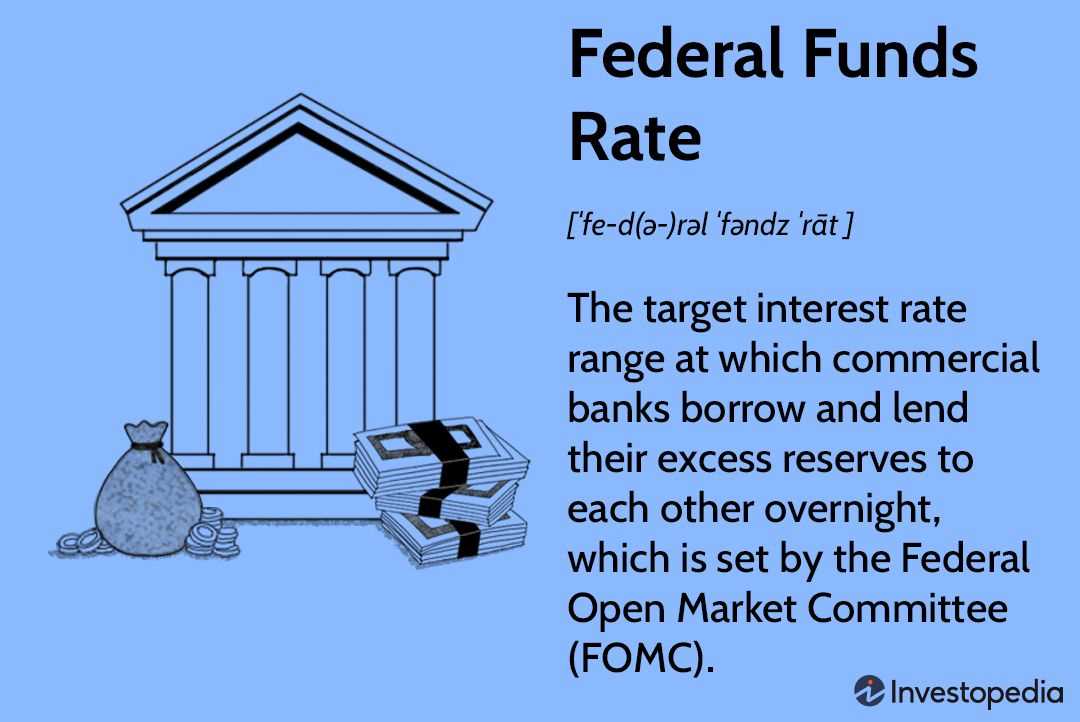

When a bank has excess reserves, it can lend them to another bank that is short on reserves. This lending and borrowing of reserves happen in the federal funds market, where banks trade reserves with each other. The interest rate at which these transactions occur is called the federal funds rate.

The Federal Reserve uses open market operations to influence the federal funds rate. By buying or selling government securities, the Federal Reserve can increase or decrease the supply of reserves in the banking system, which in turn affects the federal funds rate. The target federal funds rate is set by the Federal Open Market Committee (FOMC), which consists of members of the Federal Reserve Board and regional Federal Reserve Bank presidents.

Loan Mechanics of Federal Funds

The loan mechanics of federal funds involve the process of borrowing and lending between banks to meet their reserve requirements. Banks that have excess reserves can lend funds to banks that are in need of reserves to meet their requirements. This borrowing and lending activity takes place in the federal funds market.

The federal funds rate is determined by the supply and demand for federal funds in the market. When there is high demand for funds, the federal funds rate tends to increase. Conversely, when there is low demand for funds, the federal funds rate tends to decrease. The Federal Reserve, through its open market operations, can also influence the federal funds rate by buying or selling Treasury securities.

The loan mechanics of federal funds play a crucial role in the banking system. Banks rely on these loans to manage their reserve requirements and ensure they have enough funds to meet their obligations. The federal funds market provides a mechanism for banks to borrow and lend funds efficiently, helping to maintain stability in the banking system.

Interest Rates on Federal Funds

Interest rates play a crucial role in the functioning of the federal funds market. The federal funds rate refers to the interest rate at which depository institutions lend funds to one another on an overnight basis. This rate is determined by the supply and demand dynamics of the market and is influenced by the Federal Reserve’s monetary policy.

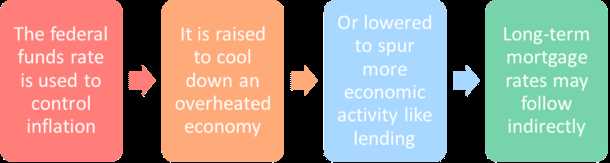

When the Federal Reserve wants to stimulate economic growth, it may lower the federal funds rate. This encourages banks to borrow more funds from one another, which increases the money supply and lowers interest rates throughout the economy. Conversely, when the Federal Reserve wants to slow down the economy and combat inflation, it may raise the federal funds rate. This makes borrowing more expensive, which reduces the money supply and increases interest rates.

The federal funds rate serves as a benchmark for other short-term interest rates in the economy. Banks and financial institutions use the federal funds rate as a reference point when setting their own interest rates for loans and other financial products. For example, the prime rate, which is the rate that banks charge their most creditworthy customers, is typically set at a certain percentage above the federal funds rate.

The Impact on Borrowers and Savers

The federal funds rate has a direct impact on borrowers and savers. When the federal funds rate is low, borrowing becomes cheaper, which can stimulate borrowing and spending by consumers and businesses. This can lead to increased economic activity and growth. On the other hand, when the federal funds rate is high, borrowing becomes more expensive, which can discourage borrowing and spending. This can slow down economic activity and potentially lead to a recession.

For savers, the impact of the federal funds rate is more nuanced. When interest rates are low, savers may earn less on their savings accounts and other fixed-income investments. However, low interest rates can also make it cheaper for individuals and businesses to borrow, which can stimulate economic growth and potentially lead to higher returns on other investments.

Conclusion

The Role of the Federal Reserve

Monetary Policy

One of the main responsibilities of the Federal Reserve is to conduct monetary policy. This involves managing the money supply and interest rates in order to promote economic growth, price stability, and full employment. The Federal Reserve uses various tools, including open market operations, to influence the federal funds rate, which in turn affects other interest rates in the economy.

By buying or selling government securities in the open market, the Federal Reserve can increase or decrease the supply of reserves in the banking system. When the Federal Reserve buys securities, it injects reserves into the system, which increases the supply of funds available for lending. This can lower the federal funds rate, making borrowing cheaper and stimulating economic activity. Conversely, when the Federal Reserve sells securities, it removes reserves from the system, reducing the supply of funds and potentially raising the federal funds rate.

Financial System Stability

In addition to conducting monetary policy, the Federal Reserve also plays a crucial role in maintaining the stability of the financial system. It supervises and regulates banks, implements measures to prevent financial crises, and provides liquidity to the banking system when needed.

Conclusion

The Federal Reserve’s role in the federal funds market is essential for the smooth functioning of the financial system. By conducting monetary policy and maintaining financial stability, the Federal Reserve helps to ensure the efficient allocation of funds, promote economic growth, and safeguard the overall health of the economy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.