What is the Time Value of Money?

This concept is based on the idea that money has a time component, and the value of money changes over time. The time value of money is influenced by factors such as inflation, interest rates, and the opportunity cost of investing or using the money in other ways.

Overall, the time value of money is an important concept in finance that recognizes the changing value of money over time. By considering the time value of money, individuals and businesses can make better financial decisions and maximize their wealth in the long run.

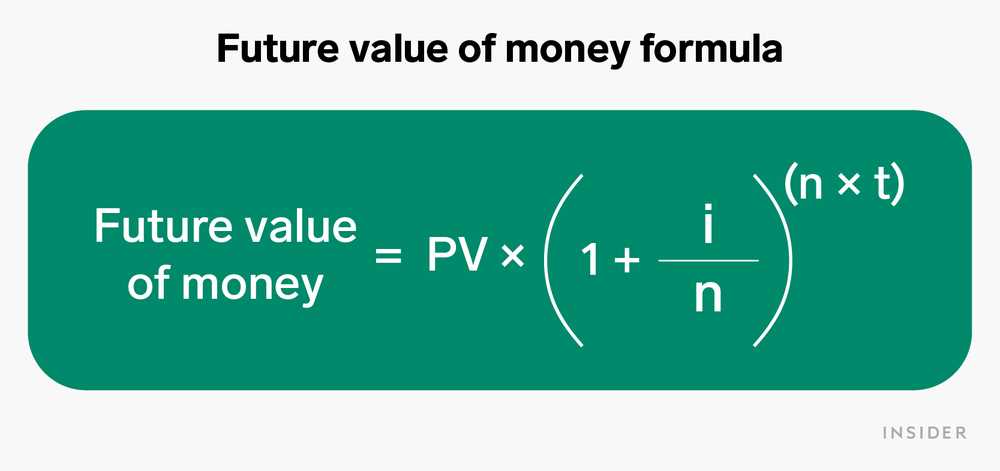

Formula for Calculating the Time Value of Money

The formula for calculating the time value of money is:

Future Value (FV) = Present Value (PV) × (1 + Interest Rate) ^ Number of Periods

Where:

- Future Value (FV) is the value of an investment or cash flow at a specified future date.

- Present Value (PV) is the current value of an investment or cash flow.

- Interest Rate is the rate at which an investment grows over time.

- Number of Periods is the length of time the investment will be held or the number of compounding periods.

This formula allows individuals and businesses to calculate the future value of an investment or cash flow by taking into account the time value of money. By inputting the present value, interest rate, and number of periods, the formula calculates the future value, which represents the potential growth or return on the investment.

For example, let’s say you have $1,000 that you want to invest for 5 years at an annual interest rate of 5%. Using the formula, the calculation would be:

Future Value (FV) = $1,000 × (1 + 0.05) ^ 5

Future Value (FV) = $1,000 × 1.27628

Future Value (FV) = $1,276.28

Therefore, the future value of your $1,000 investment after 5 years at a 5% interest rate would be $1,276.28.

Examples of the Time Value of Money

1. Future Value Calculation

Let’s say you have $1,000 and you want to invest it in a savings account that offers an annual interest rate of 5%. By using the future value formula, you can calculate how much your investment will be worth after a certain period of time. For example, if you invest the $1,000 for 5 years, the future value of your investment would be:

Future Value = $1,000 * (1 + 0.05)^5 = $1,276.28

This means that after 5 years, your initial investment of $1,000 will grow to $1,276.28 due to the interest earned.

2. Present Value Calculation

Present Value = $10,000 / (1 + 0.03)^3 = $8,738.64

This means that the present value of $10,000 to be received in 3 years, discounted at a rate of 3%, is approximately $8,738.64.

3. Loan Repayment Calculation

This means that you would need to make monthly payments of approximately $386.66 for 5 years in order to repay the $20,000 loan plus interest.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.