What is Earned Income?

Earned income refers to the money that an individual receives for their work or services rendered. It includes wages, salaries, tips, and self-employment income. Earned income is different from unearned income, which includes income from investments, rental properties, and other passive sources.

Earned income can come from various sources, such as employment with a company, freelancing, or running a business. It is the result of the individual’s active participation and effort in generating income. This distinguishes it from passive income, which is earned without direct involvement or labor.

Types of Earned Income

There are different types of earned income, depending on the nature of the work or services provided:

1. Wages and Salaries: This is the most common form of earned income and refers to the compensation received by employees for their work. It can be paid on an hourly, weekly, or monthly basis.

2. Tips and Gratuities: Tips received by service industry workers, such as waiters, bartenders, or taxi drivers, are also considered earned income. These tips are often received in addition to the base wage or salary.

3. Self-Employment Income: Individuals who work for themselves and run their own businesses generate self-employment income. This can include income from freelance work, consulting services, or operating a small business.

4. Commissions and Bonuses: Some individuals receive a portion of their income in the form of commissions or bonuses based on their performance or sales. These additional earnings are considered part of their earned income.

Importance of Earned Income

Earned income is crucial for individuals and families as it provides the means to cover living expenses, save for the future, and achieve financial stability. It allows individuals to support themselves and their dependents, pay bills, and invest in their education or career development.

Furthermore, earned income plays a significant role in determining eligibility for certain government programs and benefits. For example, the Earned Income Tax Credit (EITC) is a tax benefit for low- to moderate-income individuals and families. The amount of EITC received is based on earned income, with higher income levels resulting in a higher credit.

How is Earned Income Calculated?

Earned income is calculated by adding up all the income you earn from working, such as wages, salaries, tips, and self-employment income. It is important to note that earned income does not include income from investments, rental properties, or other passive sources.

To calculate your earned income, you need to gather all your income statements, including pay stubs, W-2 forms, 1099 forms, and any other documentation that shows your earnings. Add up all the amounts to get your total earned income for the year.

If you are self-employed, calculating your earned income can be a bit more complex. You will need to track your business expenses and subtract them from your total business income to determine your net self-employment income. This net income is then considered part of your earned income.

Once you have calculated your earned income, you can use this information to determine your tax liability and any potential tax deductions or credits you may qualify for. It is recommended to consult with a tax professional or use tax software to ensure you accurately calculate your earned income and maximize your tax benefits.

The Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is a tax benefit for low to moderate-income individuals and families. It is designed to provide financial assistance to those who work but earn low wages. The EITC can help reduce the amount of taxes owed or even result in a refund.

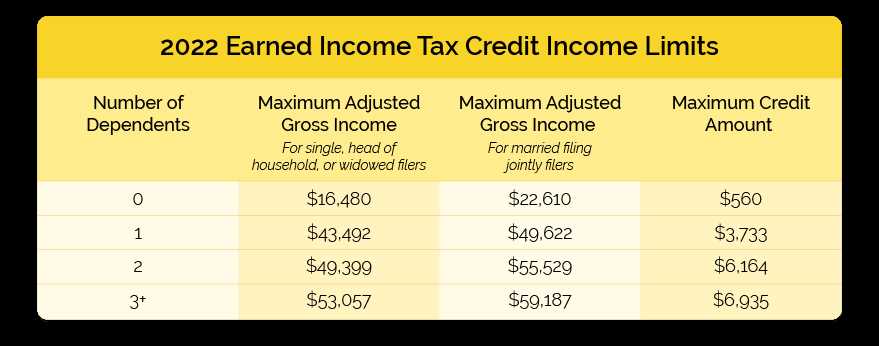

To qualify for the EITC, you must meet certain criteria, including having earned income from employment or self-employment. The amount of the credit depends on your income level and the number of qualifying children you have. The credit is calculated on a sliding scale, meaning that as your income increases, the amount of the credit decreases.

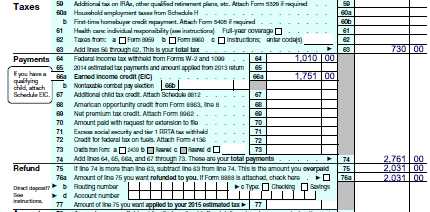

The EITC is a refundable credit, which means that if the credit exceeds the amount of taxes owed, you can receive the remaining amount as a refund. This can be especially beneficial for low-income individuals and families who may rely on the refund to cover basic living expenses or pay off debts.

In addition to providing financial assistance, the EITC also has other benefits. Research has shown that the credit can help lift families out of poverty, improve child and maternal health outcomes, and increase workforce participation. By reducing the tax burden on low-income individuals and families, the EITC can help promote economic stability and upward mobility.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.