Key Criteria for Capital Lease Accounting

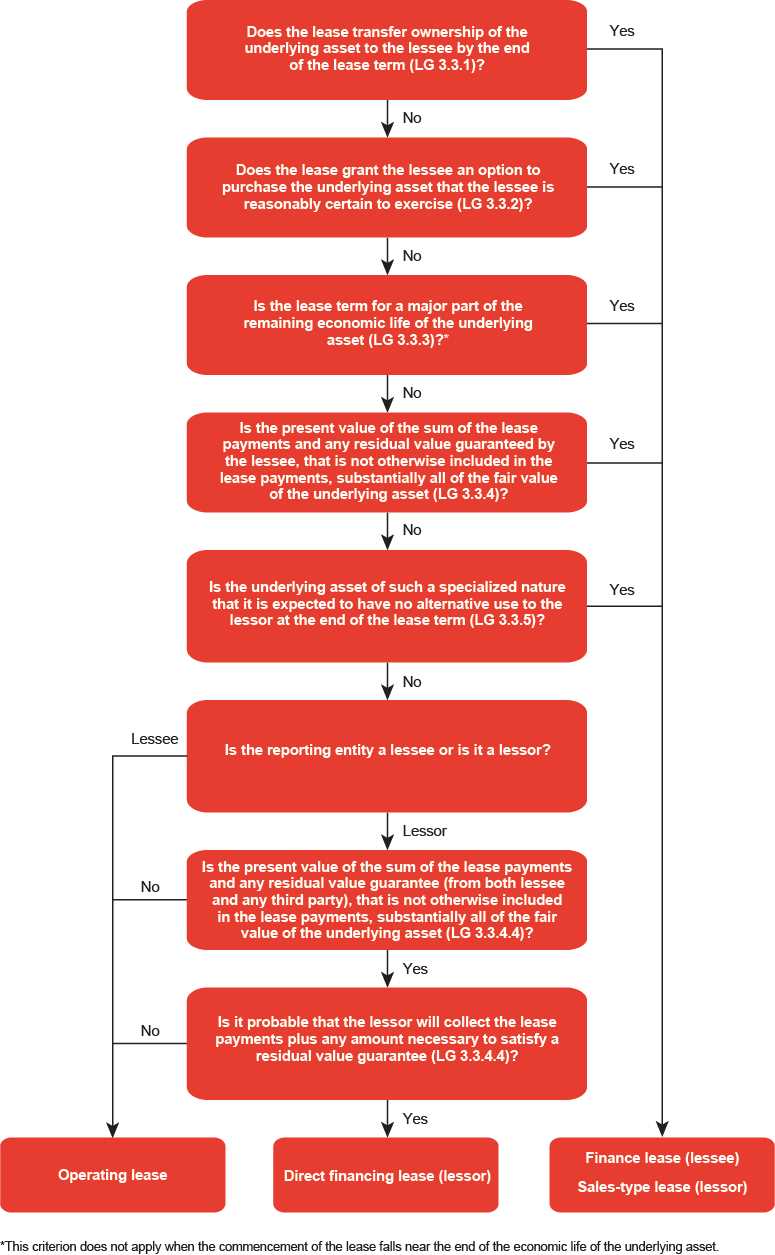

1. Ownership Transfer

One of the main criteria for a lease to be classified as a capital lease is that it must transfer ownership of the asset to the lessee by the end of the lease term. This means that at the end of the lease, the lessee will have the option to purchase the asset at a predetermined price.

2. Bargain Purchase Option

3. Lease Term

The lease term is another important criterion for capital lease accounting. In order for a lease to be classified as a capital lease, it must have a term that is equal to or greater than 75% of the asset’s estimated useful life. This ensures that the lessee will have the asset for a significant portion of its useful life.

4. Present Value of Lease Payments

The present value of lease payments is also taken into consideration when determining whether a lease is a capital lease. If the present value of the lease payments is equal to or greater than 90% of the asset’s fair market value, then the lease is classified as a capital lease. This criterion ensures that the lessee is essentially financing the purchase of the asset through the lease payments.

Benefits of Capital Lease Accounting

Capital lease accounting offers several benefits for businesses. By utilizing capital leases, companies can enjoy the following advantages:

1. Improved Financial Ratios

One of the key benefits of capital lease accounting is that it allows businesses to improve their financial ratios. Since capital leases are treated as long-term debt, the lease payments are not considered as operating expenses. As a result, the company’s debt-to-equity ratio and other financial ratios can be improved, which can enhance the company’s financial standing and creditworthiness.

2. Tax Benefits

Capital lease accounting can also provide tax benefits for businesses. In many jurisdictions, lease payments can be deducted as a business expense, reducing the taxable income. Additionally, capital leases may allow for depreciation deductions, which can further lower the tax liability. These tax benefits can result in significant cost savings for companies.

3. Access to High-Quality Assets

Another advantage of capital lease accounting is that it enables businesses to access high-quality assets without the need for a large upfront investment. By leasing assets instead of purchasing them outright, companies can conserve their cash flow and allocate resources to other areas of the business. This flexibility can be especially beneficial for startups and small businesses with limited capital.

4. Off-Balance Sheet Financing

Capital lease accounting allows businesses to keep leased assets off their balance sheet. This means that the company does not have to report the leased assets as a liability, which can improve the company’s financial ratios and make it more attractive to investors and lenders. Off-balance sheet financing can also provide a more accurate representation of the company’s financial position.

Implications of Capital Lease Accounting

1. Financial Reporting

Capital lease accounting affects the financial reporting of a business. Leased assets are recorded as both an asset and a liability on the balance sheet. This means that the business will have higher total assets and liabilities, which can impact financial ratios and key performance indicators.

2. Taxation

Capital lease accounting can have tax implications for businesses. In some jurisdictions, leased assets may be subject to different tax treatments compared to owned assets. It is important for businesses to understand the tax implications of capital lease accounting and consider them when making financial decisions.

3. Cash Flow

Capital lease accounting affects cash flow for businesses. Lease payments are considered as both an expense and a reduction of the lease liability. This means that businesses need to carefully manage their cash flow to ensure they have sufficient funds to meet lease payment obligations.

4. Risk and Ownership

Capital lease accounting affects the risk and ownership of leased assets. While the business does not have legal ownership of the asset, it is responsible for the maintenance, insurance, and other costs associated with the leased asset. This can impact the overall risk profile of the business and its ability to manage and mitigate risks effectively.

5. Financial Flexibility

Capital lease accounting can impact the financial flexibility of a business. Leasing allows businesses to acquire assets without a large upfront cash outlay. This can free up capital for other business activities and provide flexibility in managing financial resources.

| Implication | Description |

|---|---|

| Financial Reporting | Affects the balance sheet and financial ratios |

| Taxation | May have tax implications for businesses |

| Cash Flow | Affects cash flow management |

| Risk and Ownership | Impacts the risk profile and ownership responsibilities |

| Financial Flexibility | Provides flexibility in managing financial resources |

Overall, capital lease accounting has significant implications for businesses. It is important for businesses to understand these implications and consider them when making financial decisions and managing their assets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.