Theory of Liquidity Preference: History

The theory of liquidity preference is an important concept in economics that was developed by John Maynard Keynes. It is a theory that explains how individuals and investors make decisions about holding money versus investing it in other assets.

Keynes first introduced the theory in his book “The General Theory of Employment, Interest, and Money” published in 1936. He argued that the demand for money is not solely determined by the interest rate, as classical economists believed, but also by the liquidity preference of individuals.

According to Keynes, individuals have a preference for holding money because it provides a sense of security and flexibility. Money can be easily used to make transactions and meet immediate needs. However, holding money also has a cost, as it does not generate any interest or returns.

Keynes identified three motives for holding money: the transactions motive, the precautionary motive, and the speculative motive. The transactions motive refers to the need for money to carry out day-to-day transactions. The precautionary motive refers to the desire to hold money as a precaution against unexpected expenses or emergencies. The speculative motive refers to the desire to hold money in anticipation of future investment opportunities.

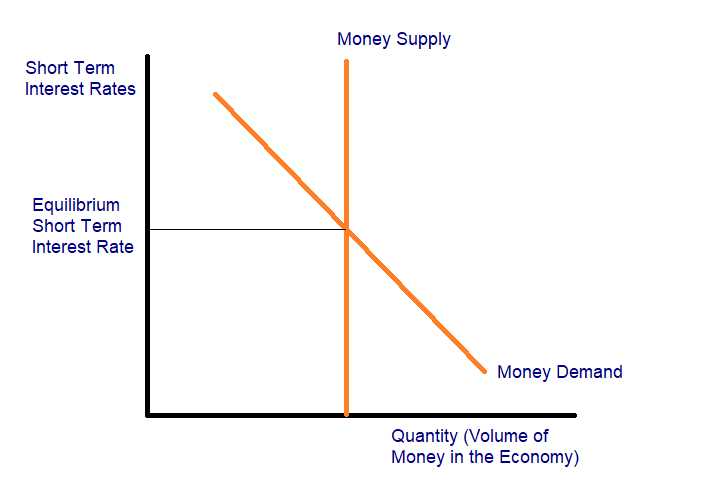

Keynes’ theory of liquidity preference has had a significant impact on economic thought and policy. It challenged the classical view that interest rates are solely determined by the supply and demand for money. Instead, Keynes argued that interest rates are influenced by the liquidity preference of individuals and investors.

Conclusion

The theory of liquidity preference, developed by John Maynard Keynes, revolutionized the way economists think about interest rates and the demand for money. Keynes argued that individuals have a preference for holding money due to its liquidity and flexibility. This preference, along with the prevailing interest rate, determines the demand for money and influences interest rates. The theory of liquidity preference has had a lasting impact on economic thought and continues to be an important concept in modern economics.

The theory of liquidity preference is a fundamental concept in economics that has evolved over time. It was first introduced by John Maynard Keynes in his book “The General Theory of Employment, Interest, and Money” in 1936. Keynes developed this theory as a way to explain the behavior of interest rates and the demand for money in an economy.

Keynes argued that individuals and businesses hold money for three main reasons: transactions, precautionary, and speculative motives. The transactions motive refers to the need for money to facilitate everyday transactions, such as buying goods and services. The precautionary motive relates to the desire to hold money as a precaution against unforeseen expenses or emergencies. The speculative motive is the desire to hold money as a store of value, in anticipation of future changes in interest rates or asset prices.

According to Keynes, the demand for money is influenced by these three motives, and it varies with changes in income and interest rates. When income increases, people tend to spend more, which increases the demand for money for transactions. Similarly, when interest rates are high, the opportunity cost of holding money increases, leading to a decrease in the demand for money.

The theory of liquidity preference has evolved since Keynes’ time, with economists adding new insights and refinements. For example, some economists have introduced the concept of liquidity traps, where interest rates are so low that the demand for money becomes virtually insensitive to changes in interest rates. Others have explored the role of expectations and uncertainty in shaping the demand for money.

The Role of Central Banks

Central banks play a crucial role in implementing the theory of liquidity preference. They use monetary policy tools, such as open market operations and interest rate adjustments, to influence the supply of money and interest rates in the economy. By managing the money supply, central banks can affect the level of liquidity in the financial system and influence the behavior of interest rates.

During periods of economic downturn or recession, central banks may adopt expansionary monetary policies to stimulate economic activity. They do this by increasing the money supply and lowering interest rates, which encourages borrowing and spending. Conversely, during periods of inflationary pressure, central banks may adopt contractionary monetary policies to reduce the money supply and increase interest rates, which helps to curb inflation.

