Tax-Exempt Interest: Definition and Examples

Tax-exempt interest refers to the income that is not subject to federal income tax. This type of interest is typically earned from certain investments or bonds, such as municipal bonds, that are issued by state and local governments.

When individuals or businesses invest in tax-exempt bonds, they receive regular interest payments that are not taxed by the federal government. This allows investors to potentially earn a higher after-tax return compared to taxable investments.

There are several reasons why the government provides tax exemptions for certain types of interest. One of the main reasons is to encourage investment in projects that benefit the public, such as infrastructure development or education. By offering tax-exempt interest, the government can attract more investors and raise funds for these projects.

Examples of tax-exempt interest include interest earned from municipal bonds, certain types of savings bonds, and interest earned on loans made to qualified students. Municipal bonds are issued by state and local governments to finance public projects, and the interest earned from these bonds is typically exempt from federal income tax. Similarly, certain savings bonds, such as Series EE and Series I bonds, offer tax-exempt interest if used for qualified education expenses.

It is important to note that while tax-exempt interest is not subject to federal income tax, it may still be subject to state and local income taxes. Additionally, tax-exempt interest may be subject to the alternative minimum tax (AMT) for certain taxpayers.

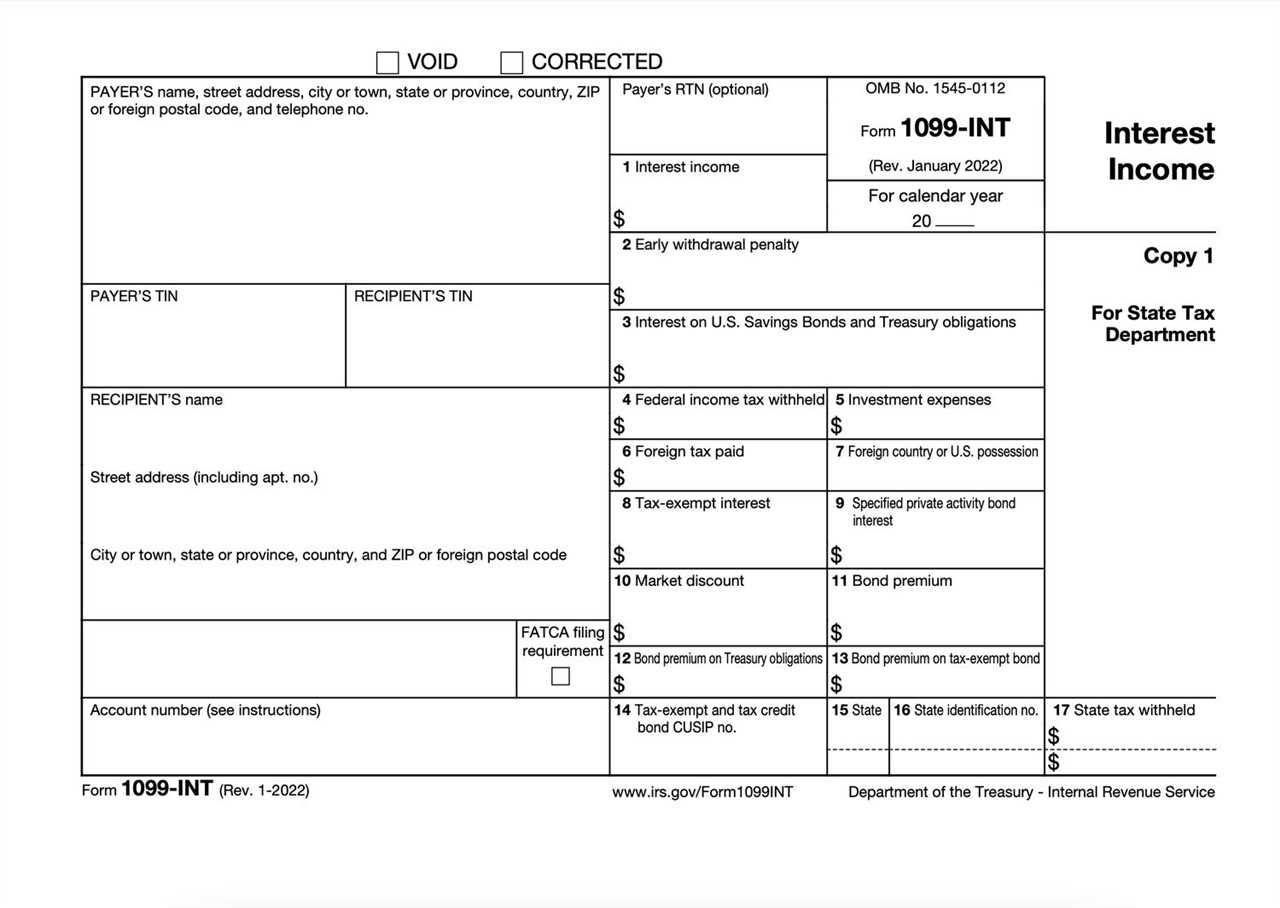

When reporting tax-exempt interest on your tax return, you will need to include the total amount of tax-exempt interest earned during the year. This information can usually be found on Form 1099-INT or Form 1099-OID, which are provided by the financial institution or issuer of the investment.

When you receive tax-exempt interest, it means that the income you earn from these investments is not included in your taxable income. This can be a significant advantage, as it allows you to keep more of your earnings and potentially lower your overall tax liability.

Benefits of Tax-Exempt Interest

Investing in tax-exempt bonds or other tax-exempt investments can provide several benefits to individuals and organizations. Here are some of the key advantages of tax-exempt interest:

| Benefits | Explanation |

|---|---|

| 1. Tax Savings | One of the main benefits of tax-exempt interest is the potential for tax savings. By investing in tax-exempt bonds, individuals and organizations can earn interest that is not subject to federal income tax. This can result in significant tax savings, especially for those in higher tax brackets. |

| 2. Higher After-Tax Returns | Since tax-exempt interest is not subject to federal income tax, the after-tax returns on tax-exempt investments can be higher compared to taxable investments with similar yields. This means that investors can potentially earn more money on their investments by choosing tax-exempt options. |

| 3. Diversification | Tax-exempt investments can provide an opportunity for diversification within an investment portfolio. By including tax-exempt bonds or other tax-exempt securities, investors can reduce their overall investment risk by spreading their investments across different asset classes and sectors. |

