What are Death Taxes?

The purpose of death taxes is to generate revenue for the government and to redistribute wealth. They are often seen as a way to prevent the concentration of wealth within a few families and promote economic equality.

Death taxes can apply to various types of assets, including real estate, investments, cash, and personal belongings. The value of these assets is assessed at the time of the individual’s death, and the tax is calculated based on the total value of the estate.

Many countries have different thresholds and exemptions for death taxes. For example, in the United States, there is a federal estate tax that applies to estates with a value above a certain threshold, currently set at $11.7 million for individuals and $23.4 million for married couples. However, some states also have their own estate or inheritance taxes with different thresholds and rates.

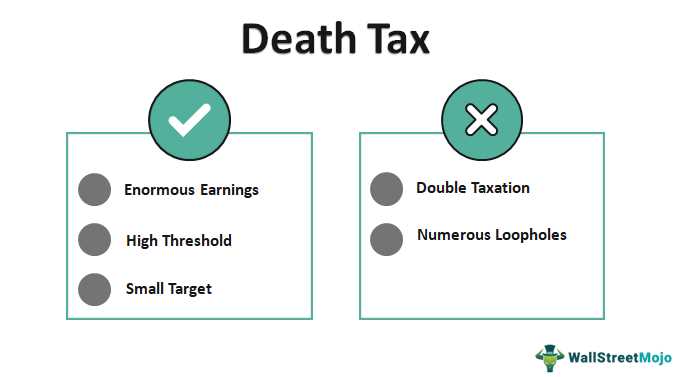

| Pros | Cons |

|---|---|

| Generate revenue for the government | Can reduce the amount of inheritance received |

| Promote economic equality | Complex regulations and calculations |

| Prevent concentration of wealth | Can require professional assistance to navigate |