Implications for Financial Markets

The theory of liquidity preference has important implications for financial markets. Changes in interest rates, driven by shifts in the demand for money, can impact the pricing and performance of various financial instruments. For example, when interest rates rise, the cost of borrowing increases, which can lead to a decrease in demand for loans and a decline in asset prices. On the other hand, when interest rates fall, borrowing becomes cheaper, which can stimulate investment and increase asset prices.

Theory of Liquidity Preference: Example

In order to understand the theory of liquidity preference, it is important to examine an example that illustrates how it works in practice. Let’s consider a hypothetical scenario involving a central bank and commercial banks.

Scenario:

The central bank decides to implement a monetary policy to stimulate economic growth. To achieve this, the central bank reduces the interest rates in the economy. As a result, commercial banks can borrow money from the central bank at a lower interest rate.

Now, let’s analyze the behavior of commercial banks based on the theory of liquidity preference:

1. Speculative Motive:

Commercial banks, taking advantage of the lower interest rates, decide to borrow a significant amount of money from the central bank. They anticipate that the lower interest rates will lead to increased economic activity and higher demand for loans from businesses and individuals.

By borrowing more money, commercial banks can lend it to businesses and individuals at a higher interest rate, thereby earning a profit. This speculative motive drives commercial banks to increase their borrowing from the central bank.

2. Precautionary Motive:

Commercial banks also consider the precautionary motive when deciding to borrow from the central bank. They want to ensure that they have enough liquidity to meet any unexpected demands for withdrawals from their depositors.

By borrowing from the central bank, commercial banks can increase their reserves and maintain sufficient liquidity. This provides them with a safety net in case of any unforeseen events that may lead to a sudden increase in withdrawals.

3. Transaction Motive:

Lastly, commercial banks also have a transaction motive for borrowing from the central bank. They need to meet the demand for loans from businesses and individuals in the economy. By borrowing from the central bank, commercial banks can increase their lending capacity and provide loans to meet the transactional needs of the economy.

Overall, the theory of liquidity preference suggests that commercial banks will increase their borrowing from the central bank when interest rates are lowered. This borrowing is driven by the speculative motive, precautionary motive, and transaction motive.

An Illustration of the Concept in Practice

The theory of liquidity preference, developed by John Maynard Keynes, is a fundamental concept in economics that explains how individuals and investors make decisions about holding money versus investing in other assets. To understand the theory in practice, let’s consider a hypothetical scenario.

Imagine a small economy facing an economic downturn. The central bank decides to implement expansionary monetary policy by reducing interest rates and increasing the money supply. As a result, commercial banks have more funds available to lend to businesses and individuals.

Now, let’s say there are two individuals, Alex and Sarah, who have different liquidity preferences. Alex prefers to hold a larger portion of his wealth in the form of cash or highly liquid assets, while Sarah is more willing to invest her money in longer-term assets such as stocks or real estate.

With the implementation of expansionary monetary policy, the interest rates on savings accounts and other short-term investments decrease. Alex, who values liquidity and wants to maintain a higher level of cash on hand, decides to keep his money in a savings account that offers a lower interest rate but allows for easy access to funds.

On the other hand, Sarah, who is more willing to take on risk and seeks higher returns, decides to invest her money in the stock market. She believes that the lower interest rates will stimulate economic growth, leading to higher corporate profits and stock prices.

As a result of their different liquidity preferences, Alex and Sarah’s actions have an impact on the overall economy. Alex’s decision to hold onto cash reduces the amount of money available for lending, which can potentially limit the amount of investment and spending in the economy. On the other hand, Sarah’s decision to invest in stocks increases the demand for stocks, driving up stock prices and potentially stimulating economic activity.

This hypothetical scenario illustrates how the theory of liquidity preference can influence economic outcomes. The theory suggests that individuals’ preferences for liquidity, influenced by factors such as risk aversion and economic conditions, can affect the overall level of investment and economic activity in an economy.

Theory of Liquidity Preference: How It Works

The theory of liquidity preference, developed by John Maynard Keynes, is an important concept in economics that explains how individuals and investors make decisions regarding the holding of money versus other assets. It is based on the idea that individuals have a preference for liquidity, or the ability to quickly convert an asset into cash, and that this preference affects their demand for money.

According to the theory, individuals and investors have a demand for money for three main reasons: transactions, precautionary, and speculative motives. The transactions motive refers to the need for money to carry out day-to-day transactions, such as buying goods and services. The precautionary motive relates to the desire to hold money as a precaution against unexpected expenses or emergencies. The speculative motive involves holding money to take advantage of investment opportunities that may arise in the future.

Changes in the demand for money can have significant effects on the overall economy. For example, if individuals and investors suddenly increase their demand for money due to a decrease in confidence or uncertainty about the future, it can lead to a decrease in spending and investment, which can result in a slowdown or recession. Conversely, if individuals and investors decrease their demand for money due to increased confidence or optimism about the future, it can lead to an increase in spending and investment, which can stimulate economic growth.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.