Underground Economy: All You Need to Know about Definition, Statistics, Trends, and Examples

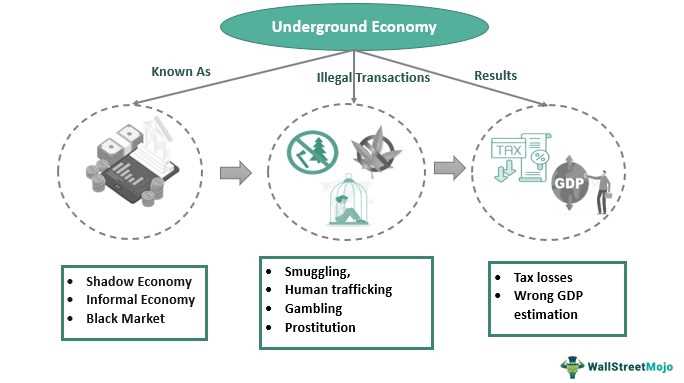

The underground economy refers to economic activities that are conducted outside the purview of government regulation and oversight. These activities are often illegal or unreported, and participants in the underground economy typically avoid paying taxes, following labor laws, or adhering to other regulations.

Statistics on the underground economy can be challenging to obtain due to its clandestine nature. However, estimates suggest that it can account for a significant portion of a country’s GDP. For example, in some developing countries, the underground economy may represent more than half of the total economic activity. In more developed countries, the size of the underground economy tends to be smaller but still significant.

Examples of the underground economy include activities such as tax evasion, smuggling, money laundering, and the sale of counterfeit goods. These activities can have far-reaching consequences, including lost tax revenues for governments, unfair competition for legitimate businesses, and potential harm to consumers who unknowingly purchase counterfeit or unsafe products.

| Definition | Statistics | Trends | Examples |

|---|---|---|---|

| The underground economy refers to economic activities conducted outside government regulation and oversight. | The size of the underground economy can vary but can account for a significant portion of a country’s GDP. | Trends in the underground economy can be influenced by economic conditions, government policies, and technological advancements. | Examples of the underground economy include tax evasion, smuggling, money laundering, and the sale of counterfeit goods. |

Definition of Underground Economy

The underground economy can include a wide range of activities, such as unreported work, undeclared income, illegal trade, tax evasion, and informal transactions. It is estimated that the size of the underground economy can vary significantly between countries, ranging from a few percent to more than 50% of the official GDP.

Characteristics of the Underground Economy

There are several key characteristics that define the underground economy:

- Informality: The activities in the underground economy are often conducted outside the formal legal framework and do not comply with government regulations and reporting requirements.

- Lack of transparency: Transactions in the underground economy are typically conducted in cash or through informal channels, making it difficult to track and monitor.

- Avoidance of taxes and regulations: Participants in the underground economy often engage in tax evasion and avoid government regulations to minimize costs and maximize profits.

- Illegal activities: The underground economy can involve illegal activities, such as drug trafficking, smuggling, counterfeiting, and human trafficking.

- Exclusion from official statistics: Since the underground economy is not reported or regulated, it is not included in official GDP calculations and other economic indicators.

Reasons for the Existence of the Underground Economy

There are several reasons why the underground economy exists:

- High tax rates: High tax rates can incentivize individuals and businesses to engage in tax evasion and participate in the underground economy to reduce their tax burden.

- Complex regulations: Complex and burdensome regulations can create barriers to entry for formal businesses, leading to the proliferation of informal and unregulated activities.

- Poverty and unemployment: In countries with high poverty rates and limited job opportunities, the underground economy can provide a source of income for individuals who are unable to find formal employment.

- Lack of trust in institutions: In some cases, individuals may choose to participate in the underground economy due to a lack of trust in government institutions and a desire to avoid corruption and bureaucracy.

Overall, the underground economy is a complex and multifaceted phenomenon that exists in various forms and sizes around the world. It poses challenges for governments in terms of revenue collection, regulation, and enforcement, and has implications for economic development, inequality, and social welfare.

Statistics on Underground Economy

However, researchers and economists have developed various methods and indicators to estimate the extent of underground economic activities. These methods include surveys, tax gap analysis, currency demand approach, and other indirect measurement techniques.

1. Surveys

Surveys are one of the primary methods used to gather data on the underground economy. These surveys involve collecting information from individuals and businesses about their participation in informal economic activities. The data collected can then be used to estimate the size and characteristics of the underground economy.

