Key Concepts of the Modigliani-Miller (M&M) Theorem

The Modigliani-Miller (M&M) theorem is a fundamental concept in finance that provides insights into the relationship between a company’s capital structure and its value. Developed by economists Franco Modigliani and Merton Miller in the 1950s, the theorem states that, under certain assumptions, the value of a firm is independent of its capital structure.

There are several key concepts that are important to understand when studying the Modigliani-Miller theorem:

1. Capital Structure

The capital structure of a company refers to the way it finances its operations through a combination of debt and equity. Debt financing involves borrowing money from lenders, such as banks or bondholders, while equity financing involves raising funds by selling shares of ownership in the company.

2. Cost of Capital

The cost of capital is the rate of return that a company must earn on its investments in order to satisfy its investors. It is determined by the cost of debt and the cost of equity, which are influenced by factors such as interest rates, credit ratings, and market conditions.

3. Capital Market Imperfections

The Modigliani-Miller theorem assumes that capital markets are perfect, meaning that there are no taxes, transaction costs, or other imperfections that could affect the value of a company. In reality, however, capital markets are not perfect, and factors such as taxes and bankruptcy costs can impact a company’s capital structure decisions.

4. Arbitrage

Arbitrage is the practice of taking advantage of price differences in different markets to make a profit with no risk. The Modigliani-Miller theorem relies on the concept of arbitrage to argue that if there were any differences in the value of companies with different capital structures, investors could exploit those differences and drive the prices back to equilibrium.

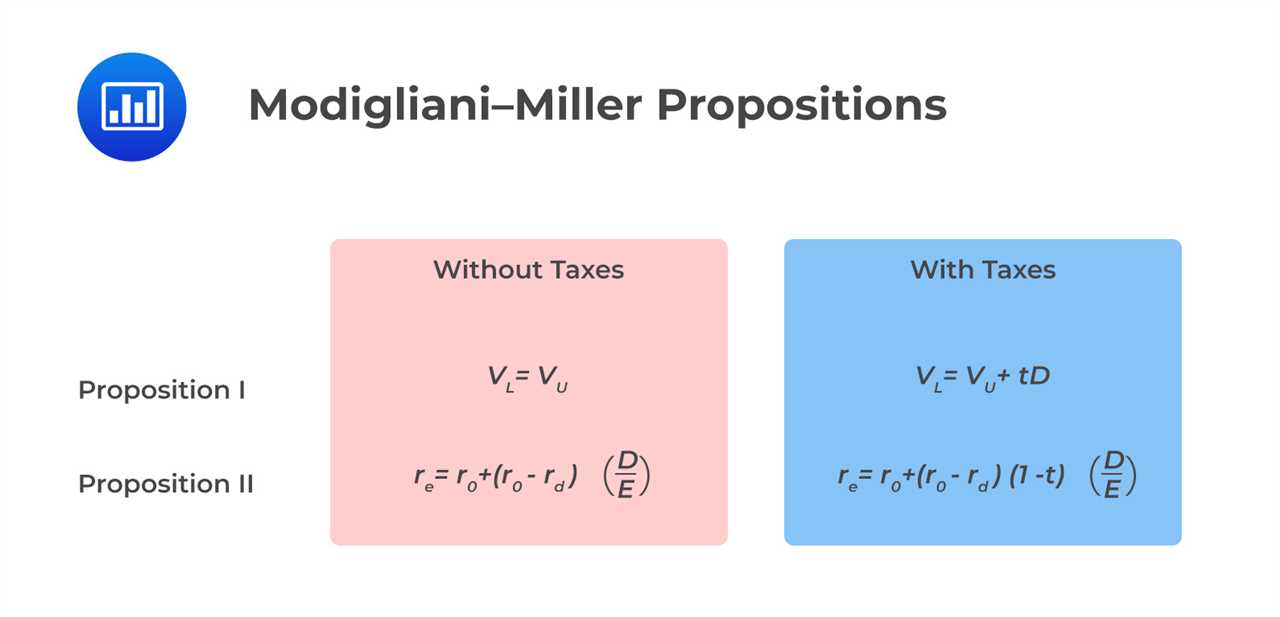

5. Modigliani-Miller Propositions

Applications of the Modigliani-Miller (M&M) Theorem

The Modigliani-Miller (M&M) theorem, developed by economists Franco Modigliani and Merton Miller in the 1950s, is a fundamental concept in corporate finance. It states that, under certain assumptions, the value of a firm is independent of its capital structure. This means that the way a company finances its operations, whether through debt or equity, does not affect its overall value.

Capital Structure Decisions

One of the key applications of the M&M theorem is in guiding capital structure decisions. The theorem suggests that the value of a firm is determined by its underlying assets and the cash flows generated by those assets, rather than the way the firm is financed. This implies that managers should focus on maximizing the value of the firm by making investment decisions that generate positive net present value (NPV) and not be overly concerned with the mix of debt and equity used to finance those investments.

However, it is important to note that the M&M theorem assumes perfect capital markets, where there are no taxes, transaction costs, or information asymmetry. In reality, these factors can impact the value of a firm and the optimal capital structure. Therefore, while the M&M theorem provides a useful framework, it should be considered alongside other factors when making capital structure decisions.

Cost of Capital

Another application of the M&M theorem is in determining the cost of capital for a firm. The theorem suggests that the cost of capital is determined by the riskiness of the firm’s underlying assets and is independent of the firm’s capital structure. This means that the cost of capital is the same whether the firm is financed entirely by equity or a combination of debt and equity.

This has important implications for firms when considering different financing options. For example, if a firm can borrow at a lower interest rate than its cost of equity, it may choose to increase its debt level to take advantage of the lower cost of debt. On the other hand, if the cost of debt becomes too high, it may be more beneficial for the firm to rely more on equity financing.

Corporate Restructuring

The M&M theorem also has implications for corporate restructuring, such as mergers and acquisitions. The theorem suggests that the value of a firm is determined by its underlying assets and cash flows, rather than the way it is structured. Therefore, a merger or acquisition that creates synergies and increases the cash flows of the combined entity can potentially create value, regardless of the financing used to fund the transaction.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.