Types of Death Taxes

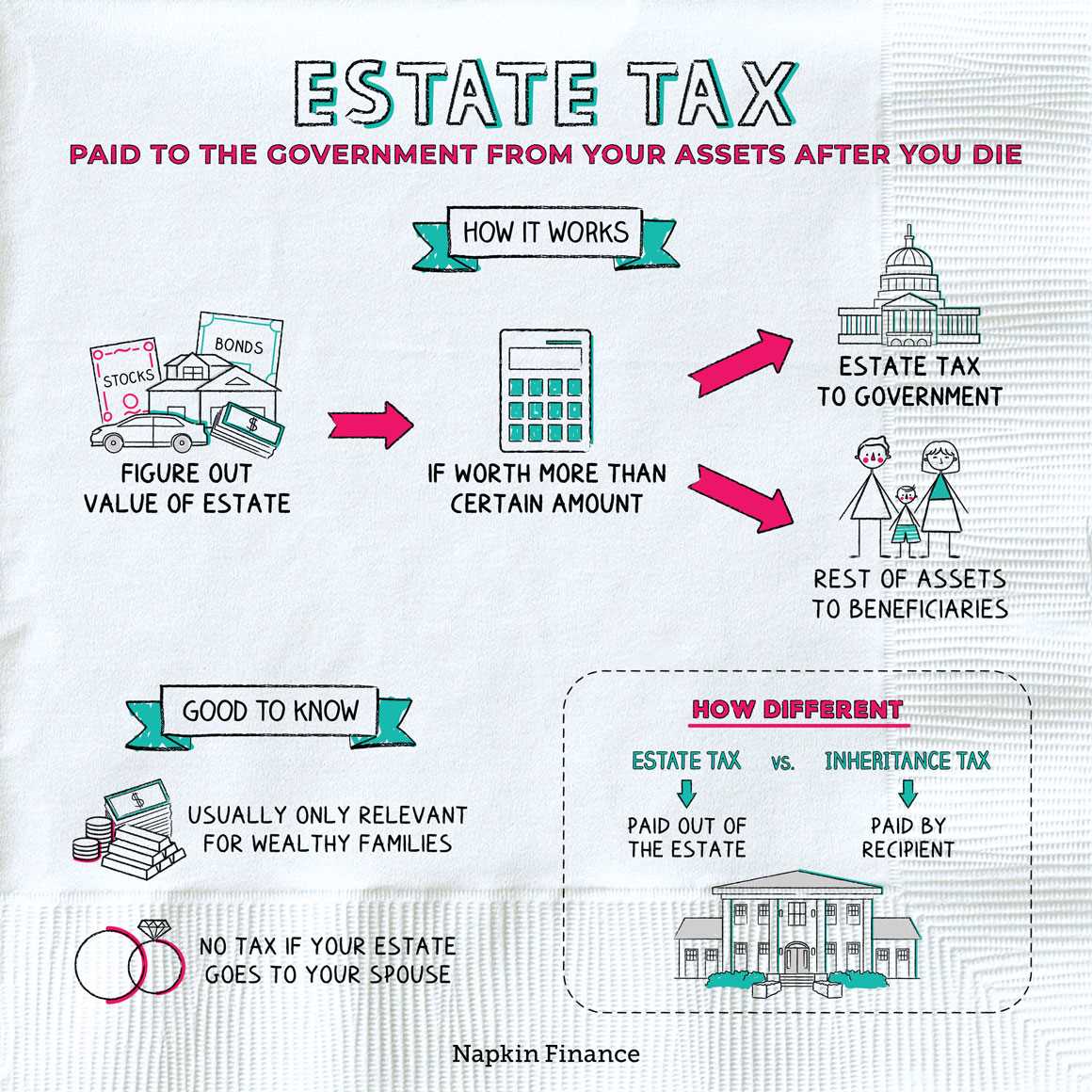

Estate Taxes

Estate taxes are taxes that are imposed on the transfer of property upon the death of an individual. These taxes are typically based on the value of the estate and can be levied by the federal government, state government, or both. The federal estate tax applies to estates that exceed a certain threshold, which is adjusted annually for inflation. State estate taxes, on the other hand, may apply to estates that are below the federal threshold or in addition to the federal estate tax.

Inheritance Taxes

Inheritance taxes are taxes that are imposed on the transfer of property from a deceased person to their heirs or beneficiaries. Unlike estate taxes, which are based on the value of the estate, inheritance taxes are based on the value of the property received by each individual heir or beneficiary. The rates and exemptions for inheritance taxes vary by state, so it is important to understand the specific rules that apply in your jurisdiction.

Gift Taxes

Gift taxes are taxes that are imposed on the transfer of property during a person’s lifetime. These taxes are designed to prevent individuals from avoiding estate taxes by giving away their assets before they die. The federal gift tax applies to gifts that exceed a certain annual exclusion amount, which is adjusted annually for inflation. Some states also have their own gift tax laws, so it is important to consult with a tax professional to understand the specific rules that apply in your jurisdiction.

Generation-Skipping Transfer Taxes

Generation-skipping transfer taxes are taxes that are imposed on transfers of property to individuals who are more than one generation younger than the transferor. These taxes are designed to prevent individuals from avoiding estate and gift taxes by transferring their assets to their grandchildren or other skip persons. The federal generation-skipping transfer tax applies to transfers that exceed a certain exemption amount, which is adjusted annually for inflation.

It is important to note that the rules and regulations surrounding death taxes can be complex and subject to change. Consulting a tax professional who specializes in estate planning and tax law can help ensure that you understand the specific rules that apply in your situation and develop strategies to minimize the impact of these taxes on your estate.