However, surveys have their limitations. Participation in surveys may be voluntary, leading to potential biases in the data. Additionally, individuals engaged in illegal activities may be hesitant to disclose their involvement, leading to underestimations of the underground economy.

2. Tax Gap Analysis

Tax gap analysis involves comparing the reported tax revenues with the estimated tax liabilities to identify discrepancies. By analyzing the difference between what should be collected in taxes and what is actually collected, researchers can estimate the size of the underground economy.

This method relies on tax data and other economic indicators to estimate the level of unreported income and tax evasion. However, tax gap analysis may not capture all underground economic activities, as some individuals and businesses may avoid detection by engaging in sophisticated tax evasion schemes.

3. Currency Demand Approach

The currency demand approach is based on the assumption that the demand for cash is related to the level of underground economic activities. By analyzing the demand for cash and comparing it to the reported economic activity, researchers can estimate the size of the underground economy.

This method relies on data from central banks and other financial institutions to estimate the amount of cash in circulation. However, it may not capture all underground economic activities, as some transactions may be conducted using alternative forms of payment, such as cryptocurrencies.

Despite the challenges and limitations, researchers have made significant progress in estimating the size and trends of the underground economy. These estimates provide valuable insights into the economic dynamics and policy implications of informal economic activities.

Trends in the Underground Economy

1. Growth

One of the key trends in the underground economy is its continuous growth. Despite efforts by governments to curb informal activities, the underground economy tends to expand over time. This growth can be attributed to various factors, such as high tax rates, excessive regulations, and limited access to formal employment opportunities. As a result, individuals and businesses turn to informal activities to generate income and avoid government scrutiny.

2. Technological Advancements

The advancement of technology has had a significant impact on the underground economy. With the rise of the internet and digital platforms, it has become easier for individuals to engage in illicit activities and evade detection. Online marketplaces and cryptocurrency transactions have facilitated anonymous and untraceable transactions, making it more challenging for authorities to monitor and regulate underground economic activities.

3. Globalization

Globalization has also contributed to the growth of the underground economy. The increasing interconnectedness of economies has created new opportunities for illicit trade and smuggling. Cross-border transactions, offshore banking, and tax havens have made it easier for individuals and businesses to hide their income and assets from authorities. This has led to a significant increase in the size and complexity of the underground economy.

4. Informal Labor Market

The underground economy is closely linked to the informal labor market. In many countries, a significant portion of the workforce is engaged in informal employment, which includes activities such as street vending, domestic work, and unregistered small businesses. The informal labor market provides a source of income for those who are unable to find formal employment, but it also contributes to the underground economy by avoiding taxes and labor regulations.

5. Impact on the Formal Economy

| Trends in the Underground Economy |

|---|

| Growth |

| Technological Advancements |

| Globalization |

| Informal Labor Market |

| Impact on the Formal Economy |

Examples of Underground Economy

1. Black Market

The black market refers to the illegal buying and selling of goods and services. This can include counterfeit products, stolen goods, drugs, weapons, and even human trafficking. The black market operates outside of the legal system and often involves organized crime.

2. Cash-in-Hand Jobs

3. Tax Evasion

Tax evasion involves deliberately avoiding paying taxes owed to the government. This can be done through various means, such as underreporting income, inflating expenses, or hiding assets. Tax evasion is a common form of underground economic activity.

4. Off-the-Books Businesses

Off-the-books businesses are unregistered or informal enterprises that operate outside of the legal framework. These businesses often avoid taxes, regulations, and licensing requirements. Examples include street vendors, unlicensed street food stalls, and unregistered small-scale businesses.

5. Bartering and Informal Exchanges

Bartering and informal exchanges involve the exchange of goods and services without the use of money. This can include trading goods directly or providing services in exchange for other services. While bartering itself is not illegal, it becomes part of the underground economy when it is used to evade taxes or regulations.

6. Illegal Gambling

Illegal gambling refers to any form of gambling that is not authorized or regulated by the government. This can include underground casinos, sports betting rings, and online gambling websites operating without proper licenses. Illegal gambling is a lucrative underground activity that often involves organized crime.

These are just a few examples of the underground economy, which exists in almost every country to some extent. The underground economy poses challenges for governments, as it undermines tax revenues, creates unfair competition for legal businesses, and can contribute to social issues such as crime and exploitation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.