| 4. Stability | Tax-exempt bonds are generally considered to be relatively stable investments. They are backed by the issuer’s ability to repay the principal and interest, which can provide a level of stability and predictability to investors. This can be particularly appealing to conservative investors or those seeking a steady income stream. |

| 5. Support for Local Communities |

Overall, tax-exempt interest offers a range of benefits, including potential tax savings, higher after-tax returns, diversification opportunities, stability, and the ability to support local communities. It is important to consult with a financial advisor or tax professional to determine the suitability of tax-exempt investments based on individual financial goals and circumstances.

Examples of Tax-Exempt Interest

| Investment | Description |

|---|---|

| Municipal Bonds | |

| Treasury Bonds | Interest earned from Treasury bonds, such as Treasury bills, notes, and bonds, is exempt from state and local taxes. However, it is still subject to federal income tax. |

| Qualified Dividend Income | Some dividends received from certain types of investments, such as qualified corporate dividends and dividends from mutual funds that invest in municipal bonds, may be considered tax-exempt interest. |

| Health Savings Account (HSA) | If you contribute to an HSA and use the funds for qualified medical expenses, any interest earned on the account is tax-exempt. |

| Education Savings Account (ESA) |

How to Report Tax-Exempt Interest

Reporting tax-exempt interest on your tax return is an important step in ensuring compliance with the IRS regulations. Here are the steps to report tax-exempt interest:

- Obtain Form 1099-INT: The financial institution that paid you the tax-exempt interest will provide you with a Form 1099-INT. This form will detail the amount of tax-exempt interest you received during the tax year.

- Review the Form 1099-INT: Carefully review the Form 1099-INT to ensure that the information provided is accurate. Check for any discrepancies and contact the financial institution if you find any errors.

- Enter the information on your tax return: On your tax return, you will need to report the tax-exempt interest on Schedule B, which is used to report interest and ordinary dividends. Fill in the required information, including the name of the payer, the amount of tax-exempt interest, and any other relevant details.

- Calculate the taxable portion, if applicable: In some cases, you may receive tax-exempt interest that is partially taxable. If this is the case, you will need to calculate the taxable portion using the appropriate IRS guidelines. This taxable portion should be reported on your tax return as well.

- File your tax return: Once you have completed reporting the tax-exempt interest and any taxable portion, you can file your tax return. Make sure to submit it by the deadline to avoid any penalties or interest charges.

It is important to note that tax-exempt interest should be reported even if you do not receive a Form 1099-INT. You are still responsible for reporting this income accurately on your tax return.

By following these steps and accurately reporting your tax-exempt interest, you can ensure compliance with IRS regulations and avoid any potential issues with your tax return.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.