Strategies to Minimize Death Tax Impact

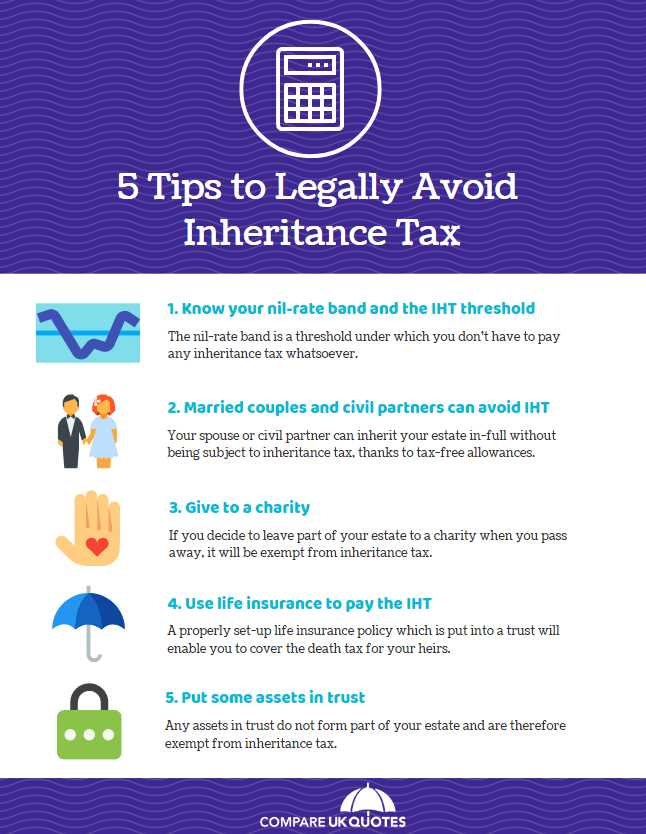

1. Gifting

One strategy to minimize death tax impact is through gifting. By gifting assets to loved ones during your lifetime, you can reduce the size of your estate and potentially lower the amount of taxes owed upon death. The annual gift tax exclusion allows individuals to gift up to a certain amount each year without incurring any gift tax. By taking advantage of this exclusion, you can gradually transfer assets to your beneficiaries and reduce the overall value of your estate.

2. Irrevocable Life Insurance Trusts

Another strategy is to set up an irrevocable life insurance trust (ILIT). With an ILIT, the life insurance policy is owned by the trust rather than the individual. This removes the policy from the taxable estate, reducing the overall value subject to death taxes. The trust can also provide liquidity to pay any estate taxes that may be owed, ensuring that other assets are not forced to be sold to cover the tax liability.

3. Charitable Giving

Charitable giving can also be an effective strategy to minimize death tax impact. By leaving a portion of your estate to a qualified charitable organization, you can receive a charitable deduction that can help offset any estate taxes that may be owed. This not only reduces the tax burden on your estate but also allows you to support causes that are important to you.

4. Family Limited Partnerships

Family limited partnerships (FLPs) can be used to transfer assets to family members while still maintaining control over those assets. By transferring assets to an FLP, you can take advantage of valuation discounts, which reduce the taxable value of the assets. This can help lower the overall estate value and potentially reduce the amount of death taxes owed.

5. Qualified Personal Residence Trusts

A qualified personal residence trust (QPRT) allows you to transfer your primary residence or vacation home to the trust while still retaining the right to live in the property for a specified period of time. By transferring the property to the trust, you can remove its value from your taxable estate. This can be an effective strategy for individuals who have a significant amount of wealth tied up in real estate.

6. Consulting a Tax Professional

Lastly, it is important to consult with a tax professional who specializes in estate planning and tax strategies. They can provide personalized advice based on your specific financial situation and help you navigate the complex world of death taxes. A tax professional can help you identify the most effective strategies for minimizing the impact of death taxes and ensure that your estate is passed on to your beneficiaries as efficiently as possible.

By implementing these strategies and seeking professional guidance, individuals can minimize the impact of death taxes and ensure that their hard-earned assets are preserved for future generations.

Consulting a Tax Professional

A tax professional specializing in estate planning and tax law can provide valuable guidance and help develop strategies to minimize the impact of death taxes. They have in-depth knowledge of the tax laws and regulations related to estate planning and can navigate through the complexities of the tax system.

Here are some reasons why consulting a tax professional is beneficial:

1. Expertise and Knowledge

Tax professionals have extensive knowledge and expertise in tax laws and regulations. They stay updated with the latest changes in tax codes and can provide accurate and up-to-date information regarding death taxes. They can analyze your specific situation and provide personalized advice based on your individual circumstances.

2. Customized Strategies

A tax professional can assess your financial situation, assets, and goals to develop customized strategies to minimize the impact of death taxes. They can help you explore various options such as setting up trusts, gifting assets, or utilizing tax exemptions to reduce the tax burden on your estate.

3. Compliance with Tax Laws

Death taxes are subject to specific laws and regulations, and failing to comply with them can result in penalties and legal issues. A tax professional can ensure that you are in compliance with all the necessary requirements and help you navigate through the complex tax landscape.

4. Estate Planning Guidance

Consulting a tax professional can also provide valuable guidance in overall estate planning. They can help you create a comprehensive estate plan that not only minimizes death taxes but also addresses other important aspects such as asset distribution, guardianship of minor children, and healthcare directives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.